Answered step by step

Verified Expert Solution

Question

1 Approved Answer

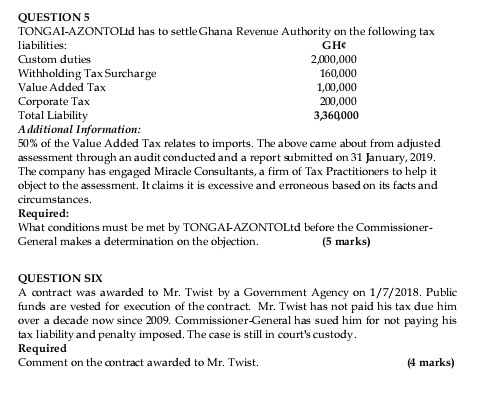

QUESTION 5 TONGAI-AZONTOLId has to settle Ghana Revenue Authority on the following tax liabilities: GH Gustom duties 2,000,000 Withholding Tax Surcharge 160,000 Value Added Tax

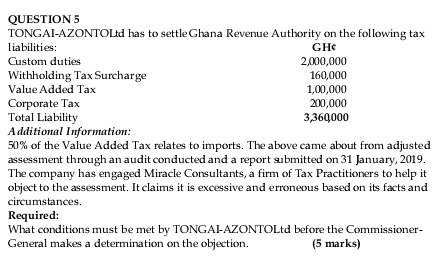

QUESTION 5 TONGAI-AZONTOLId has to settle Ghana Revenue Authority on the following tax liabilities: GH Gustom duties 2,000,000 Withholding Tax Surcharge 160,000 Value Added Tax 1,00,000 Corporate Tax 200,000 Total Liability 3,360000 Additional Information: 50% of the Value Added Tax relates to imports. The above came about from adjusted assessment through an audit conducted and a report submitted on 31 January, 2019. The company has engaged Miracle Consultants, a firm of Tax Practitioners to help it object to the assessment. It claims it is excessive and erroneous based on its facts and circumstances. Required: What conditions must be met by TONGAL-AZONTOLtd before the Commissioner- General makes a determination on the objection. (5 marks) QUESTION SIX A contract was awarded to Mr. Twist by a Government Agency on 1/7/2018. Public funds are vested for execution of the contract. Mr. Twist has not paid his tax due him over a decade now since 2009. Commissioner-General has sued him for not paying his tax liability and penalty imposed. The case is still in court's custody. Required Comment on the contract awarded to Mr. Twist. (4 marks) QUESTION 5 TONGAI-AZONTOLtd has to settle Ghana Revenue Authority on the following tax liabilities: GHC Gustom duties 2,000,000 Withholding Tax Surcharge 160,000 Value Added Tax 1,00,000 Corporate Tax 200,000 Total Liability 3,369000 Additional Information: 50% of the Value Added Tax relates to imports. The above came about from adjusted assessment through an audit conducted and a report submitted on 31 January, 2019. The company has engaged Miracle Consultants, a firm of Tax Practitioners to help it object to the assessment. It claims it is excessive and erroneous based on its facts and circumstances. Required: What conditions must be met by TONGAPAZONTOLtd before the Commissioner- General makes a determination on the objection. (5 marks) QUESTION 5 TONGAI-AZONTOLId has to settle Ghana Revenue Authority on the following tax liabilities: GH Gustom duties 2,000,000 Withholding Tax Surcharge 160,000 Value Added Tax 1,00,000 Corporate Tax 200,000 Total Liability 3,360000 Additional Information: 50% of the Value Added Tax relates to imports. The above came about from adjusted assessment through an audit conducted and a report submitted on 31 January, 2019. The company has engaged Miracle Consultants, a firm of Tax Practitioners to help it object to the assessment. It claims it is excessive and erroneous based on its facts and circumstances. Required: What conditions must be met by TONGAL-AZONTOLtd before the Commissioner- General makes a determination on the objection. (5 marks) QUESTION SIX A contract was awarded to Mr. Twist by a Government Agency on 1/7/2018. Public funds are vested for execution of the contract. Mr. Twist has not paid his tax due him over a decade now since 2009. Commissioner-General has sued him for not paying his tax liability and penalty imposed. The case is still in court's custody. Required Comment on the contract awarded to Mr. Twist. (4 marks) QUESTION 5 TONGAI-AZONTOLtd has to settle Ghana Revenue Authority on the following tax liabilities: GHC Gustom duties 2,000,000 Withholding Tax Surcharge 160,000 Value Added Tax 1,00,000 Corporate Tax 200,000 Total Liability 3,369000 Additional Information: 50% of the Value Added Tax relates to imports. The above came about from adjusted assessment through an audit conducted and a report submitted on 31 January, 2019. The company has engaged Miracle Consultants, a firm of Tax Practitioners to help it object to the assessment. It claims it is excessive and erroneous based on its facts and circumstances. Required: What conditions must be met by TONGAPAZONTOLtd before the Commissioner- General makes a determination on the objection

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started