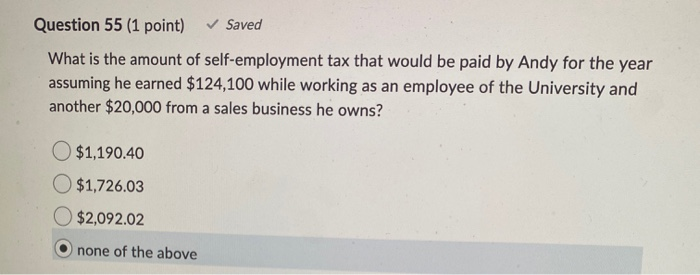

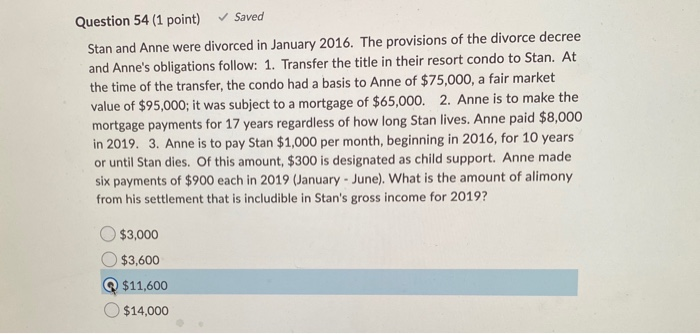

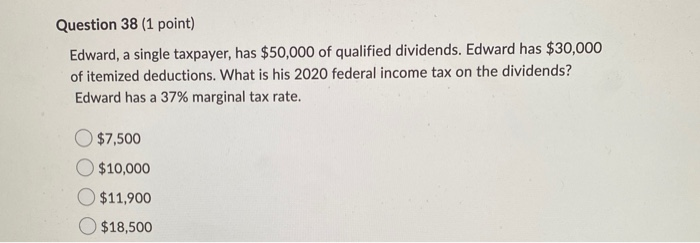

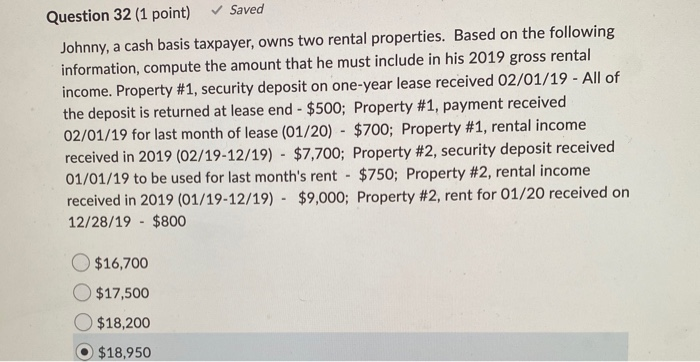

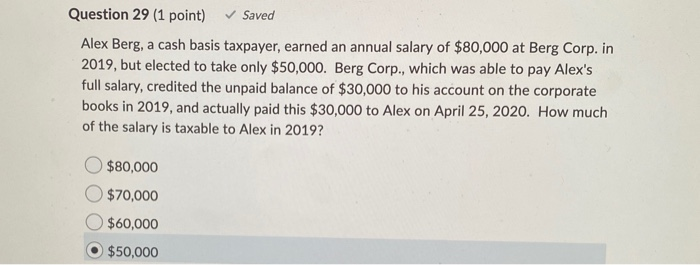

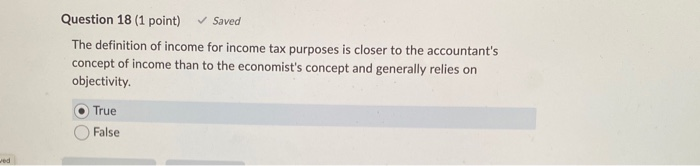

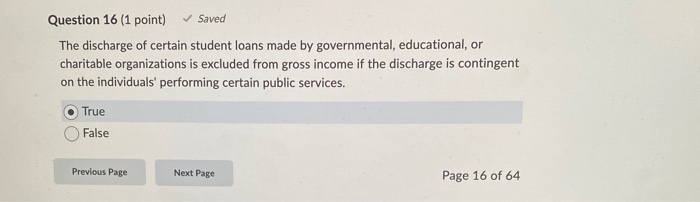

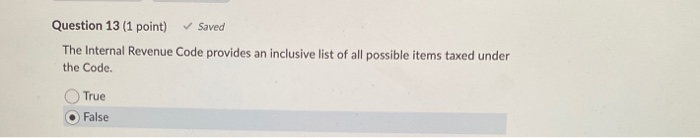

Question 55 (1 point) Saved What is the amount of self-employment tax that would be paid by Andy for the year assuming he earned $124,100 while working as an employee of the University and another $20,000 from a sales business he owns? $1,190.40 $1,726.03 $2,092.02 none of the above Question 54 (1 point) Saved Stan and Anne were divorced in January 2016. The provisions of the divorce decree and Anne's obligations follow: 1. Transfer the title in their resort condo to Stan. At the time of the transfer, the condo had a basis to Anne of $75,000, a fair market value of $95,000; it was subject to a mortgage of $65,000. 2. Anne is to make the mortgage payments for 17 years regardless of how long Stan lives. Anne paid $8,000 in 2019. 3. Anne is to pay Stan $1,000 per month, beginning in 2016, for 10 years or until Stan dies. Of this amount, $300 is designated as child support. Anne made six payments of $900 each in 2019 (January - June). What is the amount of alimony from his settlement that is includible in Stan's gross income for 2019? $3,000 $3,600 $11,600 $14,000 Question 38 (1 point) Edward, a single taxpayer, has $50,000 of qualified dividends. Edward has $30,000 of itemized deductions. What is his 2020 federal income tax on the dividends? Edward has a 37% marginal tax rate. $7,500 $10,000 O $11,900 $18,500 Question 32 (1 point) Saved Johnny, a cash basis taxpayer, owns two rental properties. Based on the following information, compute the amount that he must include in his 2019 gross rental income. Property #1, security deposit on one-year lease received 02/01/19 - All of the deposit is returned at lease end - $500; Property #1, payment received 02/01/19 for last month of lease (01/20) - $700; Property #1, rental income received in 2019 (02/19-12/19) - $7,700; Property #2, security deposit received 01/01/19 to be used for last month's rent - $750; Property #2, rental income received in 2019 (01/19-12/19) - $9,000; Property #2, rent for 01/20 received on 12/28/19 - $800 $16,700 $17,500 $18,200 $18,950 Saved Question 29 (1 point) Alex Berg, a cash basis taxpayer, earned an annual salary of $80,000 at Berg Corp. in 2019, but elected to take only $50,000. Berg Corp., which was able to pay Alex's full salary, credited the unpaid balance of $30,000 to his account on the corporate books in 2019, and actually paid this $30,000 to Alex on April 25, 2020. How much of the salary is taxable to Alex in 2019? $80,000 $70,000 $60,000 $50,000 Question 18 (1 point) Saved The definition of income for income tax purposes is closer to the accountant's concept of income than to the economist's concept and generally relies on objectivity. True False Question 16 (1 point) Saved The discharge of certain student loans made by governmental, educational, or charitable organizations is excluded from gross income if the discharge is contingent on the individuals' performing certain public services. True False Previous Page Next Page Page 16 of 64 Question 13 (1 point) Saved The Internal Revenue Code provides an inclusive list of all possible items taxed under the Code. True False