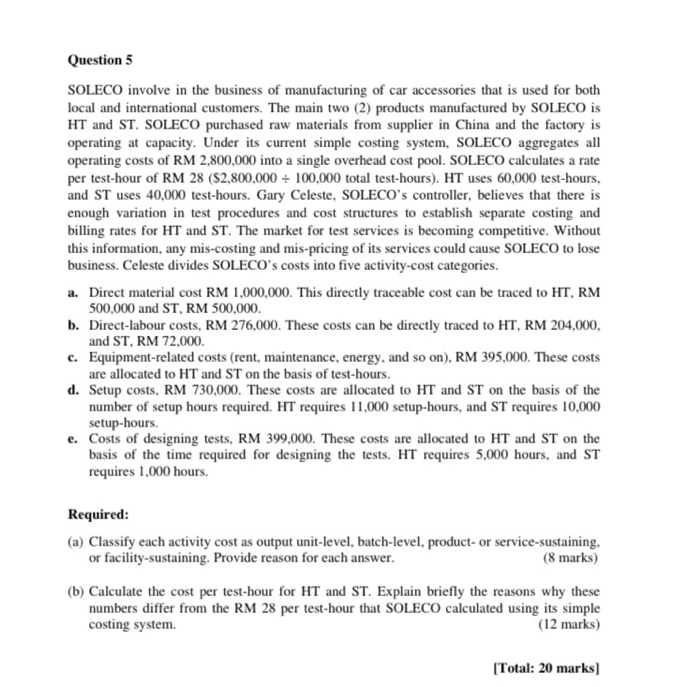

Question 5 SOLECO involve in the business of manufacturing of car accessories that is used for both local and international customers. The main two (2) products manufactured by SOLECO is HT and ST. SOLECO purchased raw materials from supplier in China and the factory is operating at capacity. Under its current simple costing system, SOLECO aggregates all operating costs of RM 2.800,000 into a single overhead cost pool. SOLECO calculates a rate per test-hour of RM 28 ($2,800,000 - 100.000 total test-hours). HT uses 60,000 test-hours, and ST uses 40,000 test-hours. Gary Celeste, SOLECO's controller, believes that there is enough variation in test procedures and cost structures to establish separate costing and billing rates for HT and ST. The market for test services is becoming competitive. Without this information, any mis-costing and mis-pricing of its services could cause SOLECO to lose business. Celeste divides SOLECO's costs into five activity-cost categories. a. Direct material cost RM 1,000,000. This directly traceable cost can be traced to HT, RM 500,000 and ST, RM 500,000. b. Direct-labour costs, RM 276,000. These costs can be directly traced to HT, RM 204,000, and ST, RM 72,000. c. Equipment-related costs (rent, maintenance, energy, and so on), RM 395,000. These costs are allocated to HT and ST on the basis of test-hours. d. Setup costs, RM 730,000. These costs are allocated to HT and ST on the basis of the number of setup hours required. HT requires 11,000 setup-hours, and ST requires 10,000 setup-hours. e. Costs of designing tests, RM 399,000. These costs are allocated to HT and ST on the basis of the time required for designing the tests. HT requires 5,000 hours, and ST requires 1,000 hours. Required: (a) Classify each activity cost as output unit-level, batch-level, product or service-sustaining, or facility-sustaining. Provide reason for each answer. (8 marks) (b) Calculate the cost per test-hour for HT and ST. Explain briefly the reasons why these numbers differ from the RM 28 per test-hour that SOLECO calculated using its simple costing system. (12 marks) [Total: 20 marks)