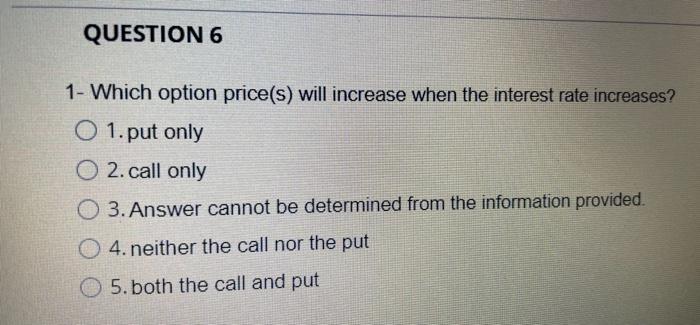

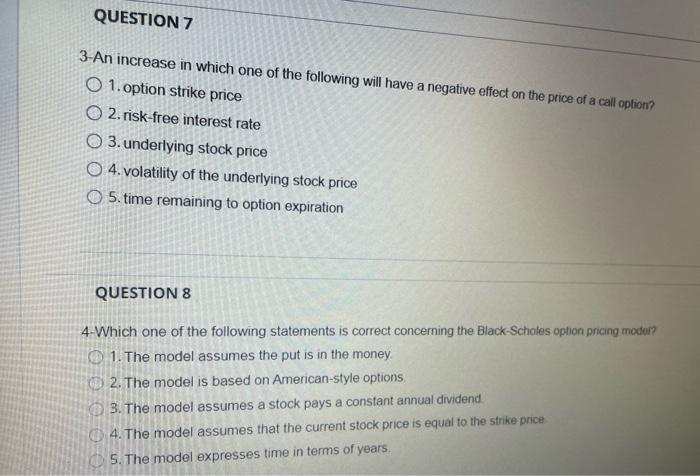

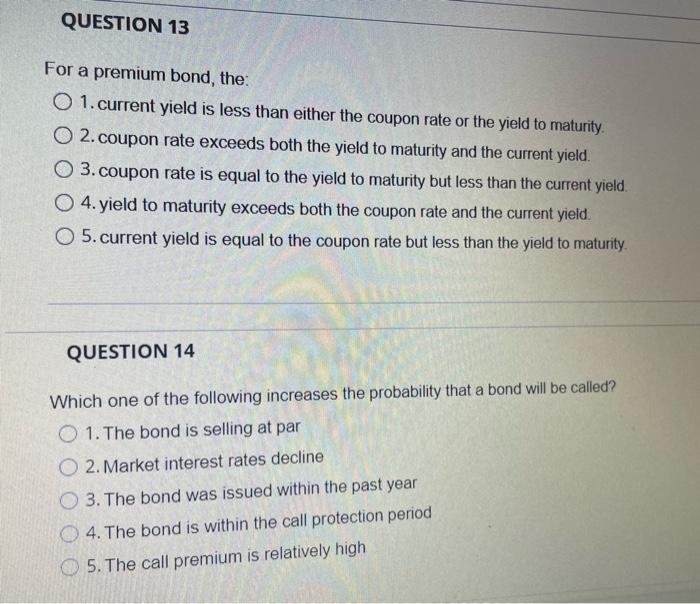

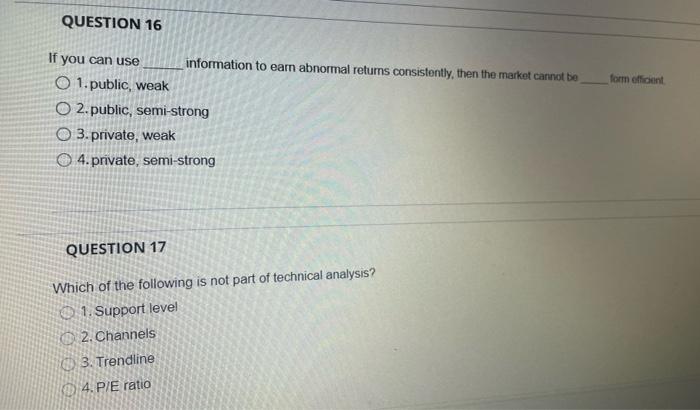

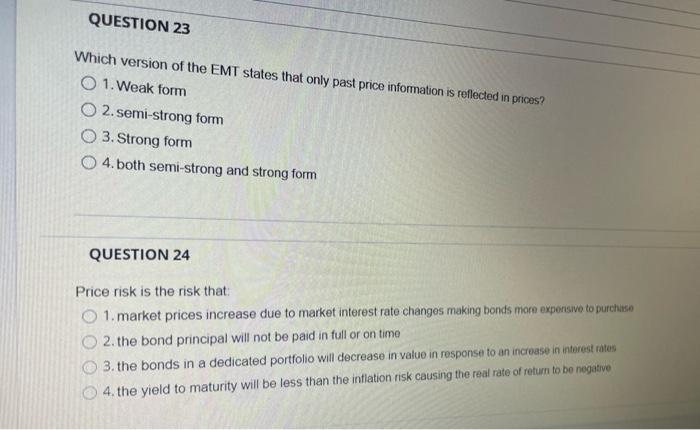

QUESTION 6 1- Which option price(s) will increase when the interest rate increases? O 1. put only O 2. call only O 3. Answer cannot be determined from the information provided. 04. neither the call nor the put 5. both the call and put QUESTION 7 3-An increase in which one of the following will have a negative effect on the price of a call ophon? O 1.option strike price 2. risk-free interest rate 3. underlying stock price 4. volatility of the underlying stock price 5. time remaining to option expiration QUESTION 8 4-Which one of the following statements is correct concerning the Black-Scholes option pncing model? 1. The model assumes the put is in the money 2. The model is based on American-style options 3. The model assumes a stock pays a constant annual dividend 4. The model assumes that the current stock price is equal to the strike price 5. The model expresses time in terms of years. QUESTION 13 For a premium bond, the O 1.current yield is less than either the coupon rate or the yield to maturity. 2. coupon rate exceeds both the yield to maturity and the current yield. 3.coupon rate is equal to the yield to maturity but less than the current yield. 4. yield to maturity exceeds both the coupon rate and the current yield. O 5.current yield is equal to the coupon rate but less than the yield to maturity QUESTION 14 Which one of the following increases the probability that a bond will be called? O 1. The bond is selling at par O 2. Market interest rates decline 3. The bond was issued within the past year 4. The bond is within the call protection period 5. The call premium is relatively high QUESTION 16 form efficent If you can use information to earn abnormal returns consistently, then the market cannot be O 1. public, weak O 2. public, semi-strong 3. private, weak 4. private, semi-strong QUESTION 17 Which of the following is not part of technical analysis? 1. Support level 2. Channels 3. Trendline 4. P/E ratio QUESTION 23 Which version of the EMT states that only past price information is reflected in prices? O 1. Weak form 2. semi-strong form 3. Strong form 4.both semi-strong and strong form QUESTION 24 Price risk is the risk that: O 1. market prices increase due to market interest rate changes making bonds more expensive to purchonso 2. the bond principal will not be paid in full or on time 3. the bonds in a dedicated portfolio will decrease in value in response to an increase in interest rates 4. the yield to maturity will be less than the inflation risk causing the real rate of return to be negative