Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6. (12 marks) Read the following information about the recent takeover bid for Sydney Airport Limited (ASX ticker symbol: SYD) and answer the following

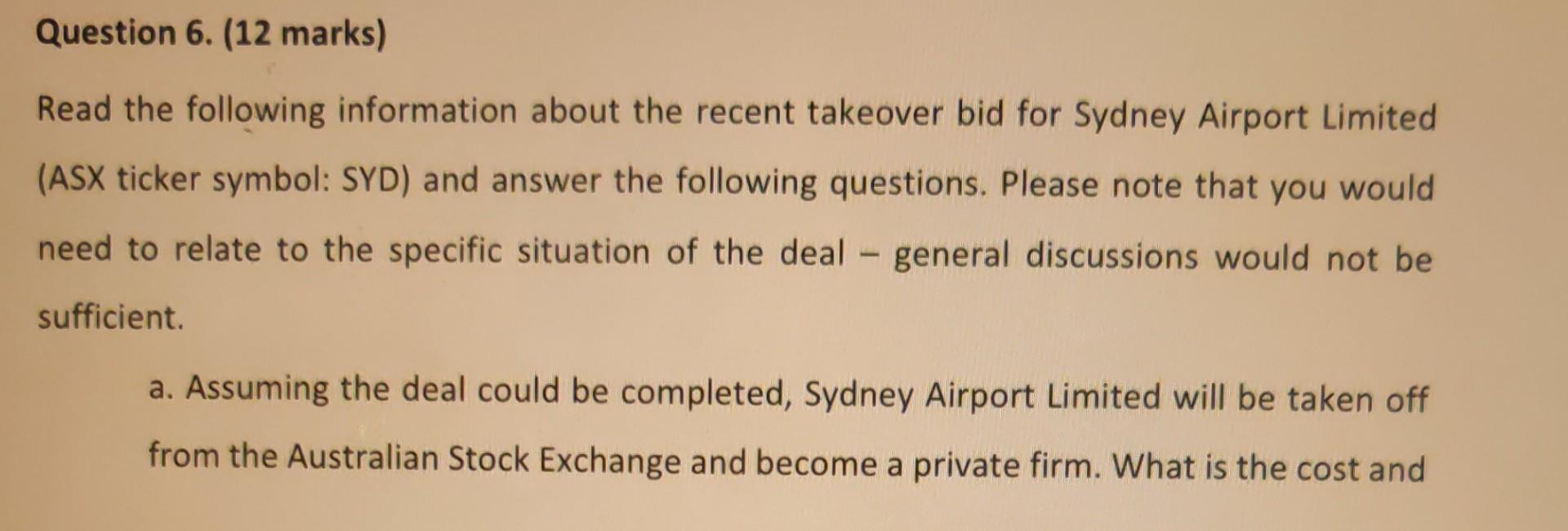

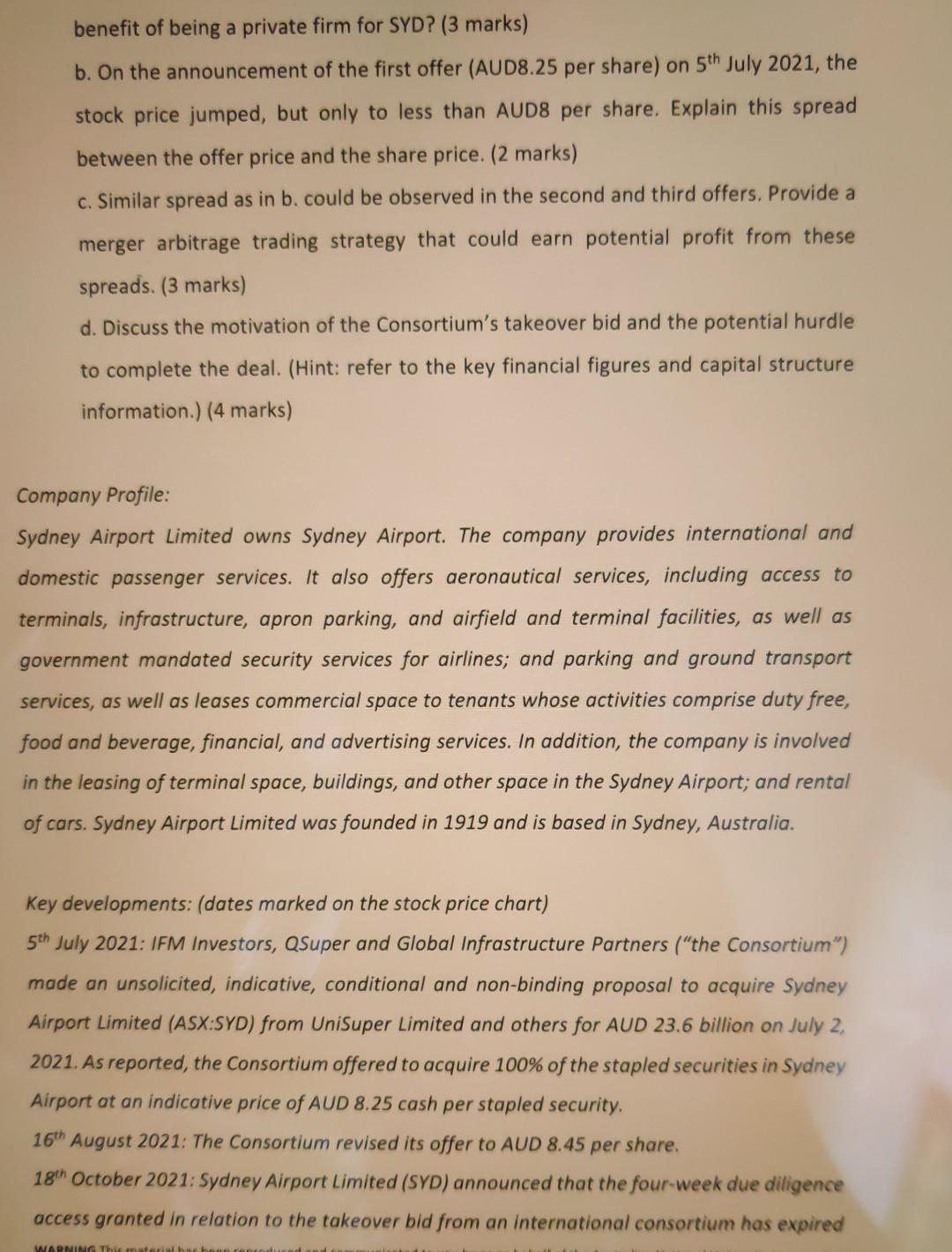

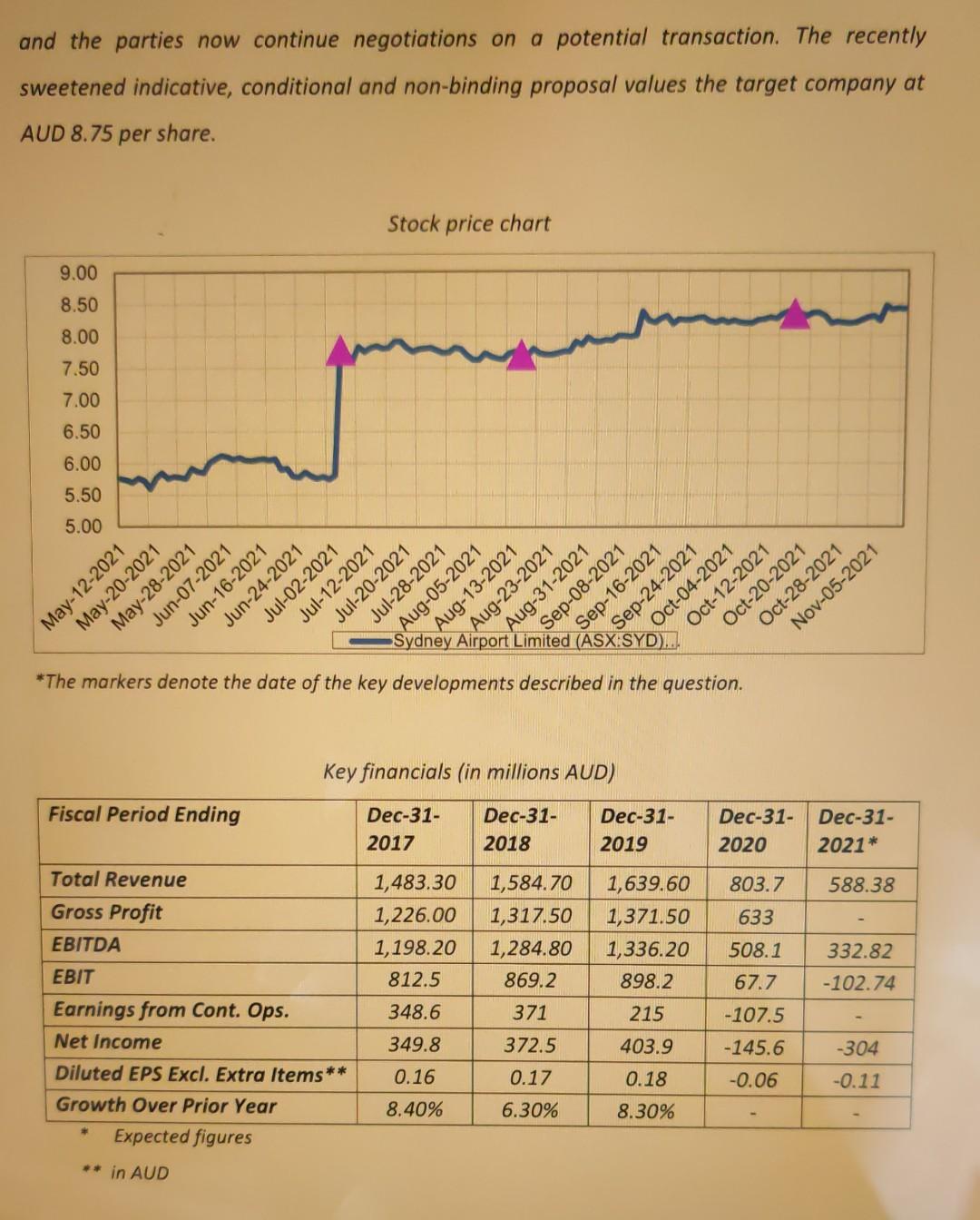

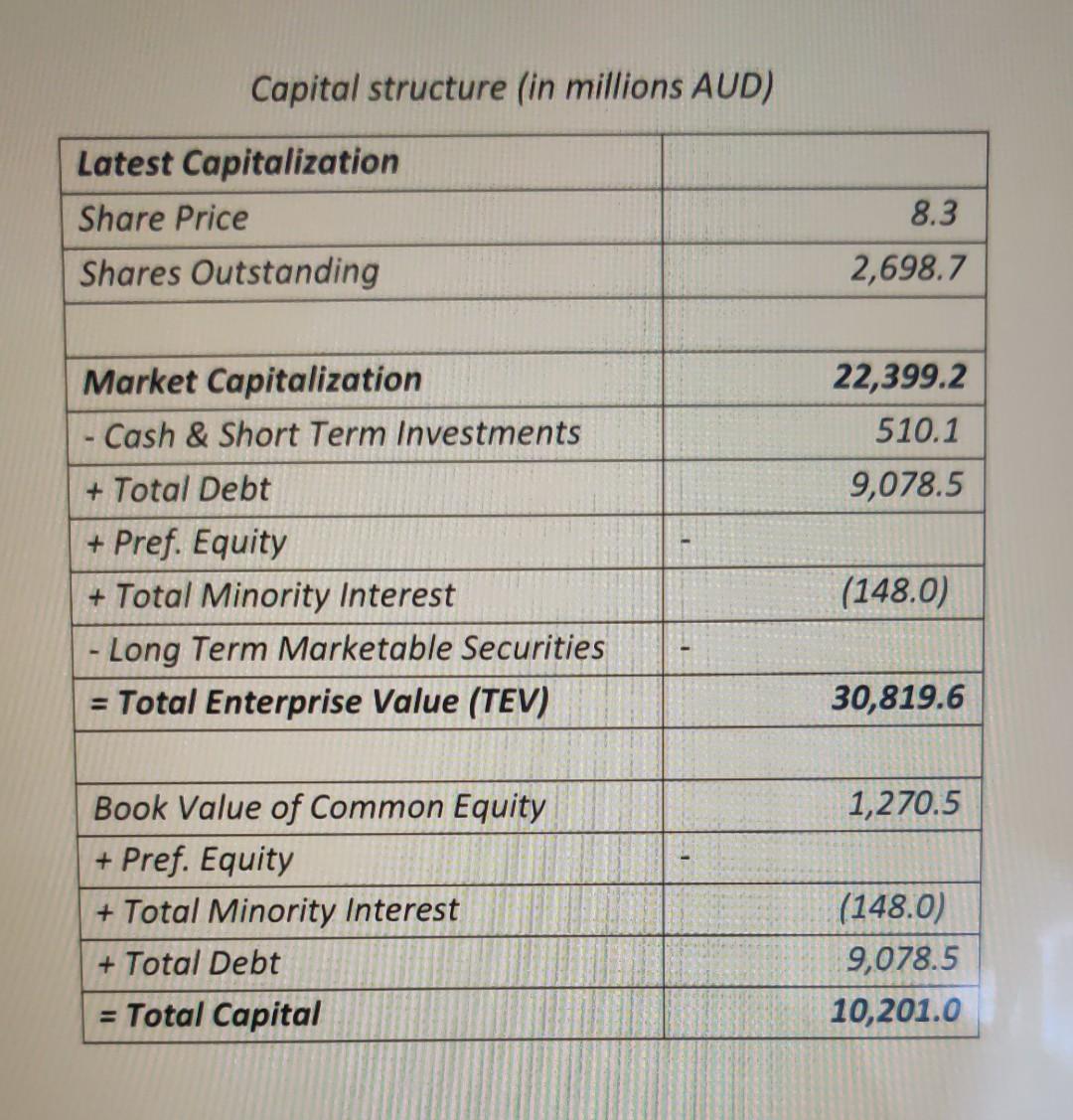

Question 6. (12 marks) Read the following information about the recent takeover bid for Sydney Airport Limited (ASX ticker symbol: SYD) and answer the following questions. Please note that you would need to relate to the specific situation of the deal - general discussions would not be sufficient. a. Assuming the deal could be completed, Sydney Airport Limited will be taken off from the Australian Stock Exchange and become a private firm. What is the cost and benefit of being a private firm for SYD? (3 marks) b. On the announcement of the first offer (AUD8.25 per share) on 5th July 2021, the stock price jumped, but only to less than AUD8 per share. Explain this spread between the offer price and the share price. (2 marks) c. Similar spread as in b. could be observed in the second and third offers. Provide a merger arbitrage trading strategy that could earn potential profit from these spreads. (3 marks) d. Discuss the motivation of the Consortium's takeover bid and the potential hurdle to complete the deal. (Hint: refer to the key financial figures and capital structure information.) (4 marks) Company Profile: Sydney Airport Limited owns Sydney Airport. The company provides international and domestic passenger services. It also offers aeronautical services, including access to terminals, infrastructure, apron parking, and airfield and terminal facilities, as well as government mandated security services for airlines; and parking and ground transport services, as well as leases commercial space to tenants whose activities comprise duty free, food and beverage, financial, and advertising services. In addition, the company is involved in the leasing of terminal space, buildings, and other space in the Sydney Airport; and rental of cars. Sydney Airport Limited was founded in 1919 and is based in Sydney, Australia. Key developments: (dates marked on the stock price chart) 5th July 2021: IFM Investors, QSuper and Global Infrastructure Partners ("the Consortium") made an unsolicited, indicative, conditional and non-binding proposal to acquire Sydney Airport Limited (ASX:SYD) from UniSuper Limited and others for AUD 23.6 billion on July 2, 2021. As reported, the Consortium offered to acquire 100% of the stapled securities in Sydney Airport at an indicative price of AUD 8.25 cash per stapled security. 16th August 2021: The Consortium revised its offer to AUD 8.45 per share. 18th October 2021: Sydney Airport Limited (SYD) announced that the four-week due diligence access granted in relation to the takeover bid from an international consortium has expired WARNING and the parties now continue negotiations on a potential transaction. The recently sweetened indicative, conditional and non-binding proposal values the target company at AUD 8.75 per share. Stock price chart 9.00 8.50 8.00 7.50 7.00 6.50 6.00 5.50 5.00 I Jul-02-2021 Jun-16-2021 Jun-24-2021 Jun-07-2021 May-12-2021 May-20-2021 May-28-2021 2. Aug-1 Sep-08-2021 24 Sep-24-2021 bo Oct-04-20 AU Oct-12-2021 Oct-20-2021 Oct-28-2021 Nov-05-2021 *The markers denote the date of the key developments described in the question. Key financials (in millions AUD) Fiscal Period Ending Dec-31- 2017 Dec-31- 2018 Dec-31- 2019 Dec-31- 2020 Dec-31- 2021* 803.7 588.38 Total Revenue Gross Profit EBITDA 633 1,483.30 1,226.00 1,198.20 812.5 1,639.60 1,371.50 1,336.20 898.2 215 332.82 1,584.70 1,317.50 1,284.80 869.2 371 372.5 0.17 EBIT -102.74 508.1 67.7 -107.5 -145.6 348.6 349.8 403.9 -304 Earnings from Cont. Ops. Net Income Diluted EPS Excl. Extra Items** Growth Over Prior Year Expected figures 0.16 0.18 -0.06 -0.11 8.40% 6.30% 8.30% ** in AUD Capital structure (in millions AUD) Latest Capitalization Share Price Shares Outstanding 8.3 2,698.7 22,399.2 510.1 9,078.5 - Market Capitalization - Cash & Short Term Investments + Total Debt + Pref. Equity + Total Minority Interest - Long Term Marketable Securities = Total Enterprise Value (TEV) (148.0) 30,819.6 1,270.5 Book Value of Common Equity + Pref. Equity + Total Minority Interest + Total Debt Total Capital (148.0) 9,078.5 10,201.0 Question 6. (12 marks) Read the following information about the recent takeover bid for Sydney Airport Limited (ASX ticker symbol: SYD) and answer the following questions. Please note that you would need to relate to the specific situation of the deal - general discussions would not be sufficient. a. Assuming the deal could be completed, Sydney Airport Limited will be taken off from the Australian Stock Exchange and become a private firm. What is the cost and benefit of being a private firm for SYD? (3 marks) b. On the announcement of the first offer (AUD8.25 per share) on 5th July 2021, the stock price jumped, but only to less than AUD8 per share. Explain this spread between the offer price and the share price. (2 marks) c. Similar spread as in b. could be observed in the second and third offers. Provide a merger arbitrage trading strategy that could earn potential profit from these spreads. (3 marks) d. Discuss the motivation of the Consortium's takeover bid and the potential hurdle to complete the deal. (Hint: refer to the key financial figures and capital structure information.) (4 marks) Company Profile: Sydney Airport Limited owns Sydney Airport. The company provides international and domestic passenger services. It also offers aeronautical services, including access to terminals, infrastructure, apron parking, and airfield and terminal facilities, as well as government mandated security services for airlines; and parking and ground transport services, as well as leases commercial space to tenants whose activities comprise duty free, food and beverage, financial, and advertising services. In addition, the company is involved in the leasing of terminal space, buildings, and other space in the Sydney Airport; and rental of cars. Sydney Airport Limited was founded in 1919 and is based in Sydney, Australia. Key developments: (dates marked on the stock price chart) 5th July 2021: IFM Investors, QSuper and Global Infrastructure Partners ("the Consortium") made an unsolicited, indicative, conditional and non-binding proposal to acquire Sydney Airport Limited (ASX:SYD) from UniSuper Limited and others for AUD 23.6 billion on July 2, 2021. As reported, the Consortium offered to acquire 100% of the stapled securities in Sydney Airport at an indicative price of AUD 8.25 cash per stapled security. 16th August 2021: The Consortium revised its offer to AUD 8.45 per share. 18th October 2021: Sydney Airport Limited (SYD) announced that the four-week due diligence access granted in relation to the takeover bid from an international consortium has expired WARNING and the parties now continue negotiations on a potential transaction. The recently sweetened indicative, conditional and non-binding proposal values the target company at AUD 8.75 per share. Stock price chart 9.00 8.50 8.00 7.50 7.00 6.50 6.00 5.50 5.00 I Jul-02-2021 Jun-16-2021 Jun-24-2021 Jun-07-2021 May-12-2021 May-20-2021 May-28-2021 2. Aug-1 Sep-08-2021 24 Sep-24-2021 bo Oct-04-20 AU Oct-12-2021 Oct-20-2021 Oct-28-2021 Nov-05-2021 *The markers denote the date of the key developments described in the question. Key financials (in millions AUD) Fiscal Period Ending Dec-31- 2017 Dec-31- 2018 Dec-31- 2019 Dec-31- 2020 Dec-31- 2021* 803.7 588.38 Total Revenue Gross Profit EBITDA 633 1,483.30 1,226.00 1,198.20 812.5 1,639.60 1,371.50 1,336.20 898.2 215 332.82 1,584.70 1,317.50 1,284.80 869.2 371 372.5 0.17 EBIT -102.74 508.1 67.7 -107.5 -145.6 348.6 349.8 403.9 -304 Earnings from Cont. Ops. Net Income Diluted EPS Excl. Extra Items** Growth Over Prior Year Expected figures 0.16 0.18 -0.06 -0.11 8.40% 6.30% 8.30% ** in AUD Capital structure (in millions AUD) Latest Capitalization Share Price Shares Outstanding 8.3 2,698.7 22,399.2 510.1 9,078.5 - Market Capitalization - Cash & Short Term Investments + Total Debt + Pref. Equity + Total Minority Interest - Long Term Marketable Securities = Total Enterprise Value (TEV) (148.0) 30,819.6 1,270.5 Book Value of Common Equity + Pref. Equity + Total Minority Interest + Total Debt Total Capital (148.0) 9,078.5 10,201.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started