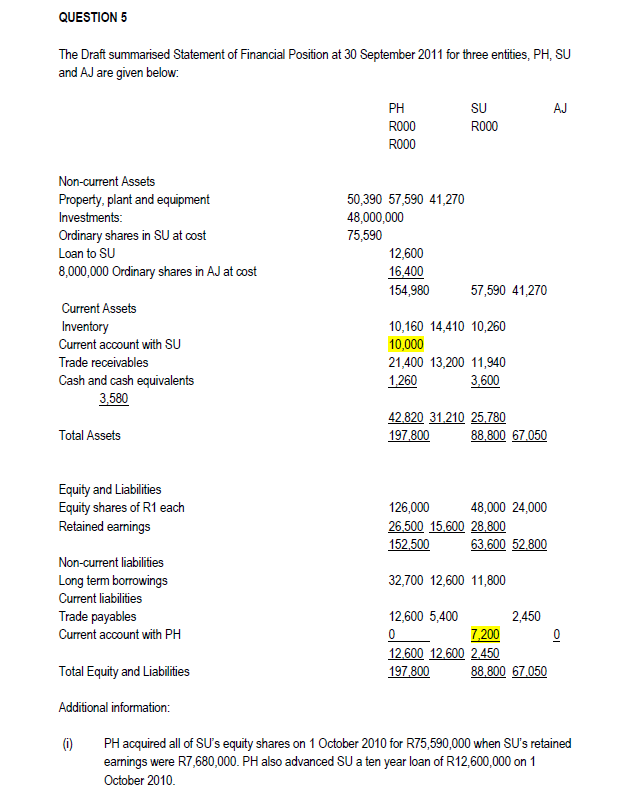

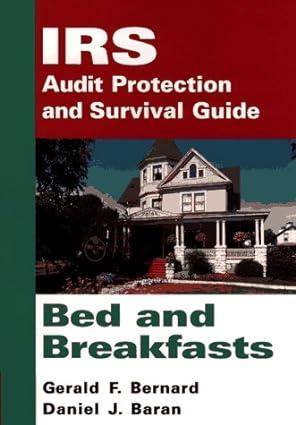

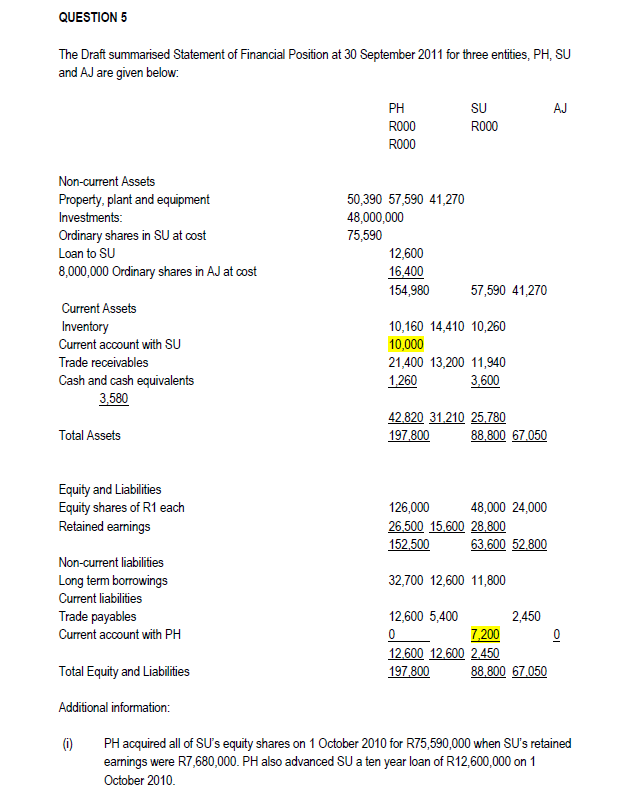

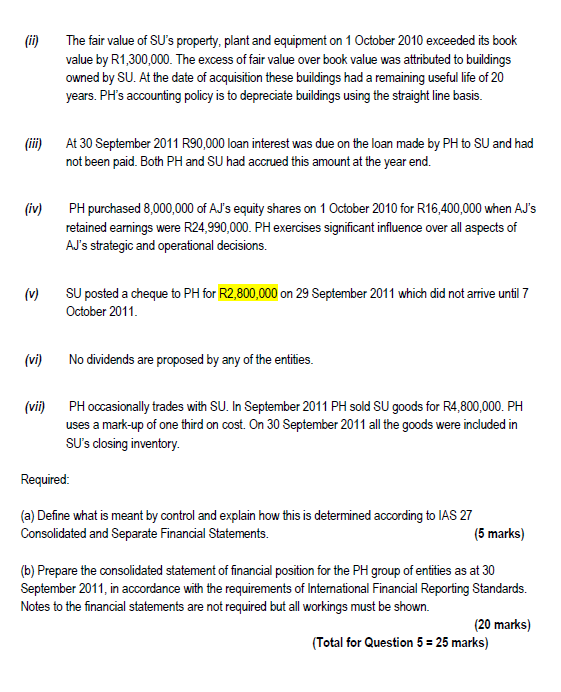

QUESTION 5 The Draft summarised Statement of Financial Position at 30 September 2011 for three entities, PH, SU and AJ are given below: PH SU AJ R000 R000 R000 Non-current Assets Property, plant and equipment Investments: Ordinary shares in SU at cost Loan to SU 8,000,000 Ordinary shares in AJ at cost 50,390 57,590 41,270 48,000,000 75,590 12,600 16,400 154,980 57,590 41,270 Current Assets Inventory Current account with SU Trade receivables Cash and cash equivalents 3.580 10,160 14,410 10,260 10,000 21,400 13,200 11,940 1,260 3,600 Total Assets 42.820 31.210 25,780 197.800 88,800 67.050 Equity and Liabilities Equity shares of R1 each Retained earnings 126,000 48,000 24,000 26.500 15.600 28.800 152,500 63,600 52,800 32,700 12,600 11,800 Non-current liabilities Long term borrowings Current liabilities Trade payables Current account with PH 0 12,600 5,400 2,450 7,200 0 12,600 12,600 2.450 197.800 88,800 67.050 Total Equity and Liabilities Additional information: (0) PH acquired all of SU's equity shares on 1 October 2010 for R75,590,000 when SU's retained earnings were R7,680,000. PH also advanced SU a ten year loan of R12,600,000 on 1 October 2010 (ii) The fair value of SU's property, plant and equipment on 1 October 2010 exceeded its book value by R1,300,000. The excess of fair value over book value was attributed to buildings owned by SU. At the date of acquisition these buildings had a remaining useful life of 20 years. PH's accounting policy is to depreciate buildings using the straight line basis. (iii) At 30 September 2011 R90,000 loan interest was due on the loan made by PH to SU and had not been paid. Both PH and SU had accrued this amount at the year end. (iv) PH purchased 8,000,000 of AJ's equity shares on 1 October 2010 for R16,400,000 when AJ's retained earnings were R24,990,000. PH exercises significant influence over all aspects of AJ's strategic and operational decisions. (v) SU posted a cheque to PH for R2,800,000 on 29 September 2011 which did not arrive until 7 October 2011 (vi) No dividends are proposed by any of the entities. (vii) PH occasionally trades with SU. In September 2011 PH sold SU goods for R4,800,000. PH uses a mark-up of one third on cost. On 30 September 2011 all the goods were included in SU's closing inventory Required: (a) Define what is meant by control and explain how this is determined according to IAS 27 Consolidated and Separate Financial Statements. (5 marks) (b) Prepare the consolidated statement of financial position for the PH group of entities as at 30 September 2011, in accordance with the requirements of International Financial Reporting Standards. Notes to the financial statements are not required but all workings must be shown. (20 marks) (Total for Question 5 = 25 marks)