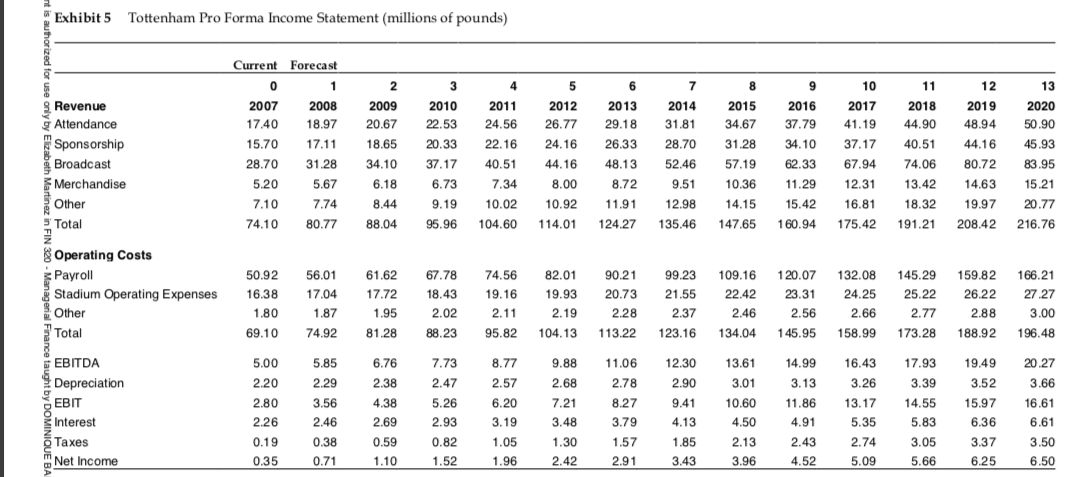

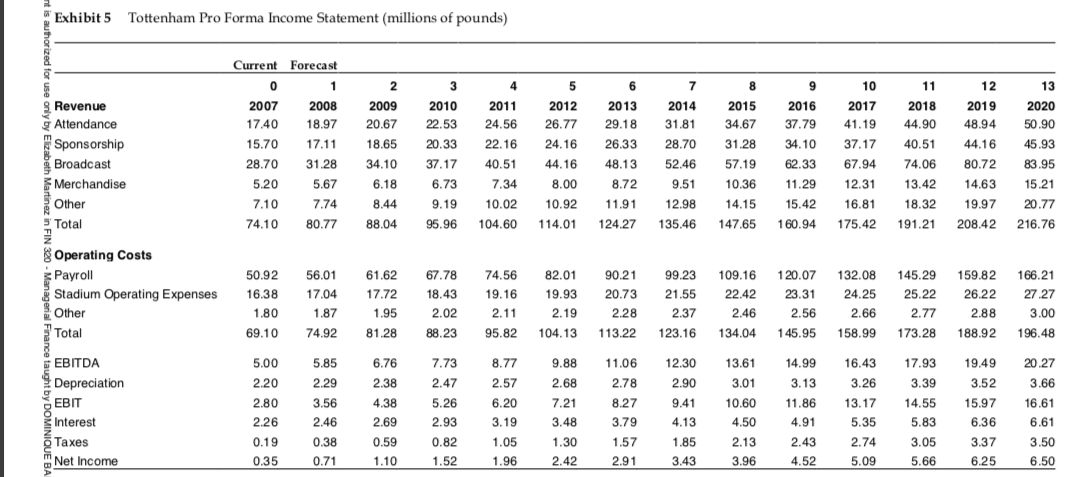

Question 5 Valuation of Tottenham with New Stadium

For this question, assume that it is January 1, 2008 (i.e. this is our time 0). You will use the data in Exhibit 5 of the case as well as additional data contained in the text to answer this question. Further assume that the stadium is depreciated using the straight-line method, that the stadium depreciation starts in year 3, and that the stadium can be used indefinitely. A) Calculate the free cash flows for Tottenham from today through 2020 with the new stadium project and calculate their NPV. Use a table similar to the one provided on page 5 of this assignment for your calculations. Note that you should value Tottenham with the stadium and not just the stadium separately (i.e. include your base calculations from Q4 and add any incremental cash flows from the Stadium). To help get you started with NWC you may assume that NWC at time 0 is -42.98 million pounds. Express numbers in millions of pounds and round your numbers to 2 decimals.

B) Assume that with the new stadium, Tottenhams free cash flows will continue to grow at 4% in perpetuity after 2020. Calculate the present value of all future free cash flows from 2021 onwards. Show your work.

Tottenham Pro Forma Income Statement (millions of pounds) Current Fore ca st 2 4 1 3 5 6 7 8 9 10 11 12 13 Revenue 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Attendance 17.40 18.97 20.67 22.53 24.56 26.77 29.18 31.81 34.67 37.79 41.19 44.90 48.94 50.90 Sponsorship Broadcast 22.16 28.70 31.28 34.10 40.5 44.16 45.93 15.70 17.11 18.65 20.33 24.16 26.33 37.17 37.17 40.51 44.16 28.70 31.28 34.10 48.13 52.46 57.19 62.33 67.94 74.06 80.72 83.95 Merchandise 11.29 5.20 5.67 6.18 6.73 7.34 8.00 8.72 9.51 10.36 12.31 13.42 14.63 15.21 Other 7.10 7.74 8.44 9.19 10.02 10.92 11.91 12.98 14.15 15.42 16.81 18.32 19.97 20.77 Total 104.60 216.76 74.10 80.77 88.04 95.96 124.27 135.46 147.65 160.94 175.42 191.21 208.42 114.01 Operating Costs 109.16 132.08 159.82 Payroll 50.92 56.01 61.62 67.78 74.56 82.01 90.21 99.23 120.07 145.29 166.21 26.22 Stadium Operating Expenses 16.38 17.04 17.72 18.43 19.16 19.93 20.73 21.55 22.42 23.31 24.25 25.22 27.27 1.87 Other 1.80 1.95 2.02 2.11 2.19 2.28 2.37 2.46 2.56 2.66 2.77 2.88 3.00 Total 69.10 81.28 88.23 74.92 95.82 104.13 113.22 123.16 134.04 145.95 158.99 173.28 188.92 196.48 5.85 12.30 20.27 TDA 5.00 6.76 7.73 8.77 9.88 11.06 13.61 14.99 16.43 17.93 19.49 Depreciation 3.66 2.20 2.29 2.38 2.47 2.57 2.68 2.78 2.90 3.01 3.13 3.26 3.39 3.52 3.56 T 2.80 4.38 5.26 6.20 7.21 8.27 9.41 10.60 11.86 13.17 14.55 15.97 16.61 Interest 4.9 2.26 2.46 2.69 2.93 3.19 3.48 3.79 4.13 4.50 5.35 5.83 6.36 6.61 3.50 Taxes 0.19 0.38 0.59 0.82 1.05 1.30 1.57 1.85 2.13 2.43 2.74 3.05 3.37 2.9 Net Income 0.35 0.71 1.10 1.52 1.96 2.42 3.43 3.96 4.52 5.09 5.66 6.25 6.50 Tottenham Pro Forma Income Statement (millions of pounds) Current Fore ca st 2 4 1 3 5 6 7 8 9 10 11 12 13 Revenue 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Attendance 17.40 18.97 20.67 22.53 24.56 26.77 29.18 31.81 34.67 37.79 41.19 44.90 48.94 50.90 Sponsorship Broadcast 22.16 28.70 31.28 34.10 40.5 44.16 45.93 15.70 17.11 18.65 20.33 24.16 26.33 37.17 37.17 40.51 44.16 28.70 31.28 34.10 48.13 52.46 57.19 62.33 67.94 74.06 80.72 83.95 Merchandise 11.29 5.20 5.67 6.18 6.73 7.34 8.00 8.72 9.51 10.36 12.31 13.42 14.63 15.21 Other 7.10 7.74 8.44 9.19 10.02 10.92 11.91 12.98 14.15 15.42 16.81 18.32 19.97 20.77 Total 104.60 216.76 74.10 80.77 88.04 95.96 124.27 135.46 147.65 160.94 175.42 191.21 208.42 114.01 Operating Costs 109.16 132.08 159.82 Payroll 50.92 56.01 61.62 67.78 74.56 82.01 90.21 99.23 120.07 145.29 166.21 26.22 Stadium Operating Expenses 16.38 17.04 17.72 18.43 19.16 19.93 20.73 21.55 22.42 23.31 24.25 25.22 27.27 1.87 Other 1.80 1.95 2.02 2.11 2.19 2.28 2.37 2.46 2.56 2.66 2.77 2.88 3.00 Total 69.10 81.28 88.23 74.92 95.82 104.13 113.22 123.16 134.04 145.95 158.99 173.28 188.92 196.48 5.85 12.30 20.27 TDA 5.00 6.76 7.73 8.77 9.88 11.06 13.61 14.99 16.43 17.93 19.49 Depreciation 3.66 2.20 2.29 2.38 2.47 2.57 2.68 2.78 2.90 3.01 3.13 3.26 3.39 3.52 3.56 T 2.80 4.38 5.26 6.20 7.21 8.27 9.41 10.60 11.86 13.17 14.55 15.97 16.61 Interest 4.9 2.26 2.46 2.69 2.93 3.19 3.48 3.79 4.13 4.50 5.35 5.83 6.36 6.61 3.50 Taxes 0.19 0.38 0.59 0.82 1.05 1.30 1.57 1.85 2.13 2.43 2.74 3.05 3.37 2.9 Net Income 0.35 0.71 1.10 1.52 1.96 2.42 3.43 3.96 4.52 5.09 5.66 6.25 6.50