Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Shambavati Game Reserve received the following government grant in the year 2018: A grant of R65 000 to acquire a darting gun and

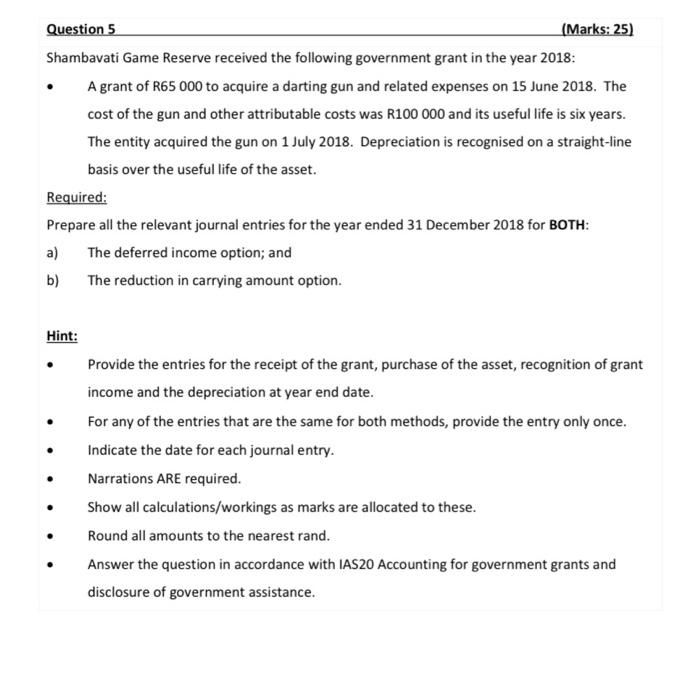

Question 5 Shambavati Game Reserve received the following government grant in the year 2018: A grant of R65 000 to acquire a darting gun and related expenses on 15 June 2018. The cost of the gun and other attributable costs was R100 000 and its useful life is six years. The entity acquired the gun on 1 July 2018. Depreciation is recognised on a straight-line basis over the useful life of the asset. (Marks: 25) Required: Prepare all the relevant journal entries for the year ended 31 December 2018 for BOTH: The deferred income option; and The reduction in carrying amount option. a) b) Hint: Provide the entries for the receipt of the grant, purchase of the asset, recognition of grant income and the depreciation at year end date. For any of the entries that are the same for both methods, provide the entry only once. Indicate the date for each journal entry. Narrations ARE required. Show all calculations/workings as marks are allocated to these. Round all amounts to the nearest rand. Answer the question in accordance with IAS20 Accounting for government grants and disclosure of government assistance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started