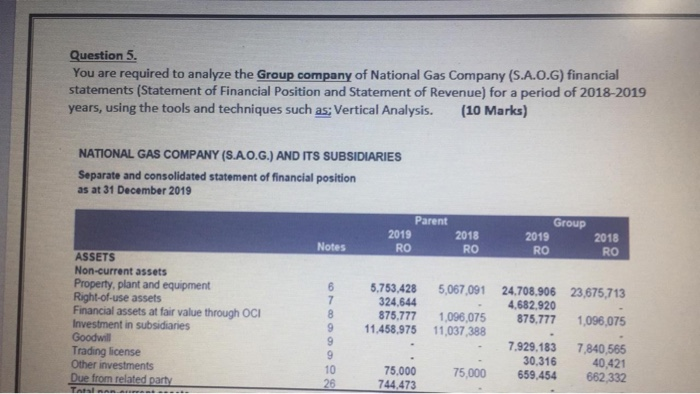

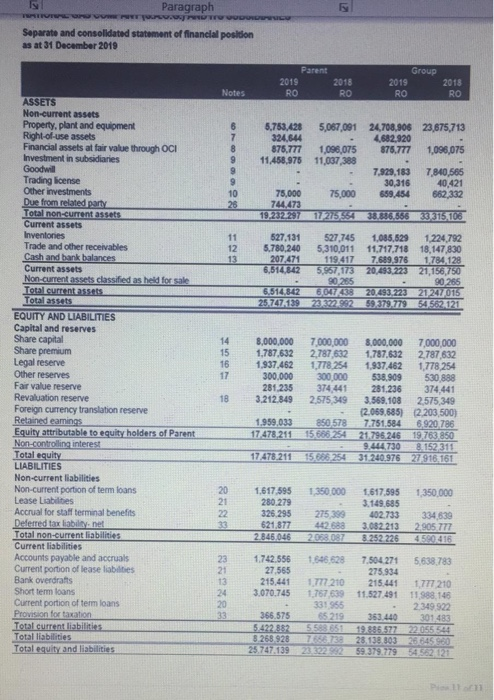

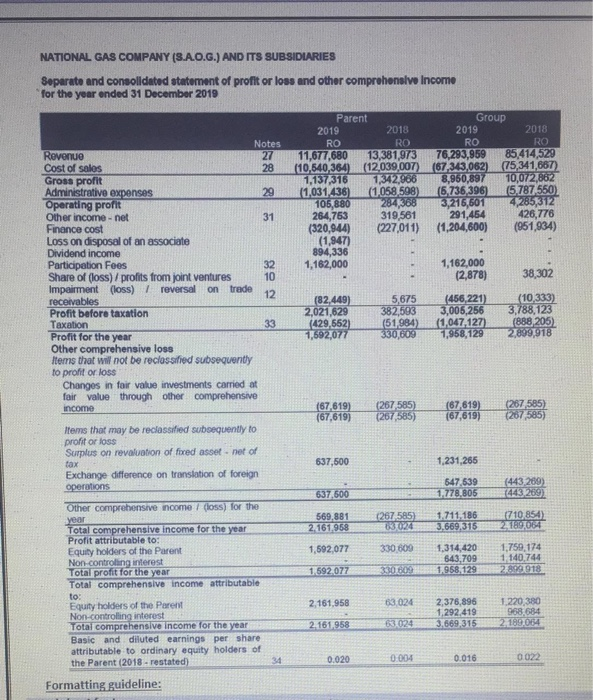

Question 5. You are required to analyze the Group company of National Gas Company (S.A.O.G) financial statements (Statement of Financial Position and Statement of Revenue) for a period of 2018-2019 years, using the tools and techniques such as: Vertical Analysis. (10 Marks) NATIONAL GAS COMPANY (S.AO.G.) AND ITS SUBSIDIARIES Separate and consolidated statement of financial position as at 31 December 2019 Parent 2019 2018 RO RO Group 2019 RO Notes 2018 RO 5,067,091 ASSETS Non-current assets Property, plant and equipment Right-of-use assets Financial assets at fair value through OCI Investment in subsidiaries Goodwill Trading license Other investments Due from related party Tam 6 7 8 9 9 9 10 26 5.753.428 324,644 875.777 11.458.975 24.708,906 23,675,713 4,682,920 875.777 1,096,075 1,096,075 11,037,388 7.929.183 30,316 659,454 7,840,565 40,421 662,332 75.000 744.473 75,000 Paragraph Separate and consolidated statement of financial position as at 31 December 2019 Parent 2019 2018 RO RO Group 2019 RO Notes 2018 RO 6 7 8 9 9 9 10 26 5,763,428 5,087,091 24,708,906 23,675,713 324,644 4,682,920 875,777 1,096,075 875,777 1,096,075 11,458,976 11,037,388 7,929,183 7,840,565 30,316 40,421 75,000 75,000 659,454 662,332 744.473 19,232297 12055543216.5663511108 11 12 13 527,131 527 745 1,086,629 1224,792 5,780,240 5,310,011 11.717.718 18,147 830 207471 119,417 7.689.976 1,784,128 6,514,842 5,957,173 20.49322321,156,750 90.265 90.265 6.514.842 6047438 20,493,223 21247015 25.7.761397372203259.379.7795456221 ASSETS Non-current assets Property, plant and equipment Right-of-use assets Financial assets at fair value through OCI Investment in subsidiaries Goodwill Trading license Other investments Due from related party Total non-current assets Current assets Inventories Trade and other receivables Cash and bank balances Current assets Non-current assets classified as held for sale Totalement assets Total assets EQUITY AND LIABILITIES Capital and reserves Share capital Share premium Legal reserve Other reserves Fair value reserve Revaluation reserve Foreign currency translation reserve Retained eaming Equity attributable to equity holders of Parent Non-controlling interest Total equity LIABILITIES Non-current liabilities Non-current portion of term loans Lease Liabilities Accrual for staff terminal benefits Deferred tax liability.net Total non-current liabilities Current liabilities Accounts payable and accruals Current portion of lease liabilities Bank overdrafts Short term loans Current portion of term loans Provision for taxation Total current liabilities Total liabilities Total equity and liabilities 14 15 16 17 8,000,000 1,787,632 1,937,462 300,000 261.235 3.212.849 18 7,000,000 8,000,000 7,000,000 2,787 632 1,787,632 2,787,632 1.778.254 1,937,462 1.778.254 300,000 538.909 530 888 374 441 281.236 374,441 2,575 349 3,569,108 2,575,349 (2.059.685) 2,203,500) 850 578 7.751,584 6,920 786 15 686 254 21.795.246 19,763 850 9.444.730 8.152 311 15.686 254 31.240.976 27916.161 1.959.033 17 478,211 17.478.211 1.350.000 1.350.000 20 21 22 1,617 595 280.279 326,295 621.877 2.845,046 275 399 442.688 2058 087 1.617.595 3.149,685 402.733 3.082.213 8.252 226 334639 2.905 777 4590416 1.646 628 23 21 13 24 20 33 1.742.556 27,565 215,441 3.070.745 1.777.210 1,767 639 331955 65 219 5588.651 7.504271 5.638.783 275.934 215.441 1.777210 11.527.491 11.988.145 2.349 922 363.440 301 483 19.835.577 22.055544 28.138.803 26645980 59.379.779462121 366.575 5.422 882 3.268,928 25.747,139 Plan NATIONAL GAS COMPANY (S.A.O.G.) AND ITS SUBSIDIARIES Separate and consolidated statement of profit or loss and other comprehensive Income for the year ended 31 December 2019 Notes Revenue 27 Cost of sales 28 Gross profit Administrative expenses 29 Operating profit Other income.net 31 Finance cost Loss on disposal of an associate Dividend income Participation Fees 32 Share of (loss)/profits from joint ventures 10 Impairment (loss) / reversal on trade 12 receivables Profit before taxation Taxation Profit for the year Other comprehensive loss Items that will not be reclassified subsequently to profit or loss Changes in fair value investments carried at fair value through other comprehensive income Parent Group 2019 2018 2019 2018 RO RO RO RO 11,677,680 13,381,973 76,293,959 85,414,529 (10,540,364) (12,039,007) (67.343,062) (75,341,667) 1,137,316 1,342,966 8,960,897 10,072,862 (1,031,436) (1.058,598) (6.736396) 15787550) 106,880 284308 3,216,601 4,285,312 264,753 319,561 291,454 426,776 (320,944) (227,011) (1,204,600) (951,934) (1,947) 894,336 1,162,000 1,162,000 (2,878) 38 302 (82,449) 5,675 (456,221) (10,333) 2,021,629 382,593 3,006,256 3,788,123 (429,662) (51984) (1.047 127) (888 205) 1,692,077 330,609 1,958,129 2,899,918 - 33 (67,619) (67,619) (267585) (267,585) (67,619 (67,619) (267 585) (267 585) Items that may be reclassified subsequently to profit or loss Surplus on revaluation of fored asset-net of tax Exchange difference on translation of foreign operations 637,500 1,231,265 647,539 1.778.805 (443,209) 1443 209) 637.500 569,881 2,161,958 1267 585 833044 1.711.186 3,669,315 (710,854) 2169,064 1,592,077 330 609 1,314,420 643,709 1.958,129 1,750,174 1 140,744 2899,018 1.592 077 3300 Other comprehensive incomo / oss) for the year Total comprehensive income for the year Profit attributable to: Equity holders of the Parent Non-controlling interest Total profit for the year Total comprehensive income attributable to: Equity holders of the Parent Non-controlling interest Total comprehensive income for the year Basic and diluted earnings per share attributable to ordinary equity holders of the Parent (2018-restated) 2,161,958 63024 2,376,896 1,292,419 3.669,315 1.220 380 968,684 2.189.084 2.161.958 34 0.020 0.004 0.016 0022 Formatting guideline