Answered step by step

Verified Expert Solution

Question

1 Approved Answer

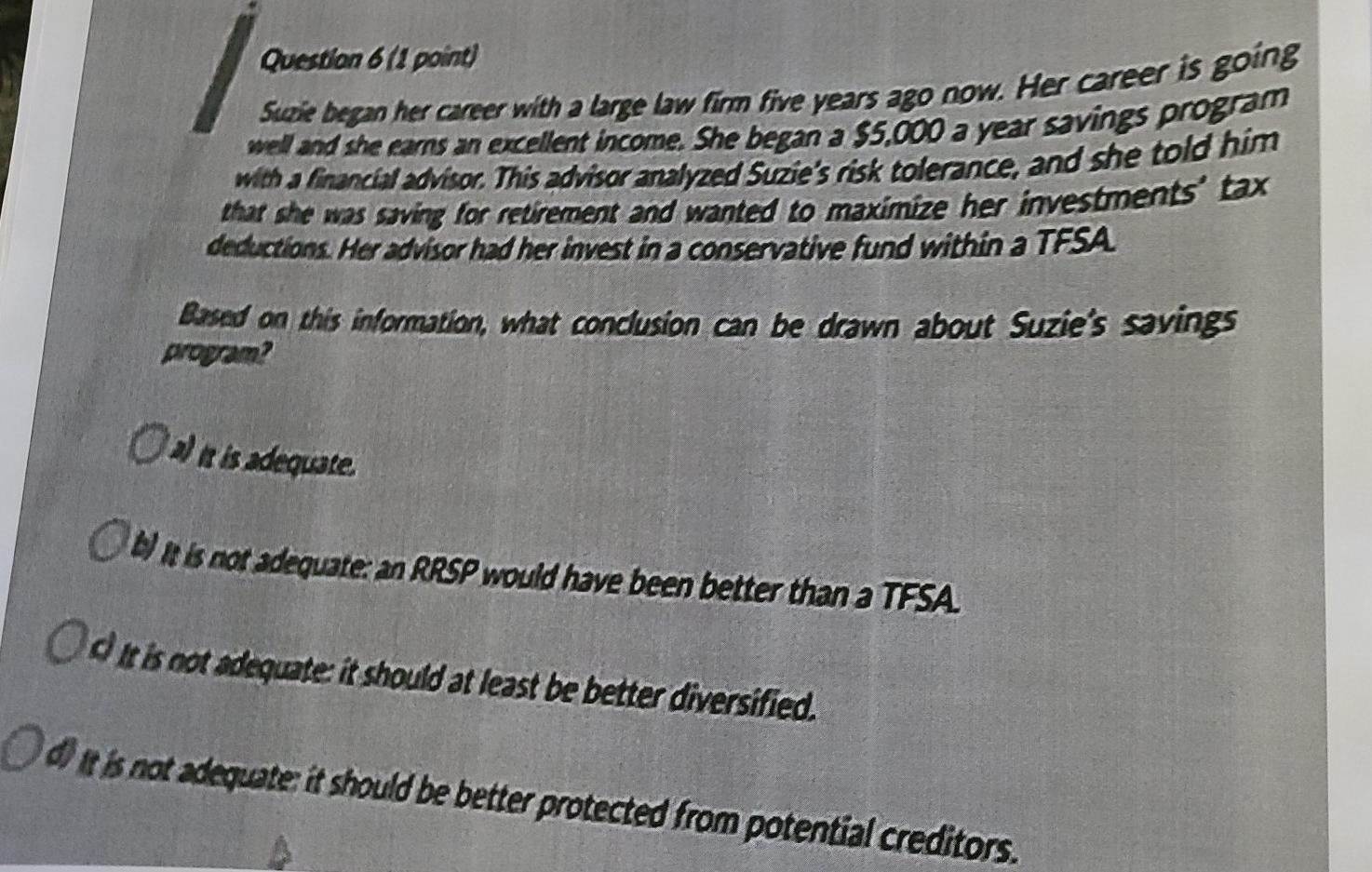

Question 6 11 point) wel and she carns an excellent income. She began a 55.000 a year savings program Suzie began her career with a

Question 6 11 point) wel and she carns an excellent income. She began a 55.000 a year savings program Suzie began her career with a large bow firm five years ago now. Her career is going that she was saving for retirement and wanted to maximize her investments tax with a financial advisor. This advisor analyzed Suzie's risk tolerance, and she told him deductions. Her advisor had her invest in a conservative fund within a TFSA Based on this information, what condusion can be drawn about Suzie's savings propram? Os) it is adequate Wer is not adequate an RRSP would have been better than a TFSA Od it is eat adequate it should at least be better diversified, Od tris not adequate it should be better protected from potential creditors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started