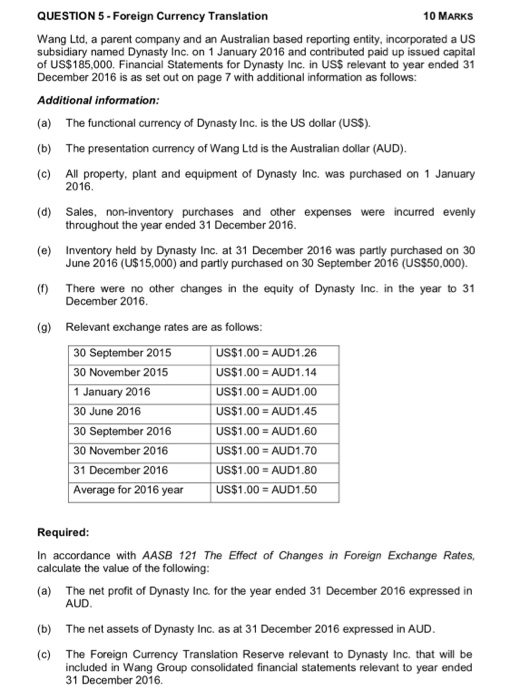

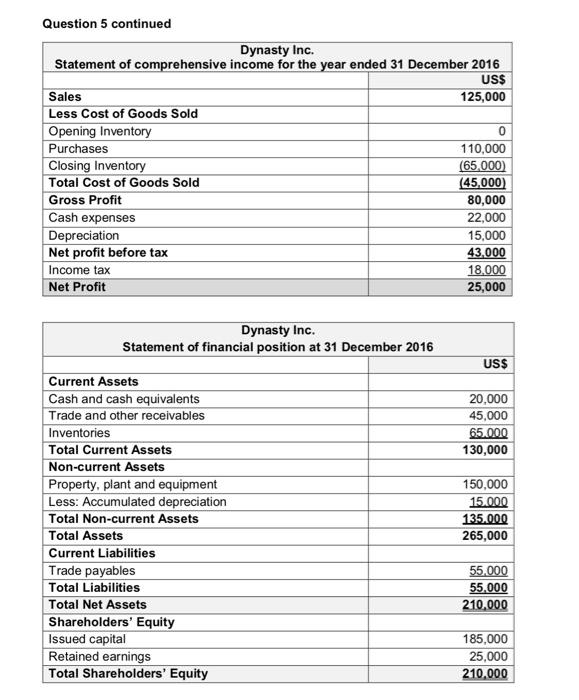

QUESTION 5-Foreign Currency Translation 10 MARKS Wang Ltd, a parent company and an Australian based reporting entity, incorporated a US subsidiary named Dynasty Inc. on 1 January 2016 and contributed paid up issued capital of US$185,000. Financial Statements for Dynasty Inc. in US$ relevant to year ended 31 December 2016 is as set out on page 7 with additional information as follows: Additional information: The functional currency of Dynasty Inc. is the US dollar (US$) (a) (b) The presentation currency of Wang Ltd is the Australian dollar (AUD) (c) All property, plant and equipment of Dynasty Inc. was purchased on 1 January 2016 (d) Sales, non-inventory purchases and other expenses were incurred evenly throughout the year ended 31 December 2016 (e) Inventory held by Dynasty Inc. at 31 December 2016 was partly purchased on 30 June 2016 (U$15,000) and partly purchased on 30 September 2016 (US$50,000). (f) There were no other changes in the equity of Dynasty Inc. in the year to 31 December 2016 (g) Relevant exchange rates are as follows: 30 September 2015 30 November 2015 1 January 2016 30 June 2016 30 September 2016 30 November 2016 31 December 2016 Average for 2016 year US$1.00 AUD1,26 US$1.00 AUD1.14 US$1.00 AUD1.00 US$1.00 AUD1.45 US$1.00 AUD1.60 US$1.00 AUD1.70 US$1.00 AUD1.80 US$1.00 AUD1,50 Required: In accordance with AASB 121 The Effect of Changes in Foreign Exchange Rates, calculate the val ue of the following: (a) The net profit of Dynasty Inc. for the year ended 31 December 2016 expressed in AUD The net assets of Dynasty Inc. as at 31 December 2016 expressed in AUD (b) (c) The Foreign Currency Translation Reserve relevant to Dynasty Inc. that will be included in Wang Group consolidated financial statements relevant to year ended 31 December 2016 3 3 Question 5 continued Dynasty Inc Statement of comprehensive income for the year ended 31 December 2016 US$ 125,000 Sales Less Cost of Goods Sold Opening Inventory Purchases 110,000 Closing Inventory (65.000) (45,000) Total Cost of Goods Sold Gross Profit Cash expenses Depreciation Net profit before tax 80,000 22,000 15,000 43,000 Income tax Net Profit 18,000 25,000 Dynasty Inc. Statement of financial position at 31 December 2016 US$ Current Assets Cash and cash equivalents 20,000 Trade and other receivables 45,000 Inventories 65.000 130,000 Total Current Assets Non-current Assets Property, plant and equipment Less: Accumulated depreciation 150,000 15.000 Total Non-current Assets 135.000 Total Assets 265,000 Current Liabilities Trade payables Total Liabilities Total Net Assets 55.000 55.000 210,000 Shareholders' Equity Issued capital Retained earnings Total Shareholders' Equity 185,000 25,000 210,000 QUESTION 5-Foreign Currency Translation 10 MARKS Wang Ltd, a parent company and an Australian based reporting entity, incorporated a US subsidiary named Dynasty Inc. on 1 January 2016 and contributed paid up issued capital of US$185,000. Financial Statements for Dynasty Inc. in US$ relevant to year ended 31 December 2016 is as set out on page 7 with additional information as follows: Additional information: The functional currency of Dynasty Inc. is the US dollar (US$) (a) (b) The presentation currency of Wang Ltd is the Australian dollar (AUD) (c) All property, plant and equipment of Dynasty Inc. was purchased on 1 January 2016 (d) Sales, non-inventory purchases and other expenses were incurred evenly throughout the year ended 31 December 2016 (e) Inventory held by Dynasty Inc. at 31 December 2016 was partly purchased on 30 June 2016 (U$15,000) and partly purchased on 30 September 2016 (US$50,000). (f) There were no other changes in the equity of Dynasty Inc. in the year to 31 December 2016 (g) Relevant exchange rates are as follows: 30 September 2015 30 November 2015 1 January 2016 30 June 2016 30 September 2016 30 November 2016 31 December 2016 Average for 2016 year US$1.00 AUD1,26 US$1.00 AUD1.14 US$1.00 AUD1.00 US$1.00 AUD1.45 US$1.00 AUD1.60 US$1.00 AUD1.70 US$1.00 AUD1.80 US$1.00 AUD1,50 Required: In accordance with AASB 121 The Effect of Changes in Foreign Exchange Rates, calculate the val ue of the following: (a) The net profit of Dynasty Inc. for the year ended 31 December 2016 expressed in AUD The net assets of Dynasty Inc. as at 31 December 2016 expressed in AUD (b) (c) The Foreign Currency Translation Reserve relevant to Dynasty Inc. that will be included in Wang Group consolidated financial statements relevant to year ended 31 December 2016 3 3 Question 5 continued Dynasty Inc Statement of comprehensive income for the year ended 31 December 2016 US$ 125,000 Sales Less Cost of Goods Sold Opening Inventory Purchases 110,000 Closing Inventory (65.000) (45,000) Total Cost of Goods Sold Gross Profit Cash expenses Depreciation Net profit before tax 80,000 22,000 15,000 43,000 Income tax Net Profit 18,000 25,000 Dynasty Inc. Statement of financial position at 31 December 2016 US$ Current Assets Cash and cash equivalents 20,000 Trade and other receivables 45,000 Inventories 65.000 130,000 Total Current Assets Non-current Assets Property, plant and equipment Less: Accumulated depreciation 150,000 15.000 Total Non-current Assets 135.000 Total Assets 265,000 Current Liabilities Trade payables Total Liabilities Total Net Assets 55.000 55.000 210,000 Shareholders' Equity Issued capital Retained earnings Total Shareholders' Equity 185,000 25,000 210,000