Answered step by step

Verified Expert Solution

Question

1 Approved Answer

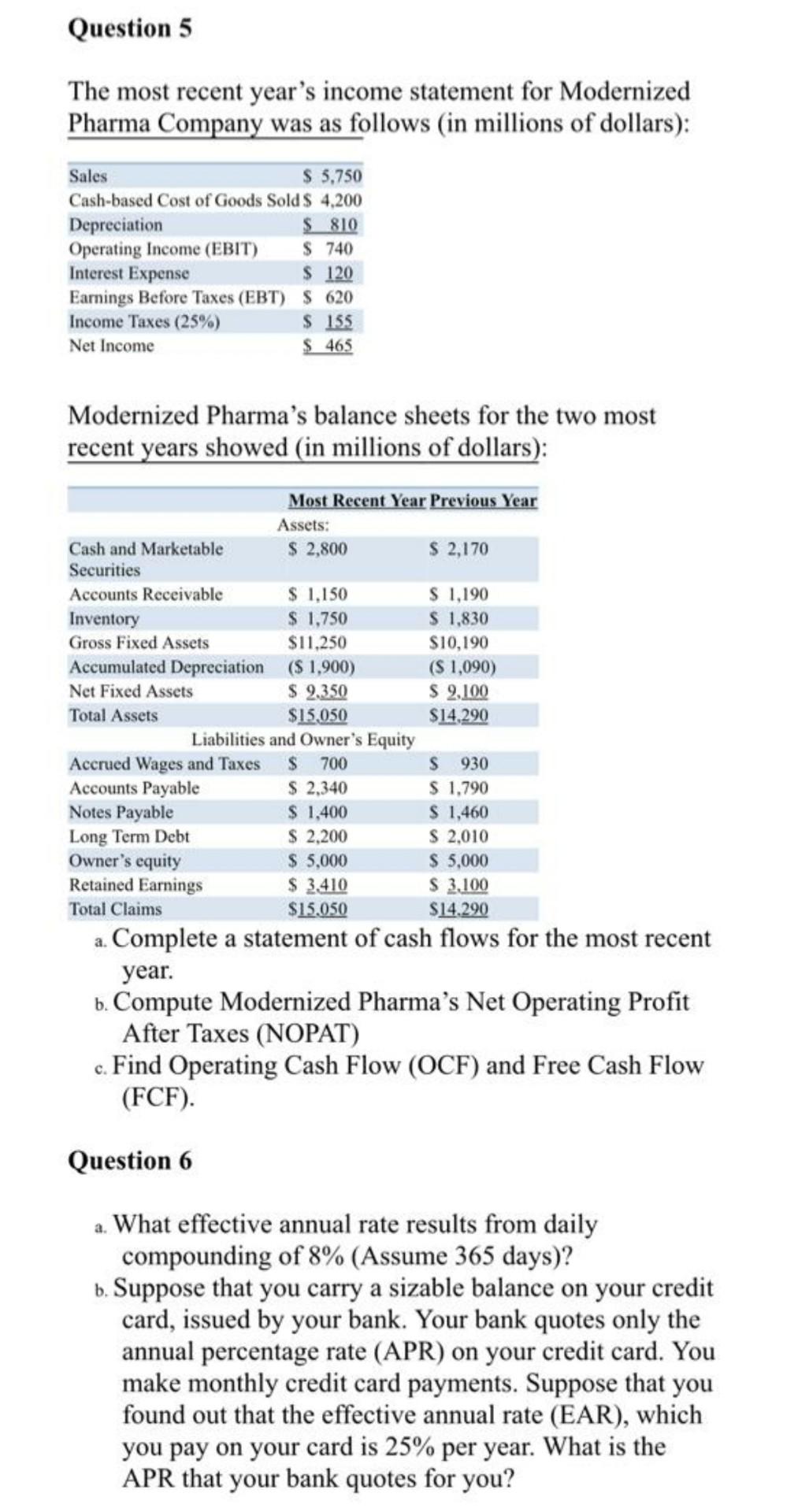

Question 5 The most recent year's income statement for Modernized Pharma Company was as follows (in millions of dollars): Sales $ 5.750 Cash-based Cost of

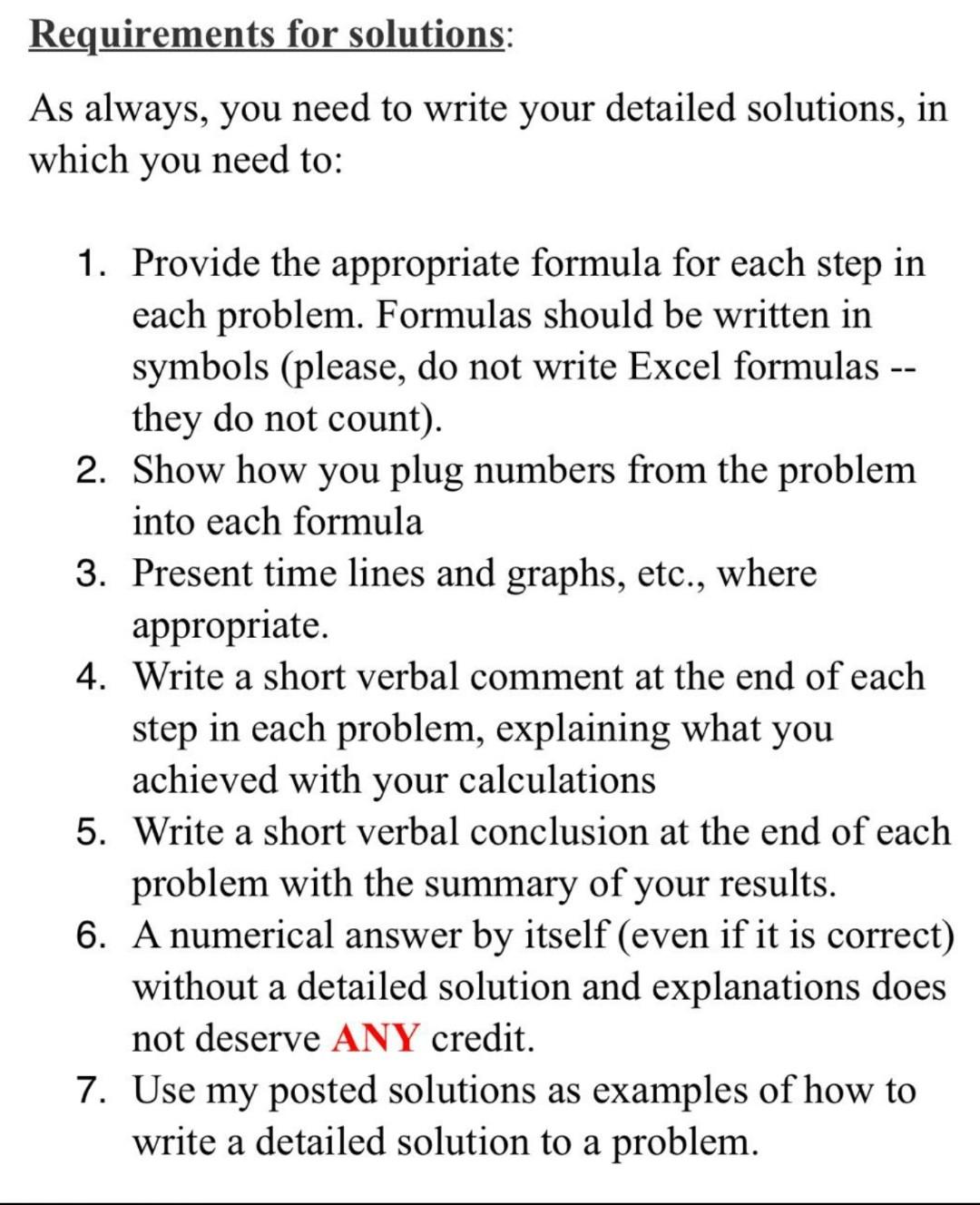

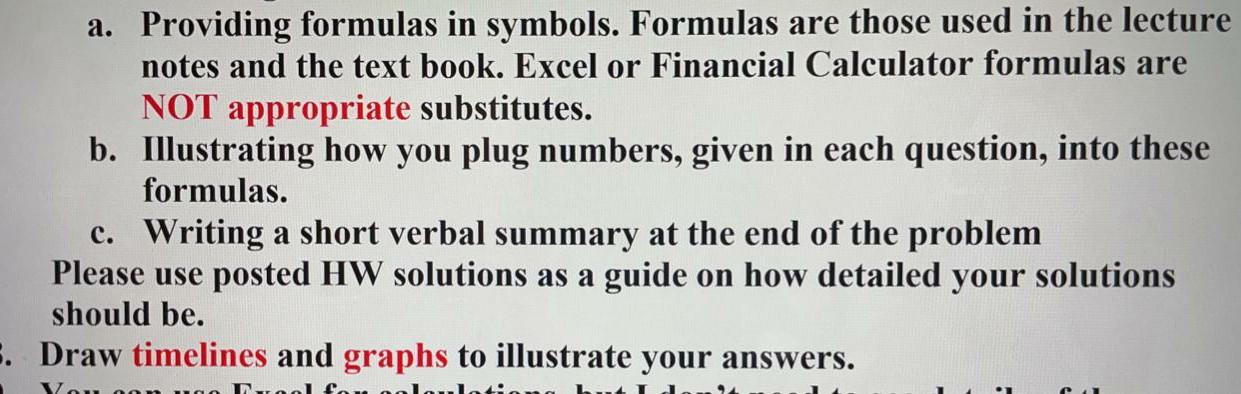

Question 5 The most recent year's income statement for Modernized Pharma Company was as follows (in millions of dollars): Sales $ 5.750 Cash-based Cost of Goods Sold $ 4,200 Depreciation $ 810 Operating Income (EBIT) $ 740 Interest Expense $ 120 Earnings Before Taxes (EBT) $ 620 Income Taxes (25%) $ 155 Net Income $ 465 Modernized Pharma's balance sheets for the two most recent years showed (in millions of dollars): S Most Recent Year Previous Year Assets: Cash and Marketable $ 2,800 $ 2,170 Securities Accounts Receivable $ 1,150 S 1,190 Inventory $ 1,750 $ 1,830 Gross Fixed Assets $11,250 $10,190 Accumulated Depreciation ($ 1,900) (S 1,090) Net Fixed Assets $ 2.350 $ 2,100 Total Assets $15,050 $14,290 Liabilities and Owner's Equity Accrued Wages and Taxes $ 700 930 Accounts Payable $ 2,340 $ 1.790 Notes Payable $ 1,400 $ 1,460 Long Term Debt $ 2.200 S 2.010 Owner's equity $ 5,000 $ 5,000 Retained Earnings $ 3.410 $ 3.100 Total Claims $15,050 $14.290 a. Complete a statement of cash flows for the most recent year. b. Compute Modernized Pharma's Net Operating Profit After Taxes (NOPAT) c. Find Operating Cash Flow (OCF) and Free Cash Flow (FCF). Question 6 a. What effective annual rate results from daily compounding of 8% (Assume 365 days)? b. Suppose that you carry a sizable balance on your credit card, issued by your bank. Your bank quotes only the annual percentage rate (APR) on your credit card. You make monthly credit card payments. Suppose that you found out that the effective annual rate (EAR), which you pay on your card is 25% per year. What is the APR that your bank quotes for you? Requirements for solutions: As always, you need to write your detailed solutions, in which you need to: 1. Provide the appropriate formula for each step in each problem. Formulas should be written in symbols (please, do not write Excel formulas -- they do not count). 2. Show how you plug numbers from the problem into each formula 3. Present time lines and graphs, etc., where appropriate. 4. Write a short verbal comment at the end of each step in each problem, explaining what you achieved with your calculations 5. Write a short verbal conclusion at the end of each problem with the summary of your results. 6. A numerical answer by itself (even if it is correct) without a detailed solution and explanations does not deserve ANY credit. 7. Use my posted solutions as examples of how to write a detailed solution to a problem. a. Providing formulas in symbols. Formulas are those used in the lecture notes and the text book. Excel or Financial Calculator formulas are NOT appropriate substitutes. b. Illustrating how you plug numbers, given in each question, into these formulas. c. Writing a short verbal summary at the end of the problem Please use posted HW solutions as a guide on how detailed your solutions should be. 5. Draw timelines and graphs to illustrate your answers. Von Prool

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started