Answered step by step

Verified Expert Solution

Question

1 Approved Answer

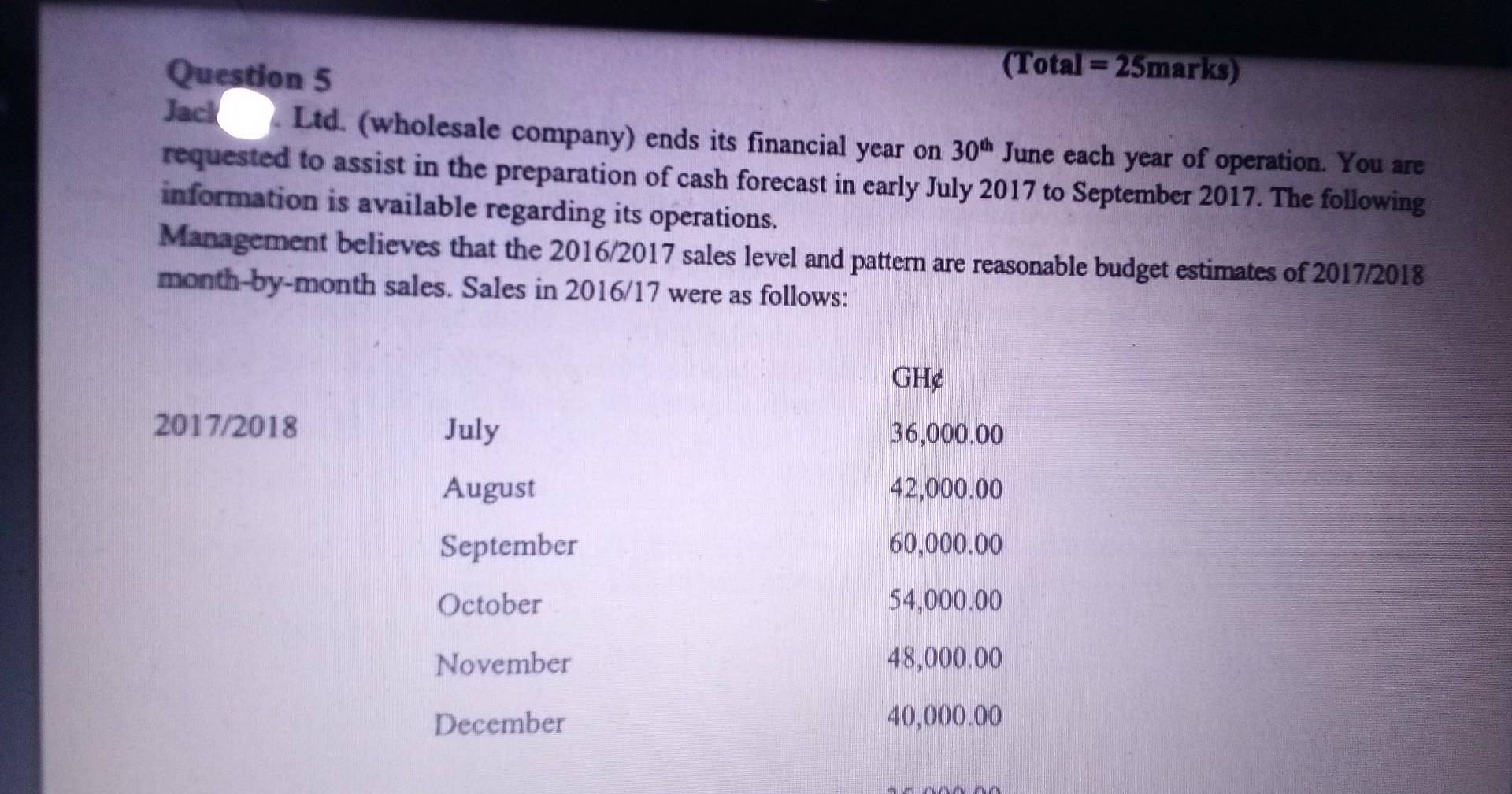

Question 5 ( rotal =25 marks ) Jack Ltd. (wholesale company) ends its financial year on 30th June each year of operation. You are requested

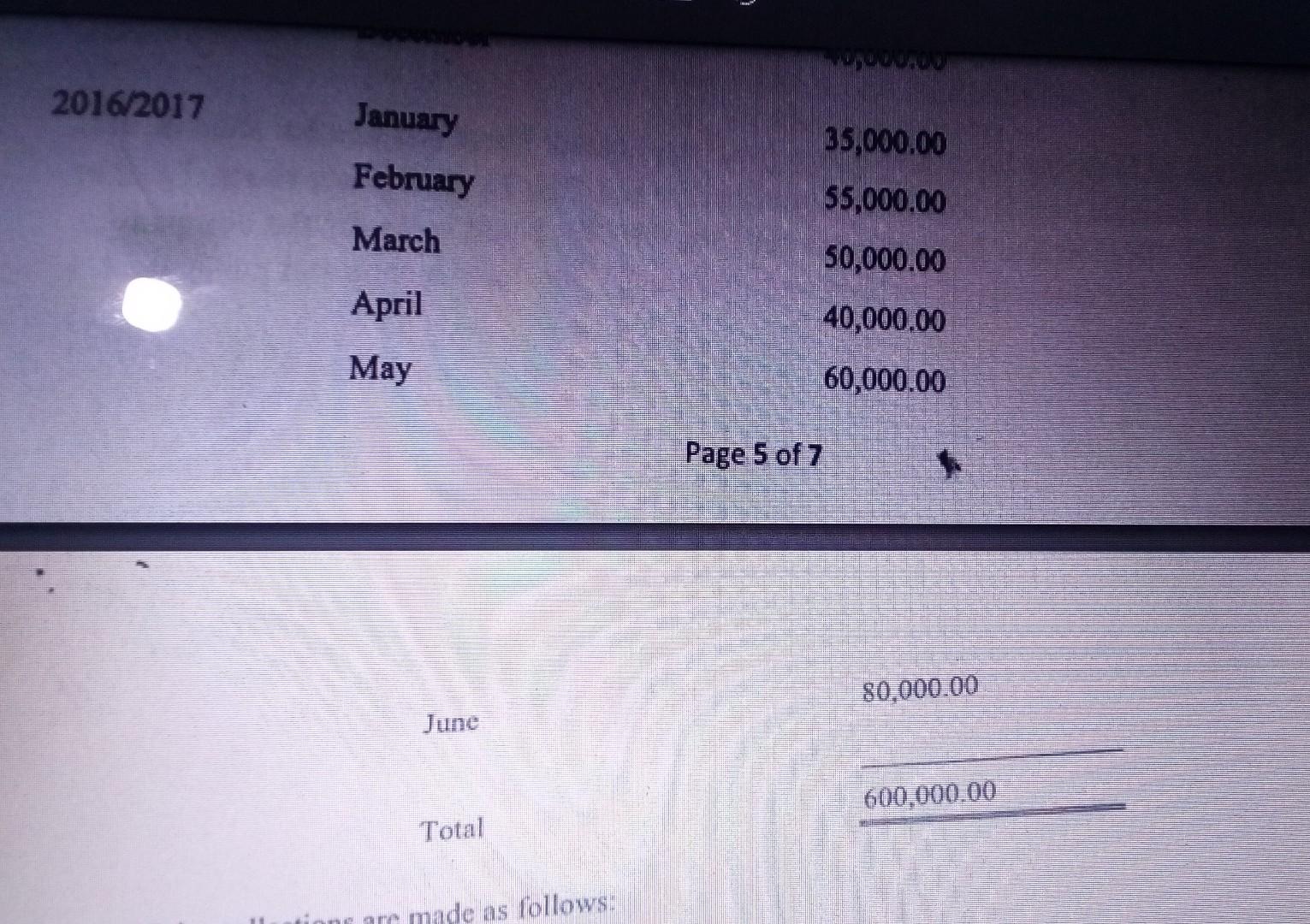

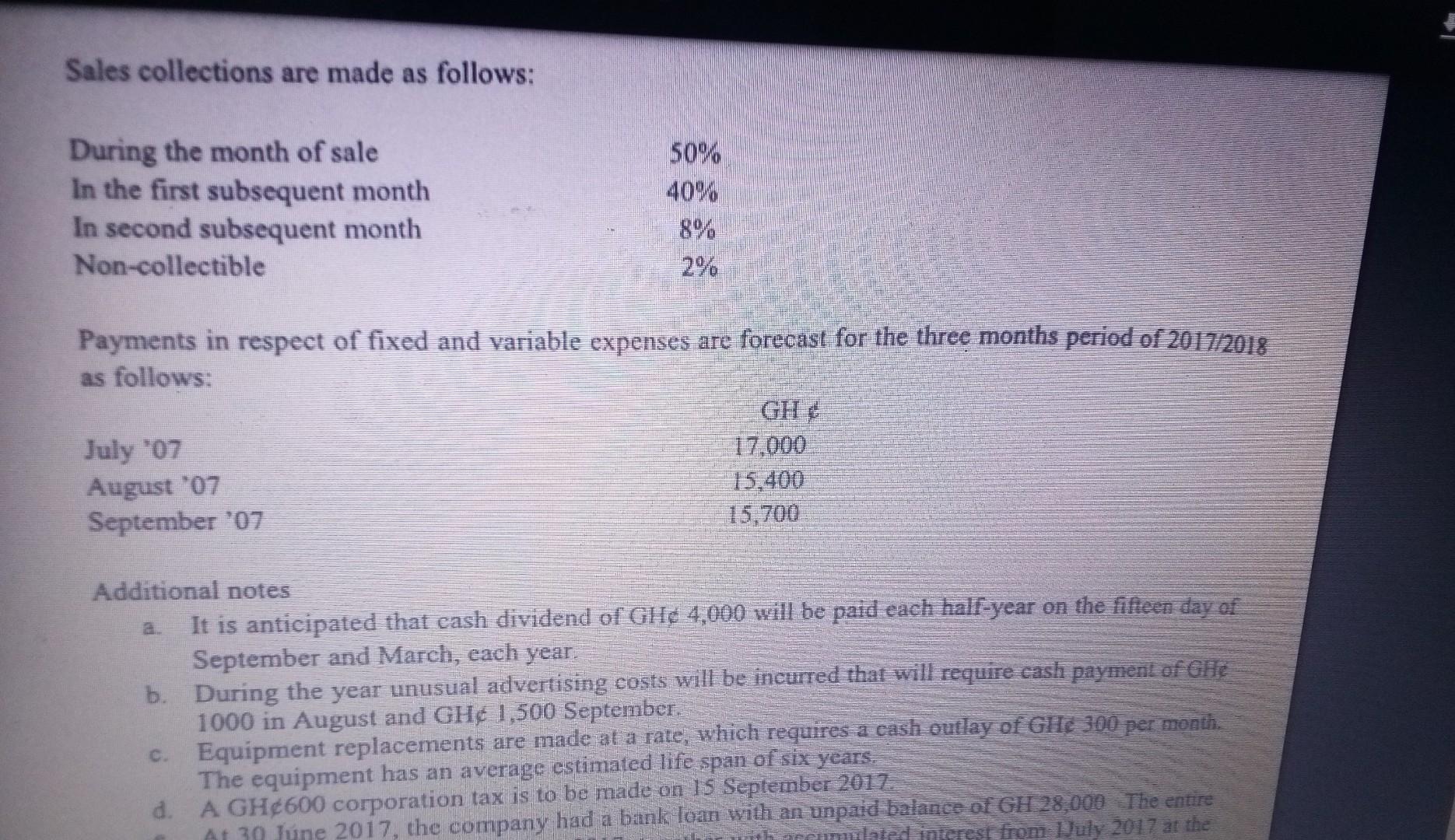

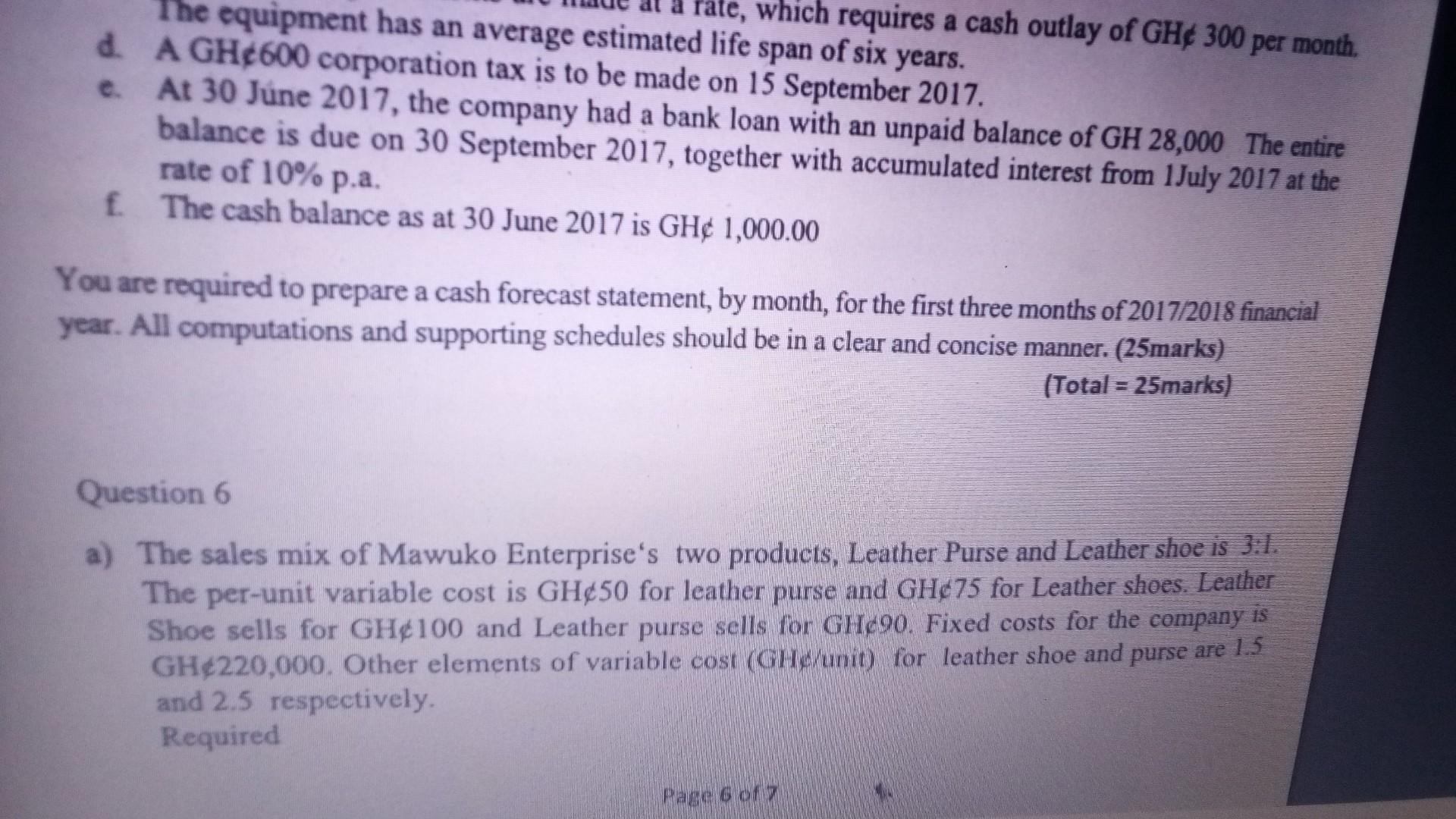

Question 5 ( rotal =25 marks ) Jack Ltd. (wholesale company) ends its financial year on 30th June each year of operation. You are requested to assist in the preparation of cash forecast in early July 2017 to September 2017. The following information is available regarding its operations. Management believes that the 2016/2017 sales level and pattern are reasonable budget estimates of 2017/2018 month-by-month sales. Sales in 2016/17 were as follows: 2016/2017FebruaryMarchAprilMayJanuary35,000.0055,000.0050,000.0040,000.0060,000.00 Page 5 of 7 June 80,000.00 Total 600,000.00 Sales collections are made as follows: Payments in respect of fixed and variable expenses are forecast for the three months period of 2017/2018 as follows: Additional notes a. It is anticipated that cash dividend of GHe 4,000 will be paid each half-year on the fifteen day of September and March, each year. b. During the year unusual advertising costs will be incurred that will require cash payment of GBE 1000 in August and GH/1,500 September. c. Equipment replacements are made at a rate, which requires a cash outlay of GHe 300 per month. The equipment has an average estimated life span of six years. d. A GH\& 600 corporation tax is to be made on 15 September 2012. d. A equipment has an average estimated life span of six sears cash outlay of GH&300 per month. d. A GHe 600 corporation tax is to be made on 15 September 2017. e. At 30 June 2017, the company had a bank loan with an unpaid balance of GH28,000 The entire balance is due on 30 September 2017, together with accumulated interest from 1July 2017 at the rate of 10% p.a. f. The cash balance as at 30 June 2017 is GH1,000.00 You are required to prepare a cash forecast statement, by month, for the first three months of 2017/2018 financial year. All computations and supporting schedules should be in a clear and concise manner. (25marks) (Total=25marks) Question 6 a) The sales mix of Mawuko Enterprise's two products, Leather Purse and Leather shoe is 3:1. Shoe sells for GH\&100 and Leather purse sells for GHe90. Fixed costs for the company is GH/220,000. Other elements of variable cost (GHe/unit) for leather shoe and purse are 1.5 and 2.5 respectively. Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started