Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5-9 multiple choice The balance of the accounts receivable control account on 31 May 2019 of Mango Traders was R15 400. Mr. Mango, the

Question 5-9 multiple choice

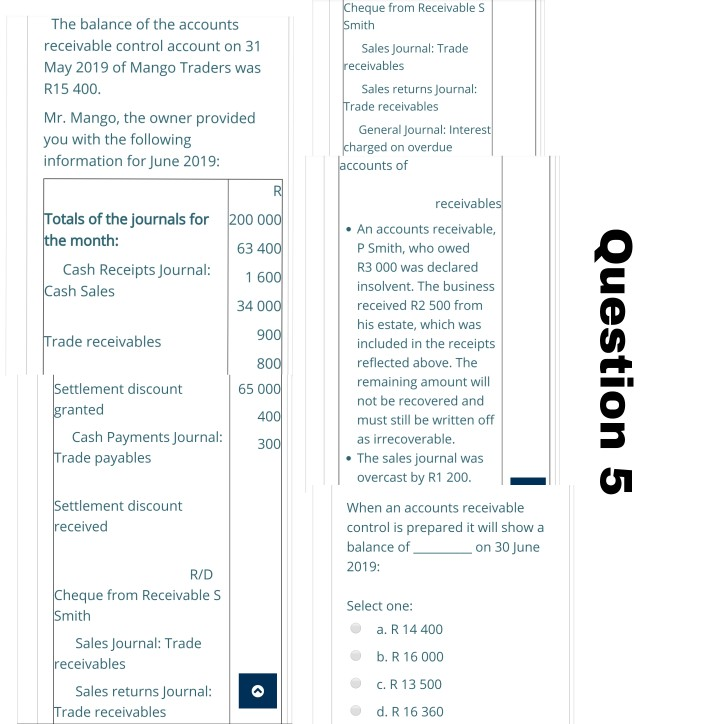

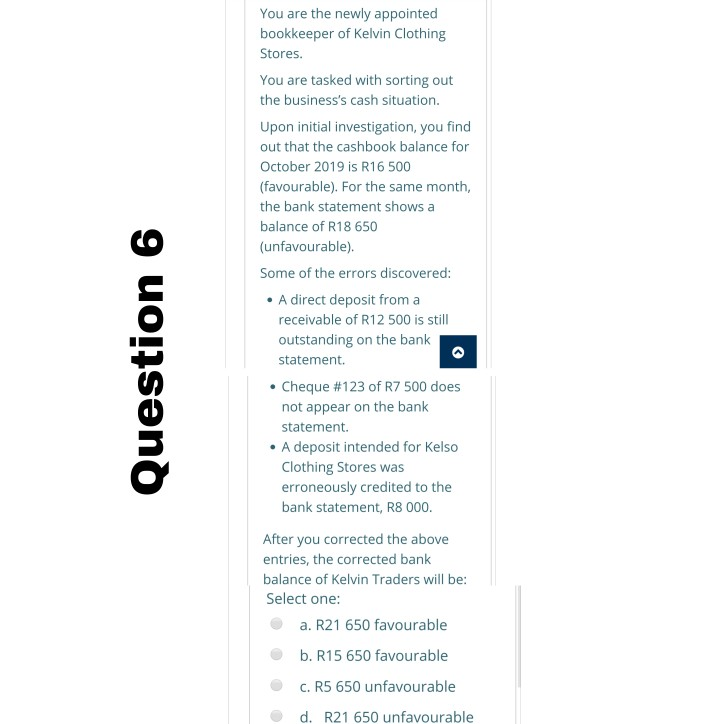

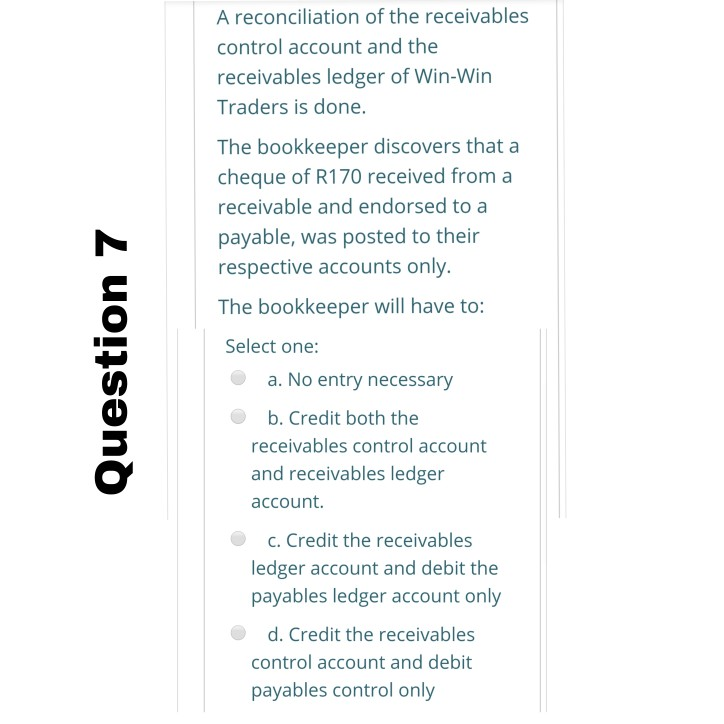

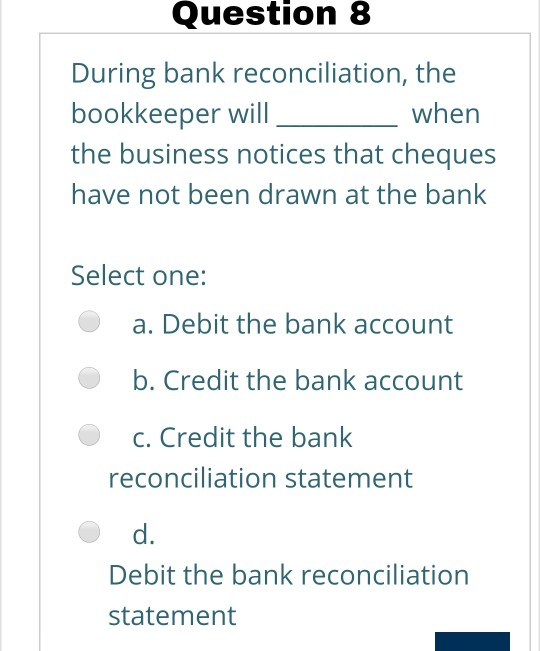

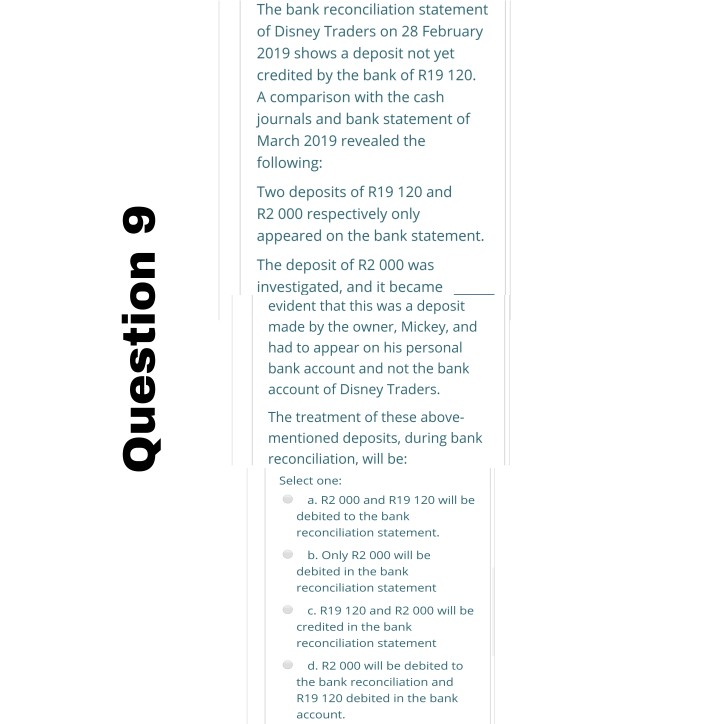

The balance of the accounts receivable control account on 31 May 2019 of Mango Traders was R15 400. Mr. Mango, the owner provided you with the following information for June 2019: Cheque from Receivables Smith Sales Journal: Trade receivables Sales returns Journal: Trade receivables General Journal: Interest charged on overdue accounts of R Totals of the journals for 200 000 the month: 63 400 Cash Receipts Journal: 1 600 Cash Sales 34 000 900 Trade receivables 800 Question 5 65 000 receivables An accounts receivable, P Smith, who owed R3 000 was declared insolvent. The business received R2 500 from his estate, which was included in the receipts reflected above. The remaining amount will not be recovered and must still be written off as irrecoverable. The sales journal was overcast by R1 200. When an accounts receivable control is prepared it will show a balance of on 30 June 2019: Settlement discount granted Cash Payments Journal: Trade payables 400 300 Settlement discount received R/D Cheque from Receivables Smith Sales Journal: Trade receivables Sales returns Journal: Trade receivables Select one: a. R 14 400 b. R 16 000 c. R 13 500 d. R 16 360 Question 6 You are the newly appointed bookkeeper of Kelvin Clothing Stores. You are tasked with sorting out the business's cash situation. Upon initial investigation, you find out that the cashbook balance for October 2019 is R16 500 (favourable). For the same month, the bank statement shows a balance of R18 650 (unfavourable). Some of the errors discovered: A direct deposit from a receivable of R12 500 is still outstanding on the bank statement Cheque #123 of R7 500 does not appear on the bank statement A deposit intended for Kelso Clothing Stores was erroneously credited to the bank statement, R8 000. After you corrected the above entries, the corrected bank balance of Kelvin Traders will be: Select one: a. R21 650 favourable b. R15 650 favourable C. R5 650 unfavourable d. R21 650 unfavourable A reconciliation of the receivables control account and the receivables ledger of Win-Win Traders is done. The bookkeeper discovers that a cheque of R170 received from a receivable and endorsed to a payable, was posted to their respective accounts only. The bookkeeper will have to: Select one: Question 7 a. No entry necessary b. Credit both the receivables control account and receivables ledger account. c. Credit the receivables ledger account and debit the payables ledger account only d. Credit the receivables control account and debit payables control only Question 8 During bank reconciliation, the bookkeeper will when the business notices that cheques have not been drawn at the bank Select one: a. Debit the bank account b. Credit the bank account c. Credit the bank reconciliation statement d. Debit the bank reconciliation statement Question 9 The bank reconciliation statement of Disney Traders on 28 February 2019 shows a deposit not yet credited by the bank of R19 120. A comparison with the cash journals and bank statement of March 2019 revealed the following: Two deposits of R19 120 and R2 000 respectively only appeared on the bank statement. The deposit of R2 000 was investigated, and it became evident that this was a deposit made by the owner, Mickey, and had to appear on his personal bank account and not the bank account of Disney Traders. The treatment of these above- mentioned deposits, during bank reconciliation, will be: Select one: a. R2 000 and R19 120 will be debited to the bank reconciliation statement. b. Only R2 000 will be debited in the bank reconciliation statement C. R19 120 and R2 000 will be credited in the bank reconciliation statement d. R2 000 will be debited to the bank reconciliation and R19 120 debited in the bank accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started