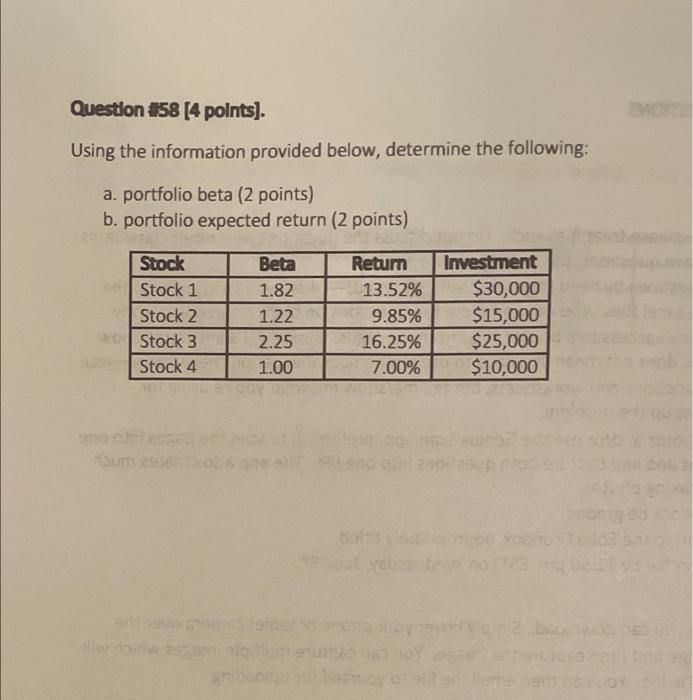

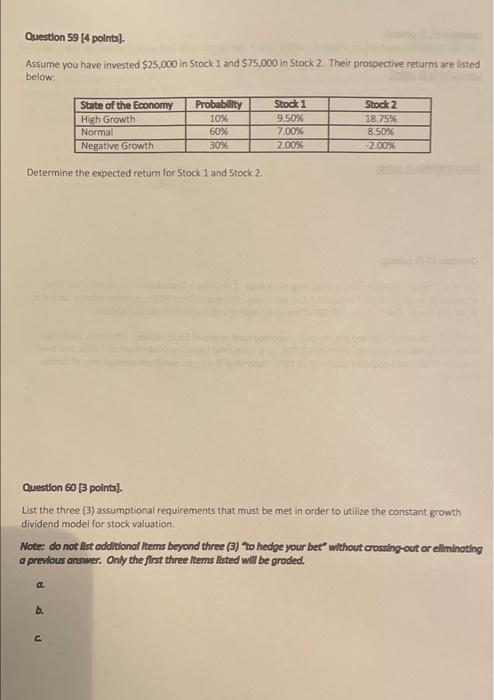

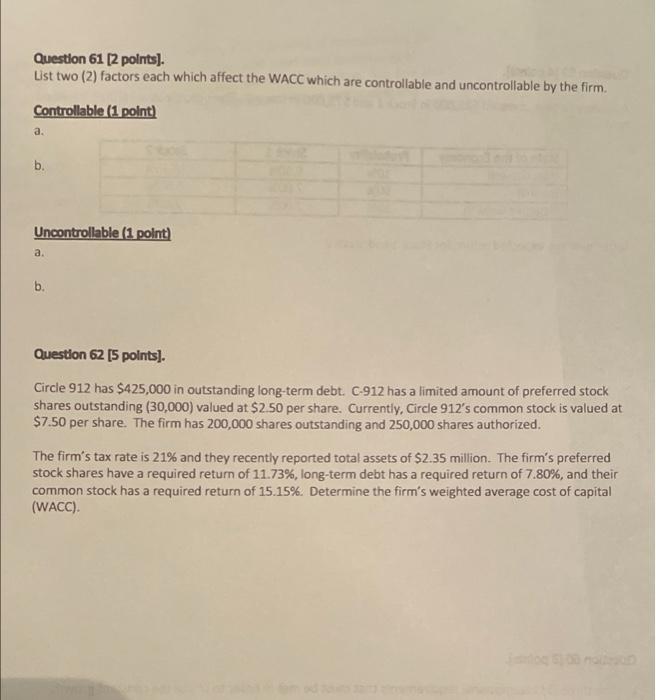

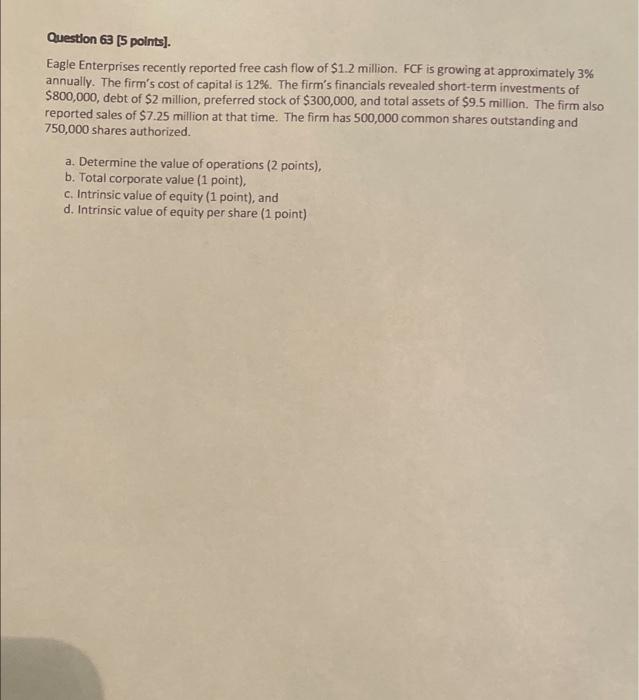

Question #58 [4 points]. Using the information provided below, determine the following: a. portfolio beta (2 points) b. portfolio expected return (2 points) Stock Beta Return Investment Stock 1 1.82 $30,000 Stock 2 1.22 $15,000 Stock 3 2.25 $25,000 Stock 4 1.00 $10,000 Houm 29:36 13.52% 9.85% 16.25% 7.00% oy ognis 161 901004 Question 59 [(4 points). Assume you have invested $25,000 in Stock 1 and $75,000 in Stock 2. Their prospective returns are listed below: Probability Stock 1 Stock 2 State of the Economy High Growth Normal 10% 9.50% 18.75% 60% 7.00% 8.50% Negative Growth 30% 2.00% -2.00% Determine the expected return for Stock 1 and Stock 2. Question 60 [3 points). List the three (3) assumptional requirements that must be met in order to utilize the constant growth dividend model for stock valuation. Note: do not list additional Items beyond three (3) to hedge your bet" without crossing-out or eliminating a previous answer. Only the first three Items listed will be graded. a b. C Question 61 [2 points]. List two (2) factors each which affect the WACC which are controllable and uncontrollable by the firm. Controllable (1 point) a. b. Uncontrollable (1 point) a. b. Question 62 [5 points]. Circle 912 has $425,000 in outstanding long-term debt. C-912 has a limited amount of preferred stock shares outstanding (30,000) valued at $2.50 per share. Currently, Circle 912's common stock is valued at $7.50 per share. The firm has 200,000 shares outstanding and 250,000 shares authorized. The firm's tax rate is 21% and they recently reported total assets of $2.35 million. The firm's preferred stock shares have a required return of 11.73%, long-term debt has a required return of 7.80%, and their common stock has a required return of 15.15%. Determine the firm's weighted average cost of capital (WACC). Question 63 [5 points]. Eagle Enterprises recently reported free cash flow of $1.2 million. FCF is growing at approximately 3% annually. The firm's cost of capital is 12%. The firm's financials revealed short-term investments of $800,000, debt of $2 million, preferred stock of $300,000, and total assets of $9.5 million. The firm also reported sales of $7.25 million at that time. The firm has 500,000 common shares outstanding and 750,000 shares authorized. a. Determine the value of operations (2 points), b. Total corporate value (1 point), c. Intrinsic value of equity (1 point), and d. Intrinsic value of equity per share (1 point)