Answered step by step

Verified Expert Solution

Question

1 Approved Answer

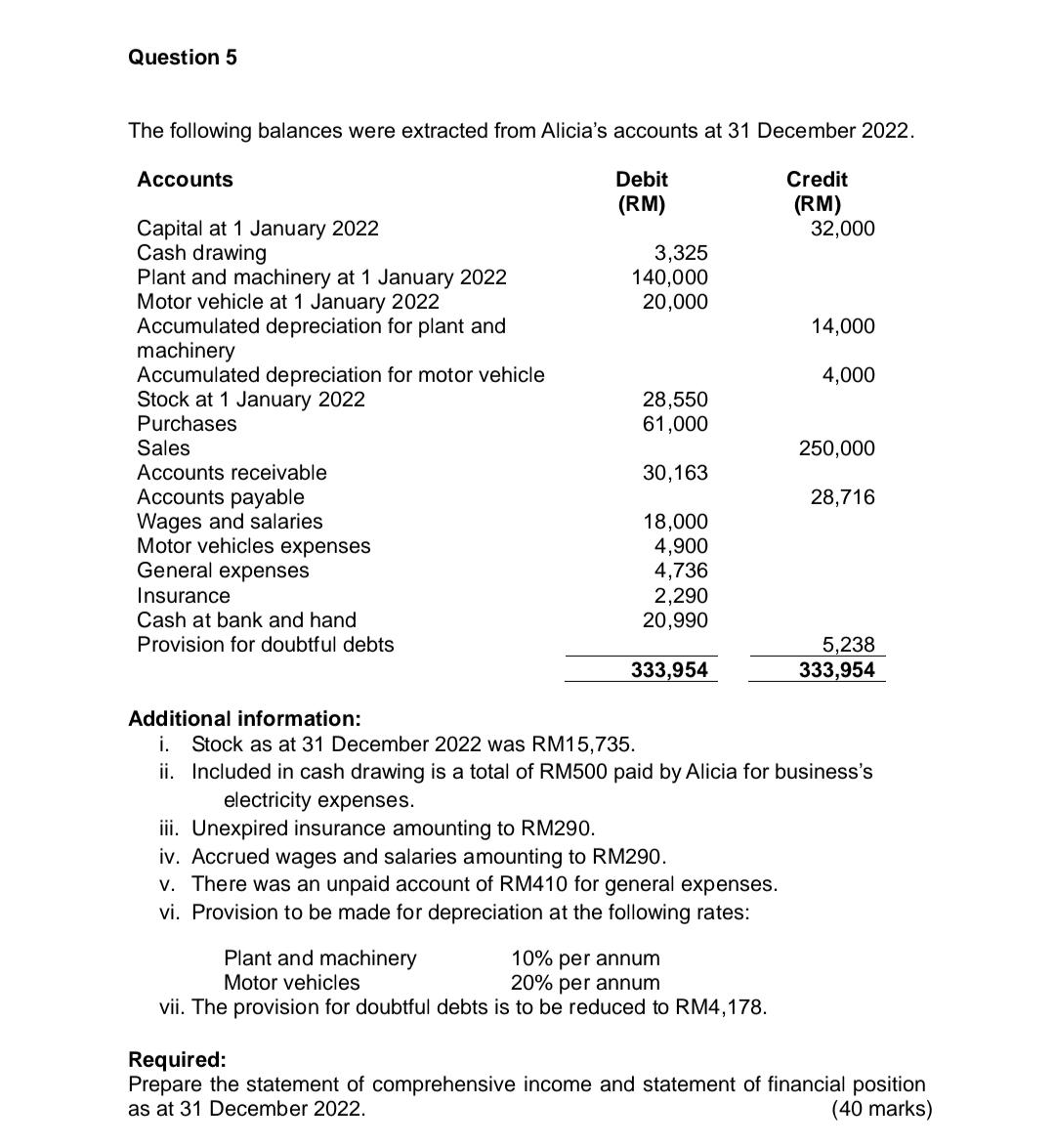

Question 5 The following balances were extracted from Alicia's accounts at 31 December 2022. Accounts Capital at 1 January 2022 Cash drawing Plant and

Question 5 The following balances were extracted from Alicia's accounts at 31 December 2022. Accounts Capital at 1 January 2022 Cash drawing Plant and machinery at 1 January 2022 Motor vehicle at 1 January 2022 Accumulated depreciation for plant and machinery Accumulated depreciation for motor vehicle Stock at 1 January 2022 Purchases Sales Accounts receivable Accounts payable Wages and salaries Motor vehicles expenses General expenses Insurance Cash at bank and hand Provision for doubtful debts Debit (RM) 3,325 140,000 20,000 28,550 61,000 30,163 18,000 4,900 4,736 Plant and machinery Motor vehicles 2,290 20,990 333,954 iii. Unexpired insurance amounting to RM290. iv. Accrued wages and salaries amounting to RM290. v. There was an unpaid account of RM410 for general expenses. vi. Provision to be made for depreciation at the following rates: 10% per annum 20% per annum vii. The provision for doubtful debts is to be reduced to RM4,178. Credit (RM) 32,000 14,000 4,000 Additional information: i. Stock as at 31 December 2022 was RM15,735. ii. Included in cash drawing is a total of RM500 paid by Alicia for business's electricity expenses. 250,000 28,716 5,238 333,954 Required: Prepare the statement of comprehensive income and statement of financial position as at 31 December 2022. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started