Answered step by step

Verified Expert Solution

Question

1 Approved Answer

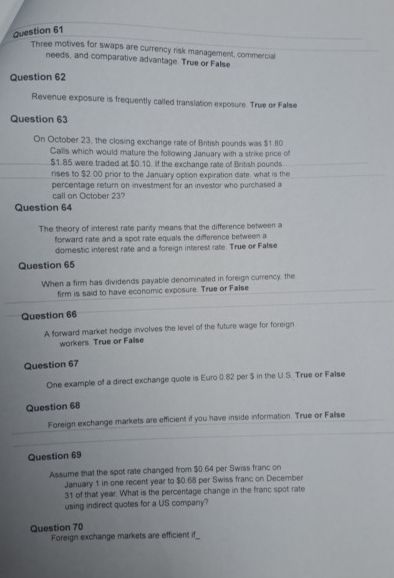

Question 6 1 Three motives for swaps are currency risk management, commercid needs, and comparative advantage. True or False Question 6 2 Revenue exposure is

Question

Three motives for swaps are currency risk management, commercid needs, and comparative advantage. True or False

Question

Revenue exposure is frequently called translation exposure. True or False

Question

On Octoter the closing exchange rate of British pounds was $ Bo Calls which would mature the following January with a strice price of $ were traded at $ if the erchange rate of Botich pounds rises to $ pror to the January opton expration date what is the percentage return on investment for an investor who purchased a call on October

Question

The theory of interest rate parfy means that the difference between a forward rate and a spot rate equals the difference bewween a domestic interest rate and a foreign interest rate. True or False

Question

When a firm has dividends payable denominated in foreign cuirency the firm is said to have economic exposure. True or False

Question

A forward maket hedge involves the level of the future wage for foreign workers True or False

Question

One example of a direct exchange quote is Euro per $ in the US True or False

Question

Foreign exchange markets are efficient if you have inside nlormation. True or False

Question

Assume that the spot rate changed from $ per Swiss franc on January in one recent year to $ per Swiss franc on December of that year. What is the percentage change in the franc spot rate using indirect quotes for a US company?

Question

Foreign exchange markets are efficient i Fon

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started