Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5a (Hedging). Krusty Burger requires pork for producing its famous Meat-Flavored Sandwich. Frozen Pork Bellies futures contracts trade on the CME. Each contract calls

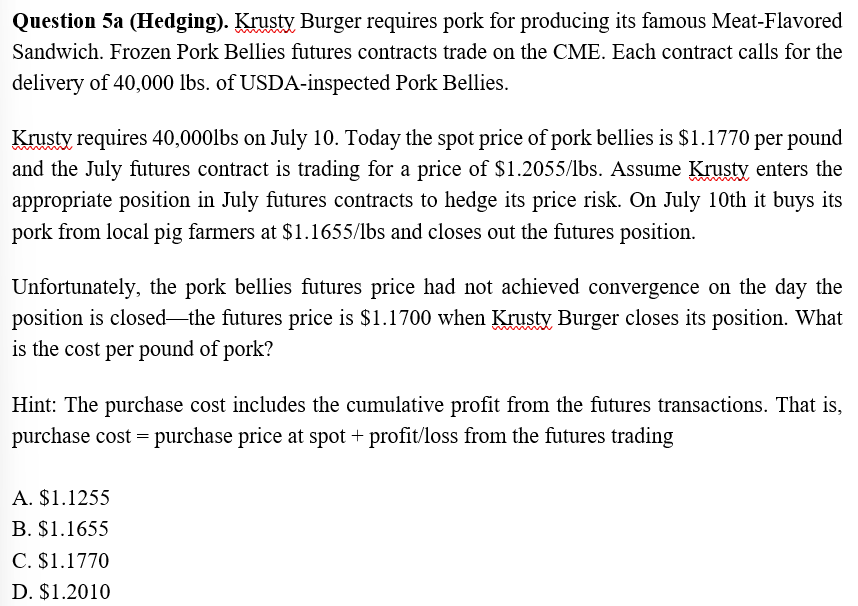

Question 5a (Hedging). Krusty Burger requires pork for producing its famous Meat-Flavored Sandwich. Frozen Pork Bellies futures contracts trade on the CME. Each contract calls for the delivery of 40,000 lbs. of USDA-inspected Pork Bellies. Krusty requires 40,000lbs on July 10 . Today the spot price of pork bellies is $1.1770 per pound and the July futures contract is trading for a price of $1.2055/lbs. Assume Krusty enters the appropriate position in July futures contracts to hedge its price risk. On July 10th it buys its pork from local pig farmers at $1.1655/lbs and closes out the futures position. Unfortunately, the pork bellies futures price had not achieved convergence on the day the position is closed - the futures price is $1.1700 when Krusty Burger closes its position. What is the cost per pound of pork? Hint: The purchase cost includes the cumulative profit from the futures transactions. That is, purchase cost = purchase price at spot + profit/loss from the futures trading A. $1.1255 B. $1.1655 C. $1.1770 D. $1.2010

Question 5a (Hedging). Krusty Burger requires pork for producing its famous Meat-Flavored Sandwich. Frozen Pork Bellies futures contracts trade on the CME. Each contract calls for the delivery of 40,000 lbs. of USDA-inspected Pork Bellies. Krusty requires 40,000lbs on July 10 . Today the spot price of pork bellies is $1.1770 per pound and the July futures contract is trading for a price of $1.2055/lbs. Assume Krusty enters the appropriate position in July futures contracts to hedge its price risk. On July 10th it buys its pork from local pig farmers at $1.1655/lbs and closes out the futures position. Unfortunately, the pork bellies futures price had not achieved convergence on the day the position is closed - the futures price is $1.1700 when Krusty Burger closes its position. What is the cost per pound of pork? Hint: The purchase cost includes the cumulative profit from the futures transactions. That is, purchase cost = purchase price at spot + profit/loss from the futures trading A. $1.1255 B. $1.1655 C. $1.1770 D. $1.2010 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started