Question 5,6,7

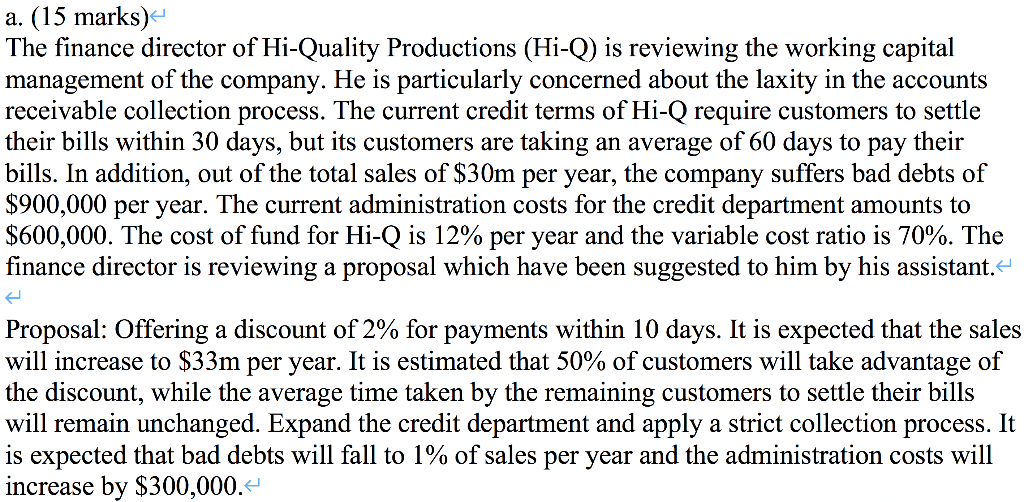

| 5] | Sales discount: | | | |

| | Existing [given] | $ - | | |

| | Proposed = 33000000*50%*2% = | | $ 3,30,000 | $ -3,30,000 |

| 6] | Net increase in profit before tax | | | $ 11,65,973 |

| 7] | THE PROPOSAL SHOULD BE ACCEPTED AS THE PROFIT BEFORE TAX WOULD INCREASE. | |

| | OTHER WORKINGS: |

a. (15 marks) The finance director of Hi-Quality Productions (Hi-Q) is reviewing the working capital management of the company. He is particularly concerned about the laxity in the accounts receivable collection process. The current credit terms of Hi-Q require customers to settle their bills within 30 days, but its customers are taking an average of 60 days to pay their bills. In addition, out of the total sales of $30m per year, the company suffers bad debts of $900,000 per year. The current administration costs for the credit department amounts to $600,000. The cost of fund for Hi-Q is 12% per year and the variable cost ratio is 70%. The finance director is reviewing a proposal which have been suggested to him by his assistant. Proposal: Offering a discount of 2% for payments within 10 days. It is expected that the sales will increase to $33m per year. It is estimated that 50% of customers will take advantage of the discount, while the average time taken by the remaining customers to settle their bills will remain unchanged. Expand the credit department and apply a strict collection process. It is expected that bad debts will fall to 1% of sales per year and the administration costs will increase by $300,000.- a. (15 marks) The finance director of Hi-Quality Productions (Hi-Q) is reviewing the working capital management of the company. He is particularly concerned about the laxity in the accounts receivable collection process. The current credit terms of Hi-Q require customers to settle their bills within 30 days, but its customers are taking an average of 60 days to pay their bills. In addition, out of the total sales of $30m per year, the company suffers bad debts of $900,000 per year. The current administration costs for the credit department amounts to $600,000. The cost of fund for Hi-Q is 12% per year and the variable cost ratio is 70%. The finance director is reviewing a proposal which have been suggested to him by his assistant. Proposal: Offering a discount of 2% for payments within 10 days. It is expected that the sales will increase to $33m per year. It is estimated that 50% of customers will take advantage of the discount, while the average time taken by the remaining customers to settle their bills will remain unchanged. Expand the credit department and apply a strict collection process. It is expected that bad debts will fall to 1% of sales per year and the administration costs will increase by $300,000