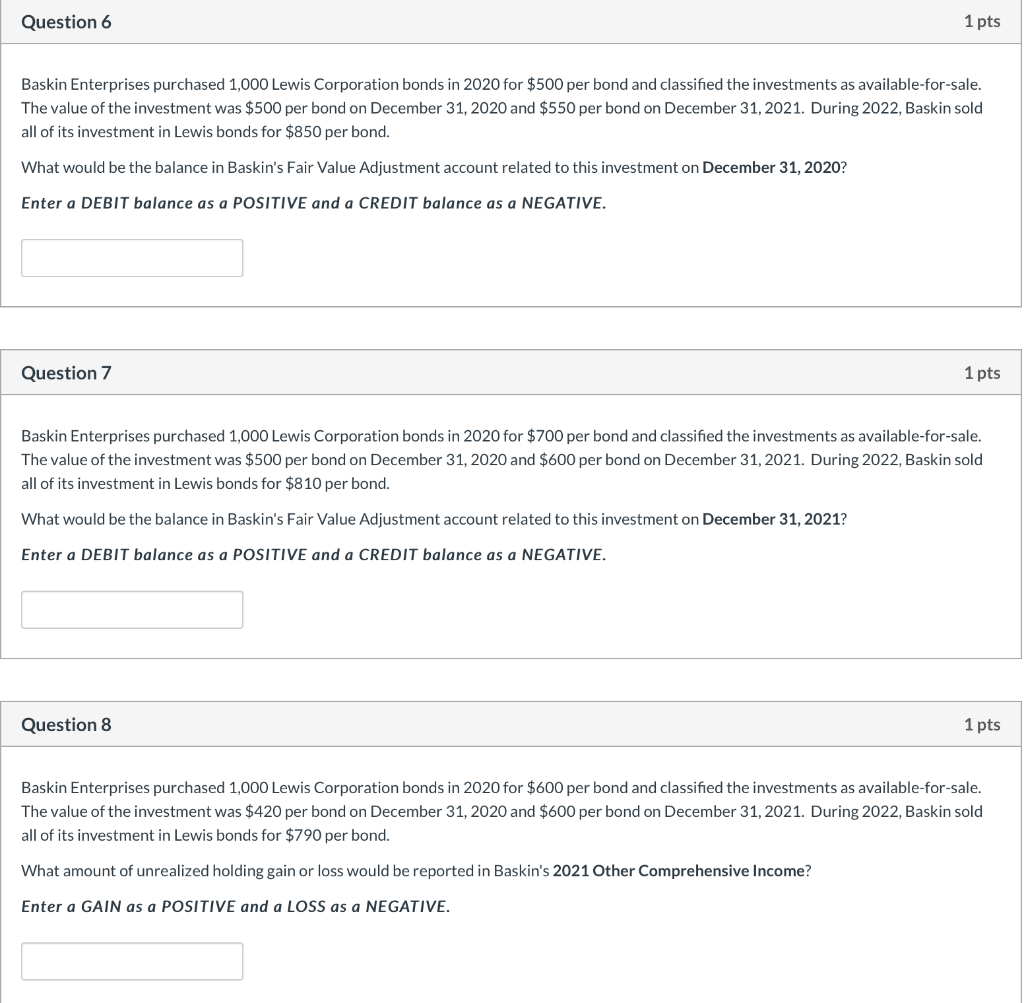

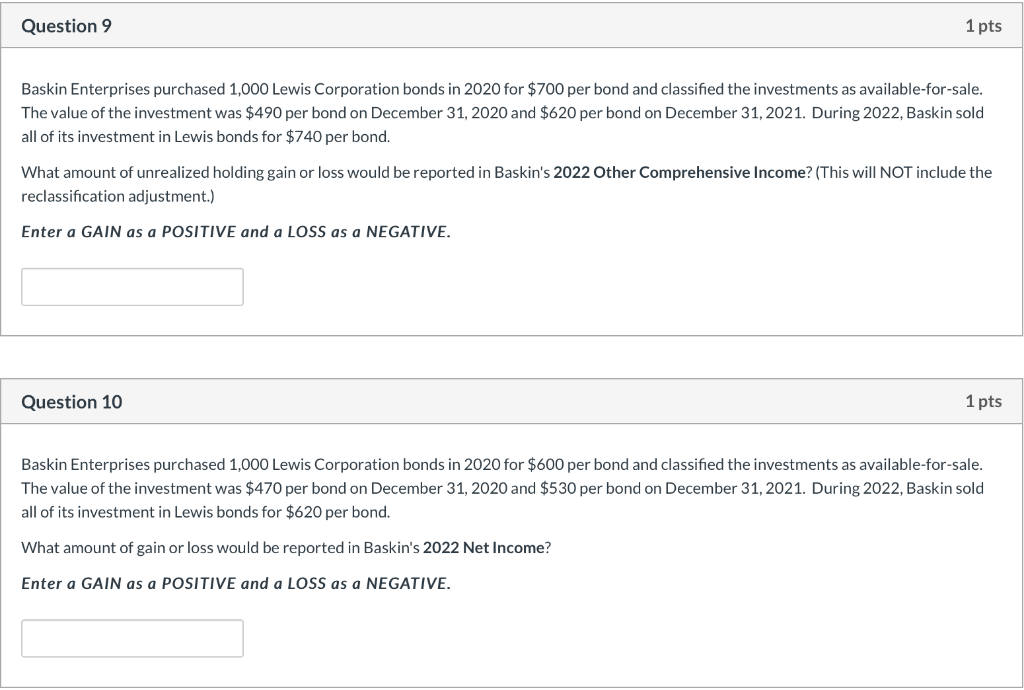

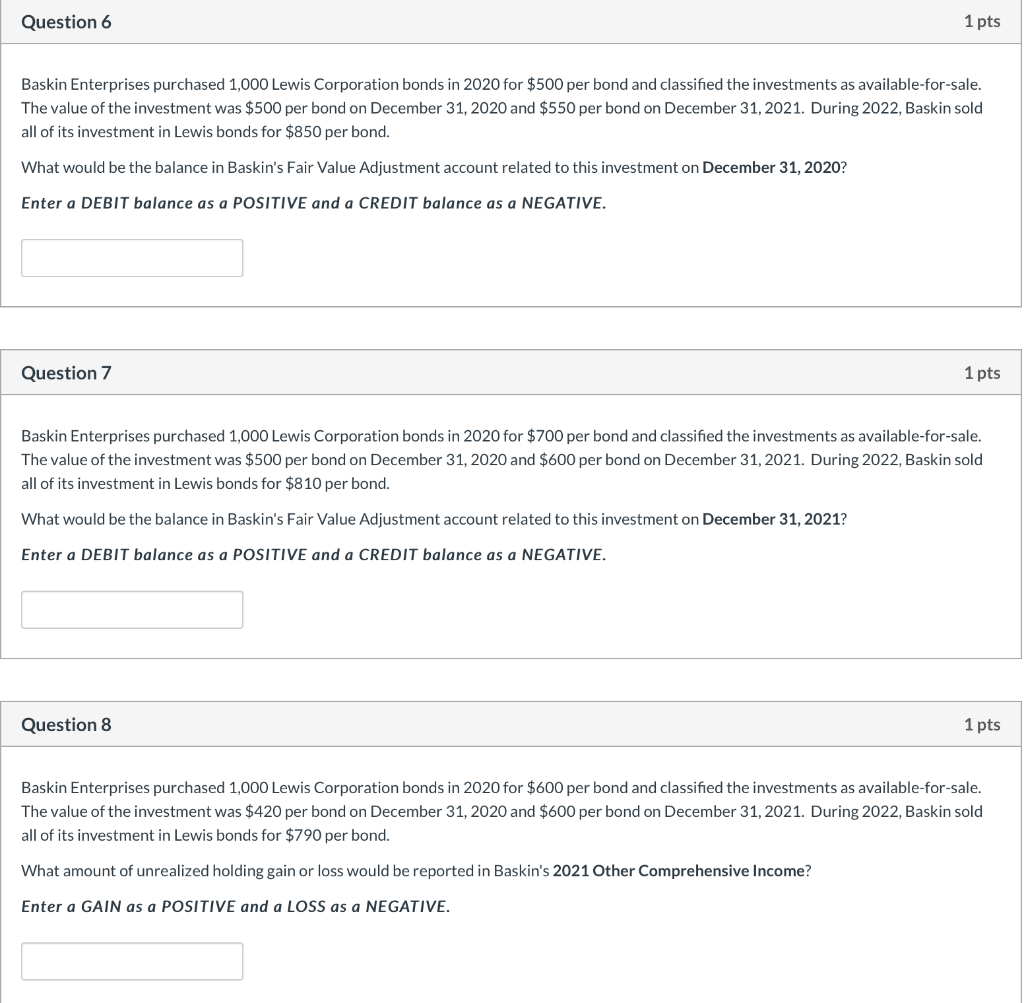

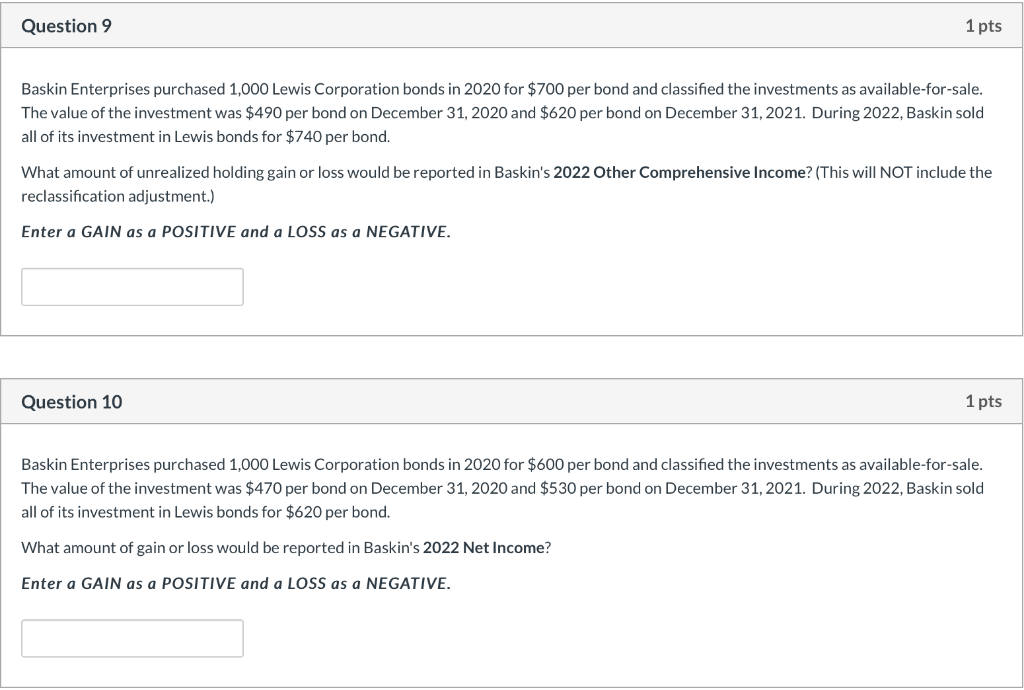

Question 6 1 pts Baskin Enterprises purchased 1,000 Lewis Corporation bonds in 2020 for $500 per bond and classified the investments as available-for-sale. The value of the investment was $500 per bond on December 31, 2020 and $550 per bond on December 31, 2021. During 2022, Baskin sold all of its investment in Lewis bonds for $850 per bond. What would be the balance in Baskin's Fair Value Adjustment account related to this investment on December 31, 2020? Enter a DEBIT balance as a POSITIVE and a CREDIT balance as a NEGATIVE. Question 7 1 pts Baskin Enterprises purchased 1,000 Lewis Corporation bonds in 2020 for $700 per bond and classified the investments as available-for-sale. The value of the investment was $500 per bond on December 31, 2020 and $600 per bond on December 31, 2021. During 2022, Baskin sold all of its investment in Lewis bonds for $810 per bond. What would be the balance in Baskin's Fair Value Adjustment account related to this investment on December 31, 2021? Enter a DEBIT balance as a POSITIVE and a CREDIT balance as a NEGATIVE. Question 8 1 pts Baskin Enterprises purchased 1,000 Lewis Corporation bonds in 2020 for $600 per bond and classified the investments as available-for-sale. The value of the investment was $420 per bond on December 31, 2020 and $600 per bond on December 31, 2021. During 2022, Baskin sold all of its investment in Lewis bonds for $790 per bond. What amount of unrealized holding gain or loss would be reported in Baskin's 2021 Other Comprehensive Income? Enter a GAIN as a POSITIVE and a LOSS as a NEGATIVE. Question 9 1 pts Baskin Enterprises purchased 1,000 Lewis Corporation bonds in 2020 for $700 per bond and classified the investments as available-for-sale. The value of the investment was $490 per bond on December 31, 2020 and $620 per bond on December 31, 2021. During 2022, Baskin sold all of its investment in Lewis bonds for $740 per bond. What amount of unrealized holding gain or loss would be reported in Baskin's 2022 Other Comprehensive Income? (This will NOT include the reclassification adjustment.) Enter a GAIN as a POSITIVE and a LOSS as a NEGATIVE. Question 10 1 pts Baskin Enterprises purchased 1,000 Lewis Corporation bonds in 2020 for $600 per bond and classified the investments as available-for-sale. The value of the investment was $470 per bond on December 31, 2020 and $530 per bond on December 31, 2021. During 2022, Baskin sold all of its investment in Lewis bonds for $620 per bond. What amount of gain or loss would be reported in Baskin's 2022 Net Income? Enter a GAIN as a POSITIVE and a LOSS as a NEGATIVE