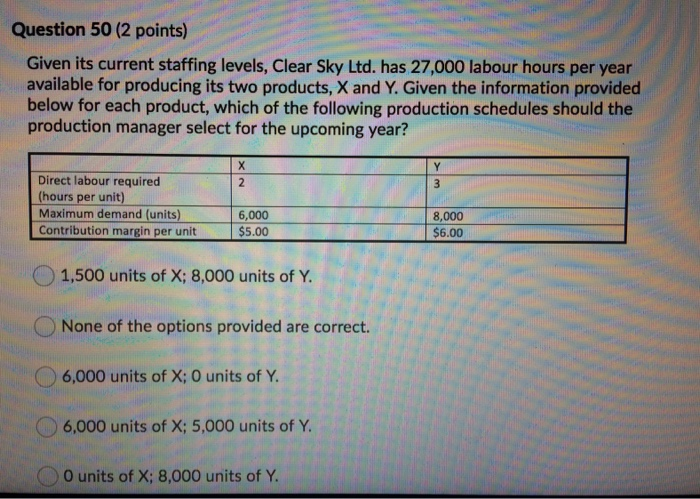

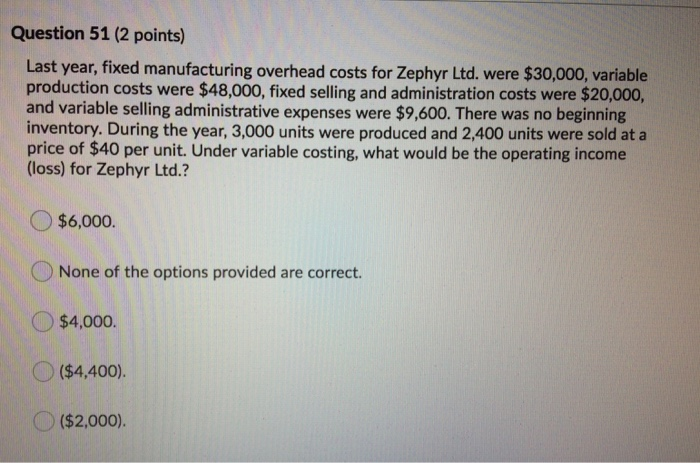

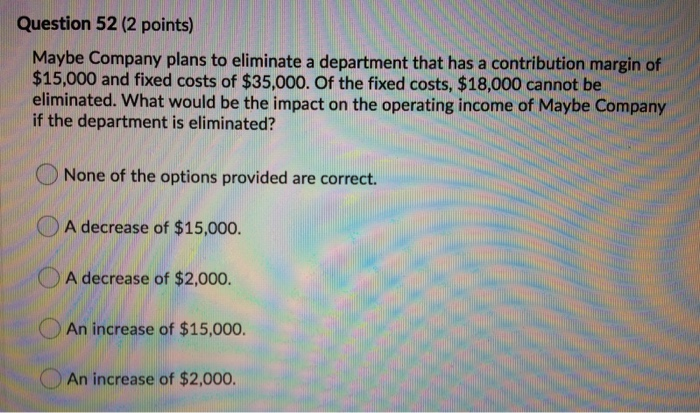

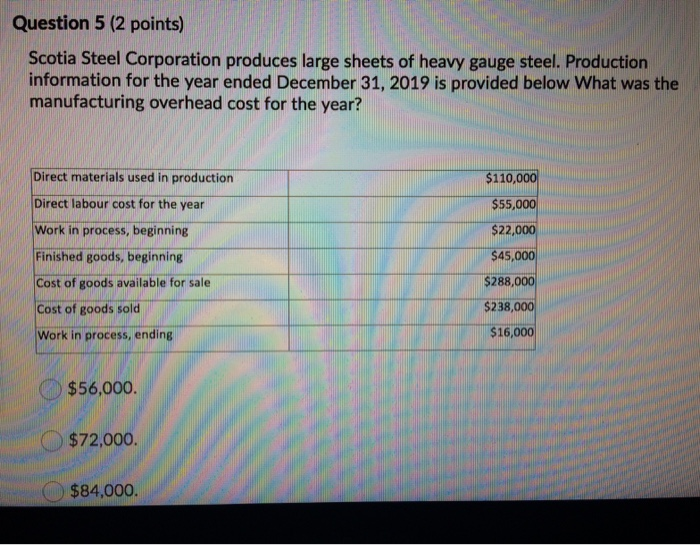

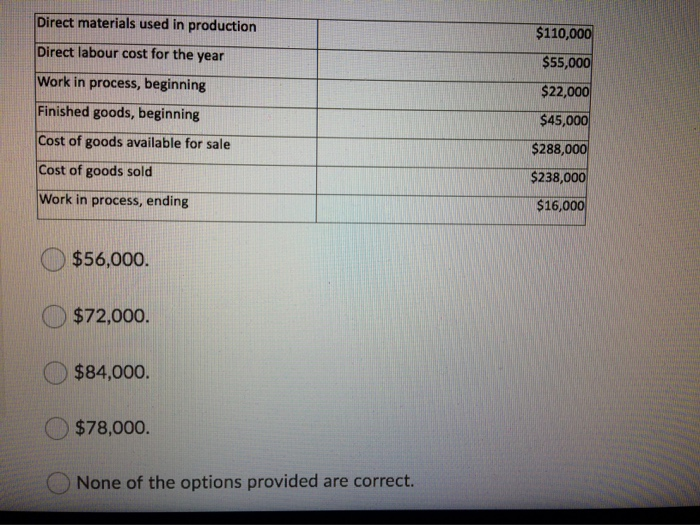

Question 50 (2 points) Given its current staffing levels, Clear Sky Ltd. has 27,000 labour hours per year available for producing its two products, X and Y. Given the information provided below for each product, which of the following production schedules should the production manager select for the upcoming year? Direct labour required (hours per unit) Maximum demand (units) Contribution margin per unit 6,000 $5.00 8,000 $6.00 1,500 units of X; 8,000 units of Y. None of the options provided are correct. 6,000 units of X; 0 units of Y. 6,000 units of X; 5,000 units of Y. O units of X; 8,000 units of Y. Question 51 (2 points) Last year, fixed manufacturing overhead costs for Zephyr Ltd. were $30,000, variable production costs were $48,000, fixed selling and administration costs were $20,000, and variable selling administrative expenses were $9,600. There was no beginning inventory. During the year, 3,000 units were produced and 2,400 units were sold at a price of $40 per unit. Under variable costing, what would be the operating income (loss) for Zephyr Ltd.? $6,000. None of the options provided are correct. $4,000 ($4,400). ($2,000). Question 52 (2 points) Maybe Company plans to eliminate a department that has a contribution margin of $15,000 and fixed costs of $35,000. Of the fixed costs, $18,000 cannot be eliminated. What would be the impact on the operating income of Maybe Company if the department is eliminated? wwwww w wwww None of the options provided are correct. Www wwwwwwwwwwwwwwwwwww wwwwwwwwwwwww A decrease of $15,000. www wwwwwww A decrease of $2,000. An increase of $15,000. An increase of $2,000. Question 5 (2 points) Scotia Steel Corporation produces large sheets of heavy gauge steel. Production information for the year ended December 31, 2019 is provided below What was the manufacturing overhead cost for the year? $110,000 $55,000 $22,000 Direct materials used in production Direct labour cost for the year Work in process, beginning Finished goods, beginning Cost of goods available for sale Cost of goods sold Work in process, ending $45,000 $288,000 $238,000 $16,000 $56,000 $72,000. $84,000. Direct materials used in production Direct labour cost for the year Work in process, beginning Finished goods, beginning Cost of goods available for sale Cost of goods sold Work in process, ending $110,000 $55,000 $22,000 $45,000 $288,000 $238,000 $16,000 $56,000. $72,000. $84,000. $78,000. None of the options provided are correct