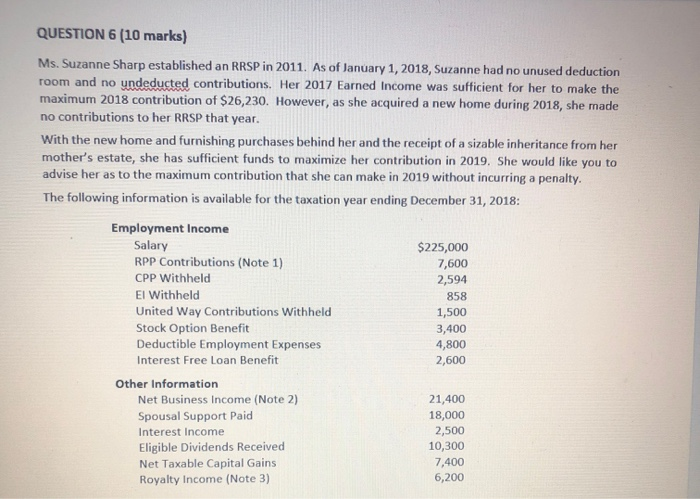

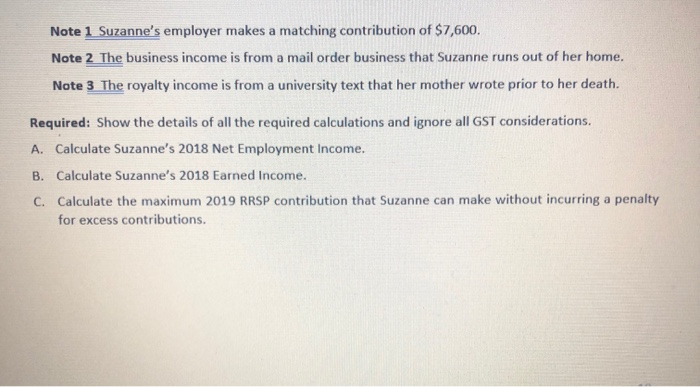

QUESTION 6 (10 marks) Ms. Suzanne Sharp established an RRSP in 2011. As of January 1, 2018, Suzanne had no unused deduction room and no undeducted contributions. Her 2017 Earned Income was sufficient for her to make the maximum 2018 contribution of $26,230. However, as she acquired a new home during 2018, she made no contributions to her RRSP that year. With the new home and furnishing purchases behind her and the receipt of a sizable inheritance from her mother's estate, she has sufficient funds to maximize her contribution in 2019. She would like you to advise her as to the maximum contribution that she can make in 2019 without incurring a penalty. The following information is available for the taxation year ending December 31, 2018: Employment Income Salary $225,000 RPP Contributions (Note 1) 7,600 CPP Withheld 2,594 El Withheld United Way Contributions Withheld 1,500 Stock Option Benefit 3,400 Deductible Employment Expenses 4,800 Interest Free Loan Benefit 2,600 Other Information Net Business Income (Note 2) 21,400 Spousal Support Paid 18,000 Interest Income 2,500 Eligible Dividends Received 10,300 Net Taxable Capital Gains 7,400 Royalty Income (Note 3) 6,200 858 Note 1 Suzanne's employer makes a matching contribution of $7,600. Note 2 The business income is from a mail order business that Suzanne runs out of her home. Note 3 The royalty income is from a university text that her mother wrote prior to her death. Required: Show the details of all the required calculations and ignore all GST considerations. A. Calculate Suzanne's 2018 Net Employment Income. B. Calculate Suzanne's 2018 Earned Income. C. Calculate the maximum 2019 RRSP contribution that Suzanne can make without incurring a penalty for excess contributions. QUESTION 6 (10 marks) Ms. Suzanne Sharp established an RRSP in 2011. As of January 1, 2018, Suzanne had no unused deduction room and no undeducted contributions. Her 2017 Earned Income was sufficient for her to make the maximum 2018 contribution of $26,230. However, as she acquired a new home during 2018, she made no contributions to her RRSP that year. With the new home and furnishing purchases behind her and the receipt of a sizable inheritance from her mother's estate, she has sufficient funds to maximize her contribution in 2019. She would like you to advise her as to the maximum contribution that she can make in 2019 without incurring a penalty. The following information is available for the taxation year ending December 31, 2018: Employment Income Salary $225,000 RPP Contributions (Note 1) 7,600 CPP Withheld 2,594 El Withheld United Way Contributions Withheld 1,500 Stock Option Benefit 3,400 Deductible Employment Expenses 4,800 Interest Free Loan Benefit 2,600 Other Information Net Business Income (Note 2) 21,400 Spousal Support Paid 18,000 Interest Income 2,500 Eligible Dividends Received 10,300 Net Taxable Capital Gains 7,400 Royalty Income (Note 3) 6,200 858 Note 1 Suzanne's employer makes a matching contribution of $7,600. Note 2 The business income is from a mail order business that Suzanne runs out of her home. Note 3 The royalty income is from a university text that her mother wrote prior to her death. Required: Show the details of all the required calculations and ignore all GST considerations. A. Calculate Suzanne's 2018 Net Employment Income. B. Calculate Suzanne's 2018 Earned Income. C. Calculate the maximum 2019 RRSP contribution that Suzanne can make without incurring a penalty for excess contributions