Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5b (Hedging). A restaurant uses wheat to bake its kummelweck buns. It requires 50,000 bushels in 2 months on July 10th. The spot price

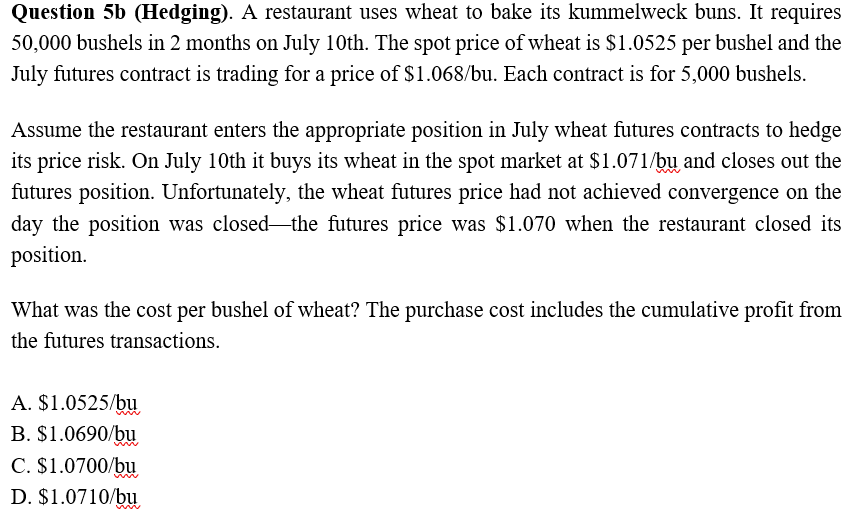

Question 5b (Hedging). A restaurant uses wheat to bake its kummelweck buns. It requires 50,000 bushels in 2 months on July 10th. The spot price of wheat is $1.0525 per bushel and the July futures contract is trading for a price of $1.068/bu. Each contract is for 5,000 bushels. Assume the restaurant enters the appropriate position in July wheat futures contracts to hedge its price risk. On July 10 th it buys its wheat in the spot market at $1.071/bu and closes out the futures position. Unfortunately, the wheat futures price had not achieved convergence on the day the position was closed-the futures price was $1.070 when the restaurant closed its position. What was the cost per bushel of wheat? The purchase cost includes the cumulative profit from the futures transactions. A. $1.0525/bu B. $1.0690/bu C. $1.0700/bu D. $1.0710/bu

Question 5b (Hedging). A restaurant uses wheat to bake its kummelweck buns. It requires 50,000 bushels in 2 months on July 10th. The spot price of wheat is $1.0525 per bushel and the July futures contract is trading for a price of $1.068/bu. Each contract is for 5,000 bushels. Assume the restaurant enters the appropriate position in July wheat futures contracts to hedge its price risk. On July 10 th it buys its wheat in the spot market at $1.071/bu and closes out the futures position. Unfortunately, the wheat futures price had not achieved convergence on the day the position was closed-the futures price was $1.070 when the restaurant closed its position. What was the cost per bushel of wheat? The purchase cost includes the cumulative profit from the futures transactions. A. $1.0525/bu B. $1.0690/bu C. $1.0700/bu D. $1.0710/bu Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started