Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 . Your best friend from high school was just drafted by the Atlanta Braves. Your friend heard you are in a finance class

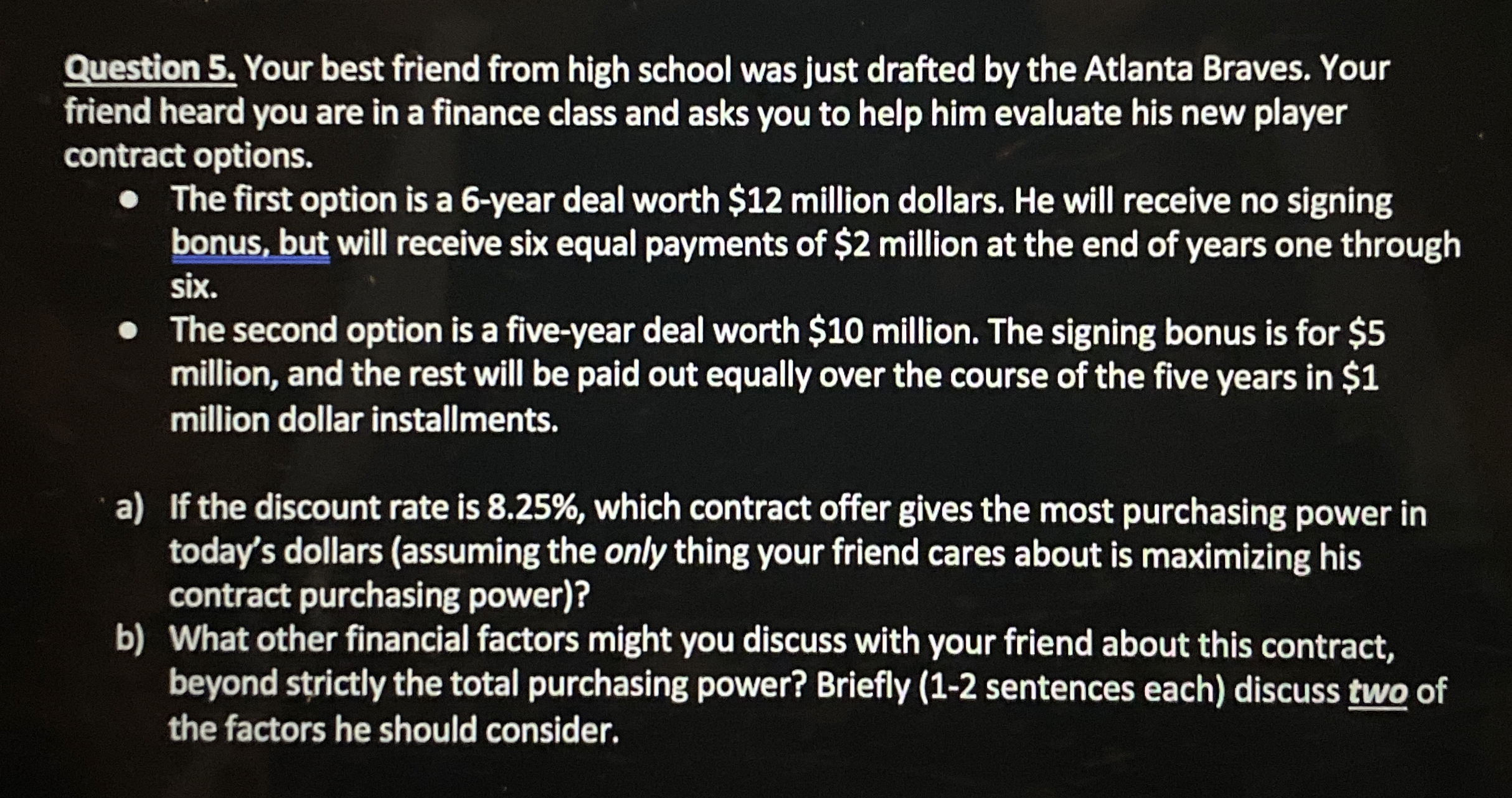

Question Your best friend from high school was just drafted by the Atlanta Braves. Your

friend heard you are in a finance class and asks you to help him evaluate his new player

contract options.

The first option is a year deal worth $ million dollars. He will receive no signing

bonus, but will receive six equal payments of $ million at the end of years one through

six.

The second option is a fiveyear deal worth $ million. The signing bonus is for $

million, and the rest will be paid out equally over the course of the five years in $

million dollar installments.

a If the discount rate is which contract offer gives the most purchasing power in

today's dollars assuming the only thing your friend cares about is maximizing his

contract purchasing power

b What other financial factors might you discuss with your friend about this contract,

beyond strictly the total purchasing power? Briefly sentences each discuss two of

the factors he should consider.

Question Your best friend from high school was just drafted by the Atlanta Braves. Your

friend heard you are in a finance class and asks you to help him evaluate his new player

contract options.

The first option is a year deal worth $ million dollars. He will receive no signing

bonus, but will receive six equal payments of $ million at the end of years one through

six.

The second option is a fiveyear deal worth $ million. The signing bonus is for $

million, and the rest will be paid out equally over the course of the five years in $

million dollar installments.

a If the discount rate is which contract offer gives the most purchasing power in

today's dollars assuming the only thing your friend cares about is maximizing his

contract purchasing power

b What other financial factors might you discuss with your friend about this contract,

beyond strictly the total purchasing power? Briefly sentences each discuss two of

the factors he should consider.

Solve in excel if possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started