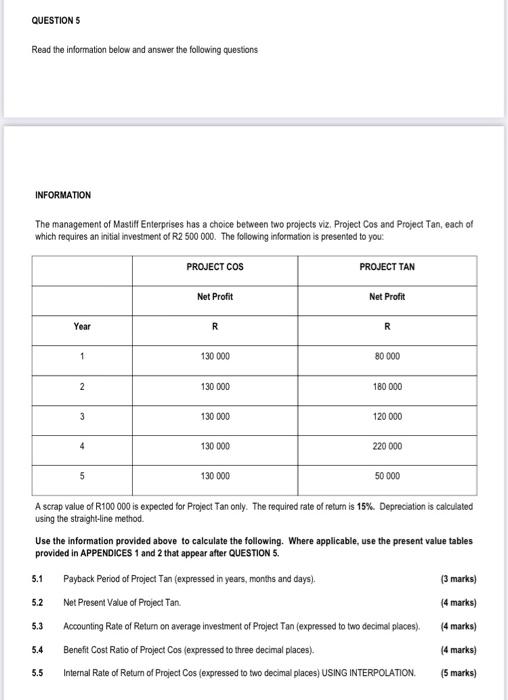

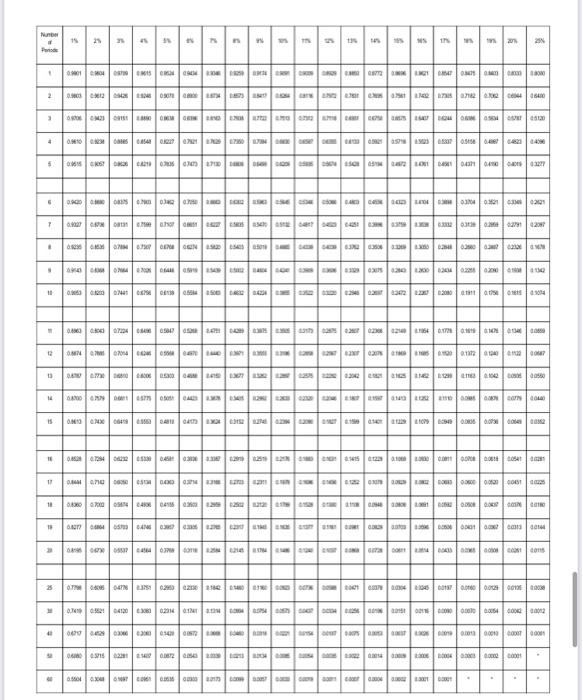

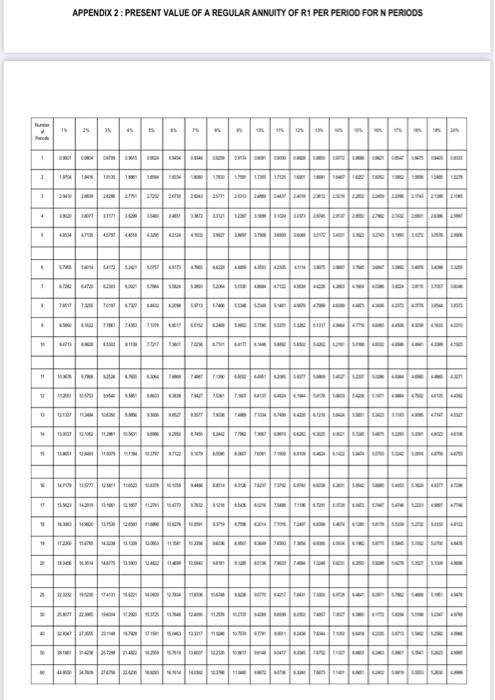

QUESTION 5 Read the information below and answer the following questions INFORMATION The management of Mastiff Enterprises has a choice between two projects viz. Project Cos and Project Tan, each of which requires an initial investment of R2 500 000. The following information is presented to you: PROJECT TAN 5.1 5.2 Year 5.3 5.4 1 5.5 2 3 4 PROJECT COS Net Profit R 130 000 130 000 130 000 130 000 130 000 Net Profit R 80 000 180 000 A scrap value of R100 000 is expected for Project Tan only. The required rate of return is 15%. Depreciation is calculated using the straight-line method. 120 000 Use the information provided above to calculate the following. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. Payback Period of Project Tan (expressed in years, months and days). Net Present Value of Project Tan. Accounting Rate of Return on average investment of Project Tan (expressed to two decimal places). Benefit Cost Ratio of Project Cos (expressed to three decimal places). Internal Rate of Return of Project Cos (expressed to two decimal places) USING INTERPOLATION. 220 000 50 000 (3 marks) (4 marks) (4 marks) (4 marks) (5 marks) APPENDIX 1: PRESENT VALUE OF R1 Number # spot - C 6 7 " " 10 13 14 01 1 2 1 60 15 16 5 0156 821 03835 034758712005441554 72141 04941 0.4371 040 040103277 15 A y e K 2 " a 3 3 52 3 MMI 55 0.001 60400961549425772647 0475 000 1800 12 0.8674 075 07014 2 0566 467 427 427 0275 05001372 0124041122007 195 000423 800MG N1647440056340 120 SK 0910023088508543 08227 076217625675601704080255745623 653070558 04670423 649 COUNC 17% LESED SEDLO MOLTO COSTO %201% 25% 0529500786467367 0676806274520 525 50103963726350603369 36606284 028600267 023366 MATTH 09063023074410879808139 0554502042403025450203472237 02080011001150304 17 0.86444.710067505534 04300343420122039 20000000002000431 10225 $ 18 0830070005474 480 04155 02602 1.299 252 121204000000 19 0.827706864057564746 03673626240601022031300144 0 100 101 19 OFFSHOR 2ND 23 200900 640090006062016061 4760D MITO ITS SIDE COED CUNO LOGO VOOR ONE SECO 0000 3000 200 000 284000 4000 SE 0.55040307 021757 OLD SHOX 190 200 2 1 SALDO 0 FL $ 0.7419 0:562104120308002314012413134000454 20550045000100000000000005400042 00012 04717 0452903066 2060 0140 0062 75009000130001000000001 06080 4.5715 221 2347 00672 00563200220040000000000000000001 000000 Bree P Pode 1 t t 4 4 " 1 . 11 7 APPENDIX 2: PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS 2% 45 # Wa 7 3 3 C $ 5 BUT IT OUTWITTET E Gatust oot at TT TT RST WENT ACTE 3 eorane 1237107574430 1113173174 YYY TROY ANG NYT 414 4 Y 242 TANG 4 SYST