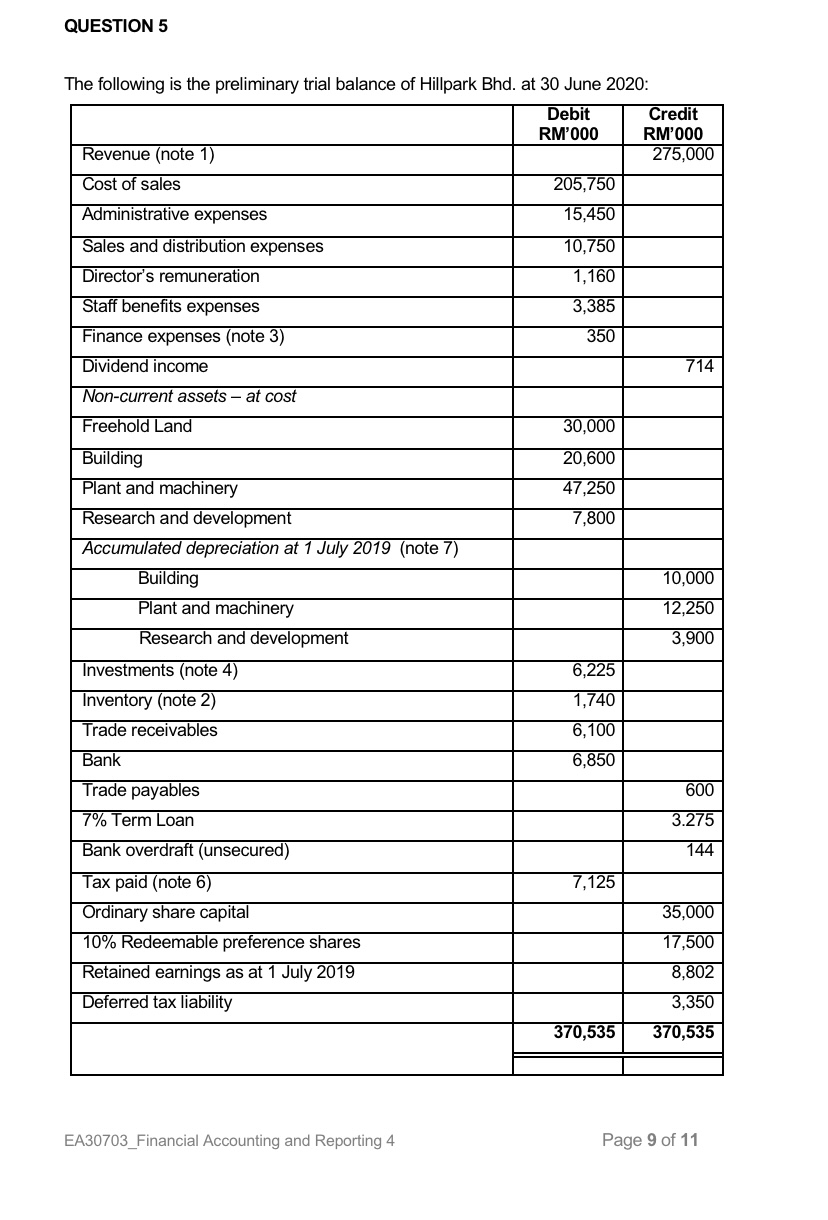

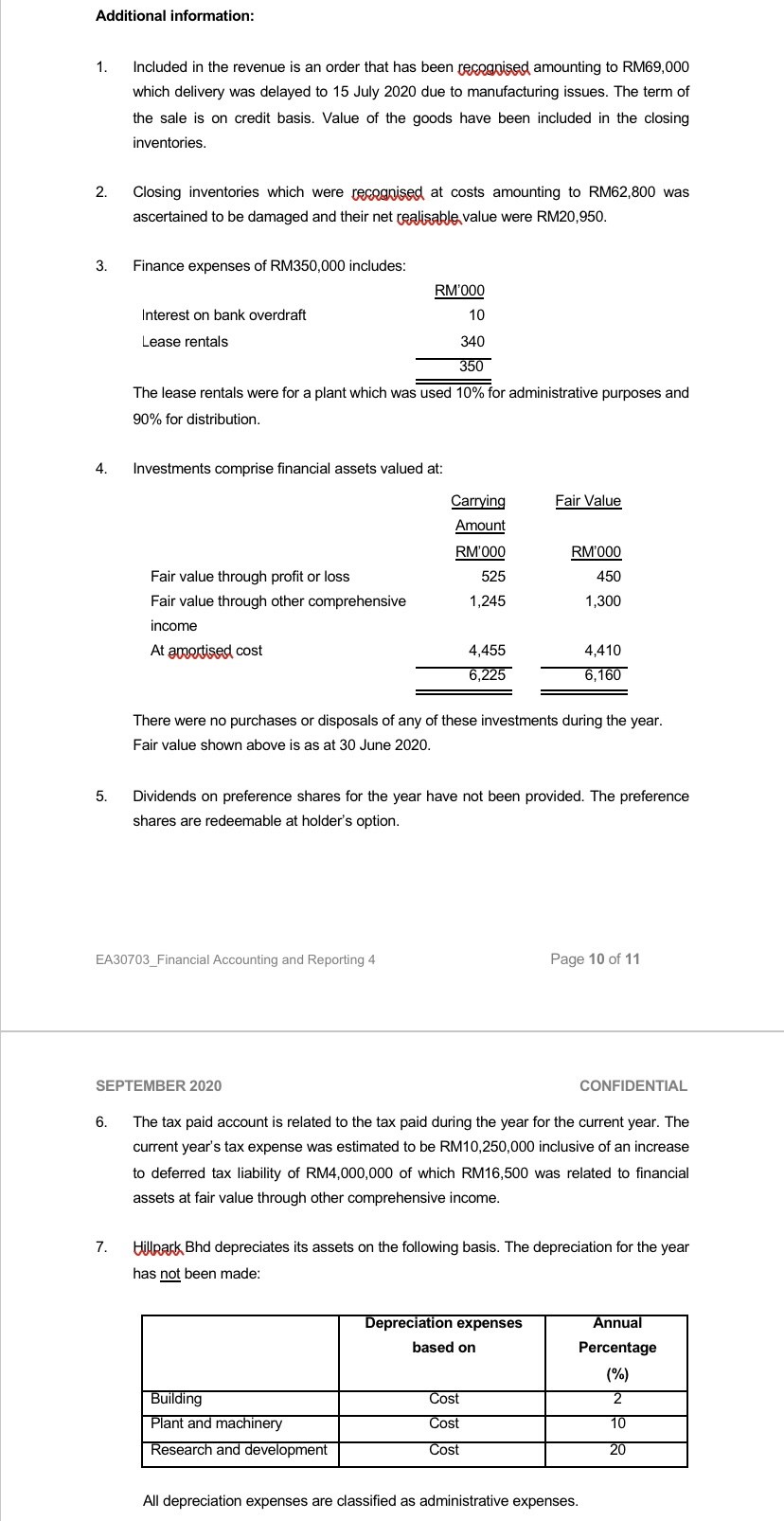

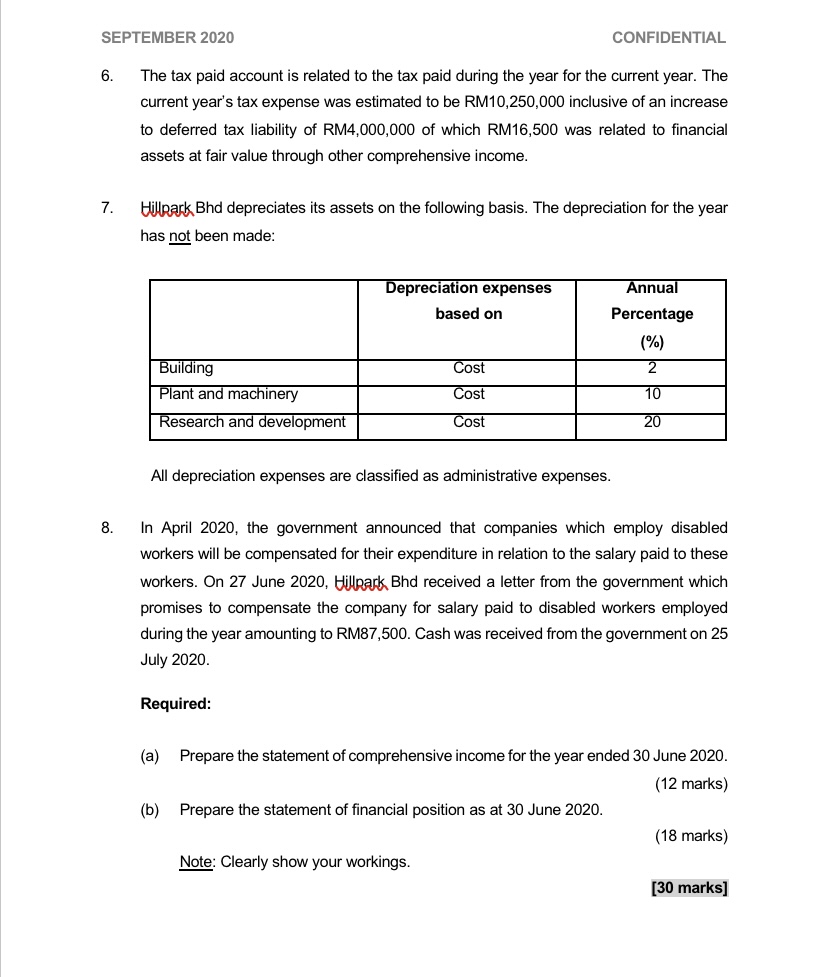

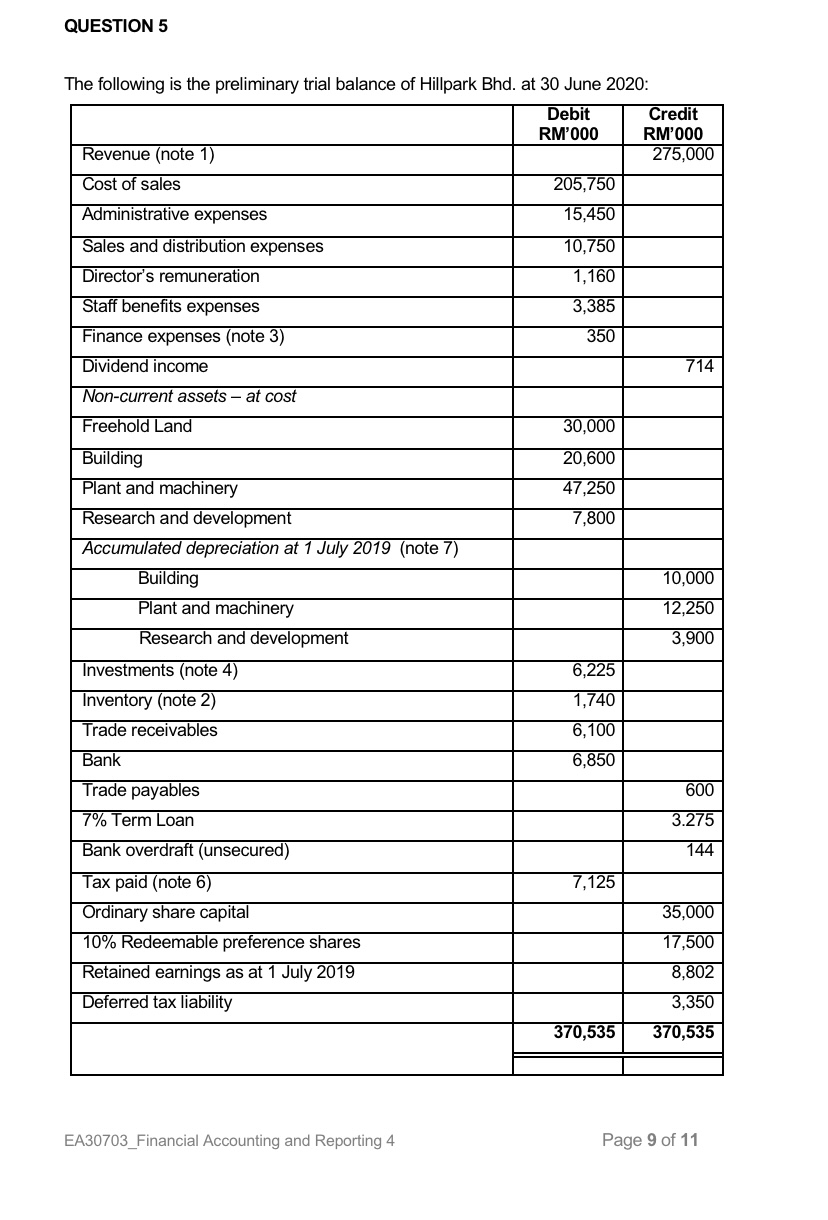

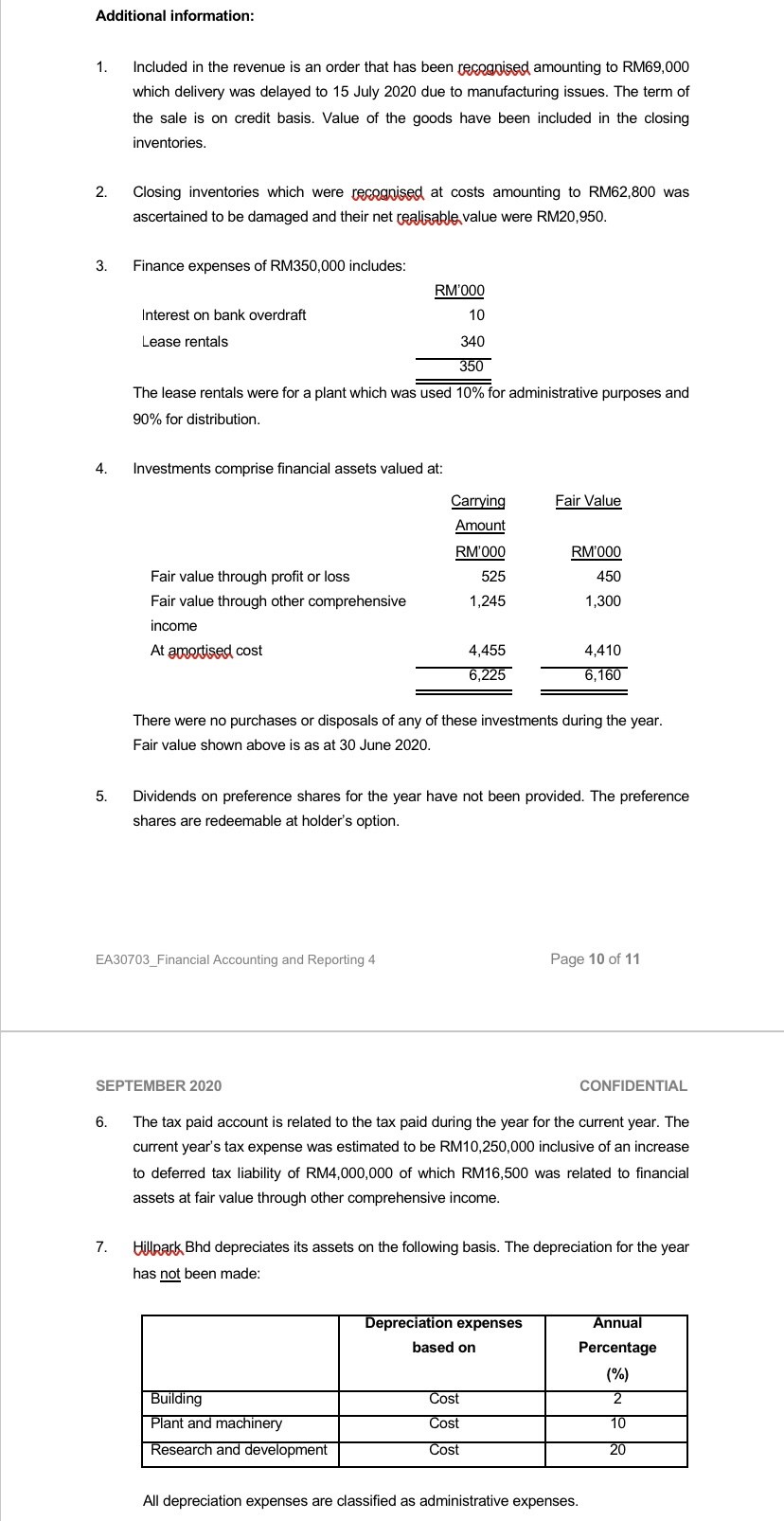

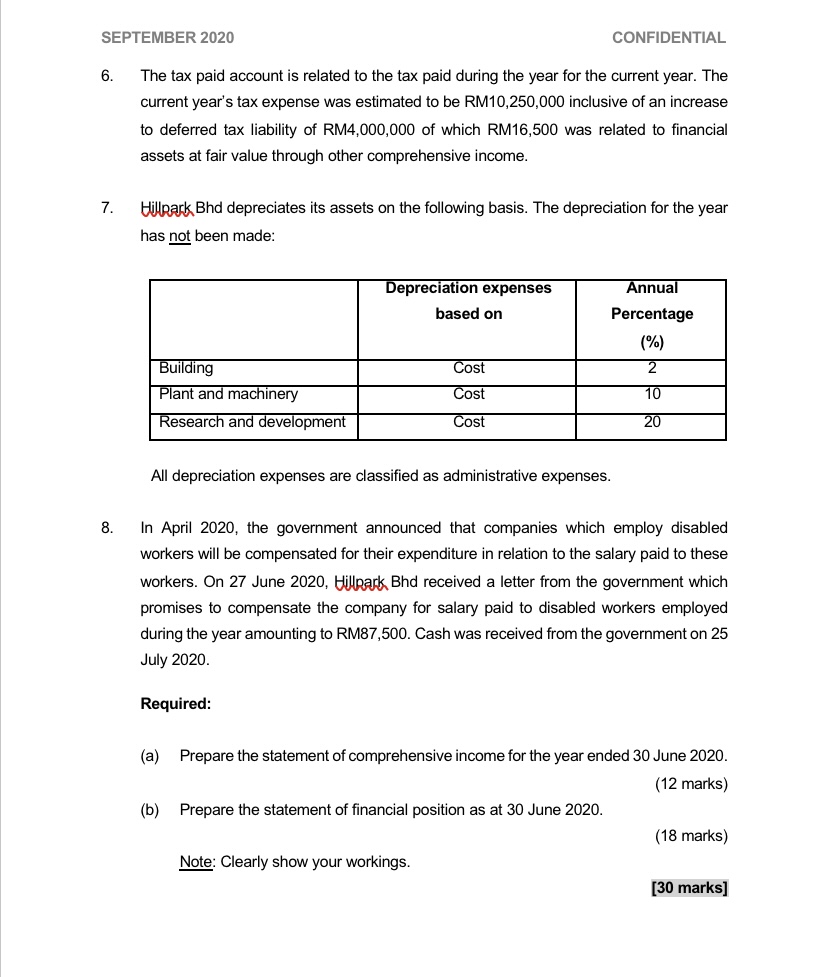

QUESTION 5 The following is the preliminary trial balance of Hillpark Bhd. at 30 June 2020: Debit Credit RM'000 RM'000 Revenue (note 1) 275,000 Cost of sales 205,750 Administrative expenses 15,450 Sales and distribution expenses 10,750 Director's remuneration 1,160 Staff benefits expenses 3,385 Finance expenses (note 3) 350 Dividend income 714 Non-current assets - at cost Freehold Land 30,000 20,600 47,250 7,800 Building Plant and machinery Research and development Accumulated depreciation at 1 July 2019 (note 7) Building Plant and machinery Research and development 10,000 12,250 3,900 6,225 Investments (note 4) Inventory (note 2) 1,740 Trade receivables 6,100 Bank 6,850 Trade payables 600 7% Term Loan 3.275 144 7,125 Bank overdraft (unsecured) Tax paid (note 6) Ordinary share capital 10% Redeemable preference shares Retained earnings as at 1 July 2019 Deferred tax liability 35,000 17,500 8,802 3,350 370,535 370,535 EA30703_Financial Accounting and Reporting 4 Page 9 of 11 Additional information: 1. Included in the revenue is an order that has been recognised amounting to RM69,000 which delivery was delayed to 15 July 2020 due to manufacturing issues. The term of the sale is on credit basis. Value of the goods have been included in the closing inventories. 2. Closing inventories which were recognised at costs amounting to RM62,800 was ascertained to be damaged and their net realisable value were RM20,950. 3. Finance expenses of RM350,000 includes: RM'000 Interest on bank overdraft 10 Lease rentals 340 350 The lease rentals were for a plant which was used 10% for administrative purposes and 90% for distribution. 4. Investments comprise financial assets valued at: Fair Value Carrying Amount RM'000 525 1,245 RM'000 450 1,300 Fair value through profit or loss Fair value through other comprehensive income At ametised cost 4,455 6,225 4,410 6,160 There were no purchases or disposals of any of these investments during the year. Fair value shown above is as at 30 June 2020. 5. Dividends on preference shares for the year have not been provided. The preference shares are redeemable at holder's option. EA30703_Financial Accounting and Reporting 4 Page 10 of 11 SEPTEMBER 2020 CONFIDENTIAL 6. The tax paid account is related to the tax paid during the year for the current year. The current year's tax expense was estimated to be RM10,250,000 inclusive of an increase to deferred tax liability of RM4,000,000 of which RM16,500 was related to financial assets at fair value through other comprehensive income. 7. Hillpark Bhd depreciates its assets on the following basis. The depreciation for the year has not been made: Depreciation expenses based on Annual Percentage (%) 2 Cost Building Plant and machinery Research and development Cost 10 Cost 20 All depreciation expenses are classified as administrative expenses. SEPTEMBER 2020 CONFIDENTIAL 6. The tax paid account is related to the tax paid during the year for the current year. The current year's tax expense was estimated to be RM10,250,000 inclusive of an increase to deferred tax liability of RM4,000,000 of which RM16,500 was related to financial assets at fair value through other comprehensive income. 7. Hillpark Bhd depreciates its assets on the following basis. The depreciation for the year has not been made: Annual Depreciation expenses based on Percentage (%) 2 10 Building Plant and machinery Research and development Cost Cost Cost 20 All depreciation expenses are classified as administrative expenses. 8. In April 2020, the government announced that companies which employ disabled workers will be compensated for their expenditure in relation to the salary paid to these workers. On 27 June 2020, Hillpark Bhd received a letter from the government which promises to compensate the company for salary paid to disabled workers employed during the year amounting to RM87,500. Cash was received from the government on 25 July 2020. Required: (a) (b) Prepare the statement of comprehensive income for the year ended 30 June 2020. (12 marks) Prepare the statement of financial position as at 30 June 2020. (18 marks) Note: Clearly show your workings. [30 marks]