Question 6. 1-3 PART QUESTION! I will give a rating if correct.

The Question is right infront of you. in the sentence!!!!

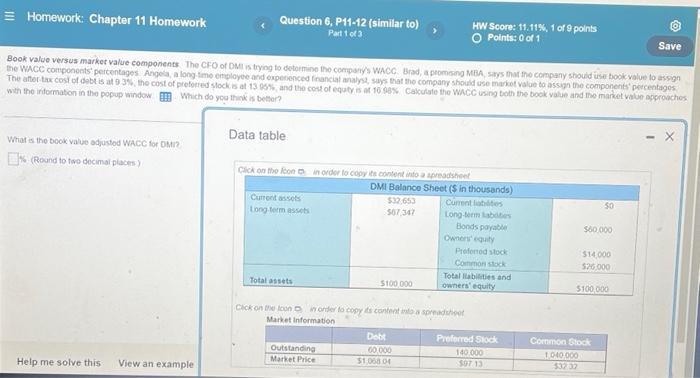

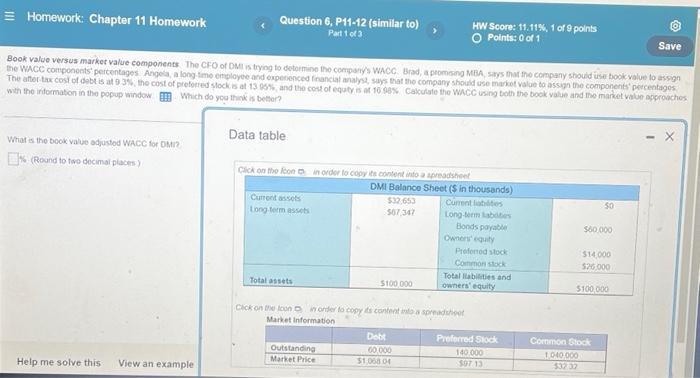

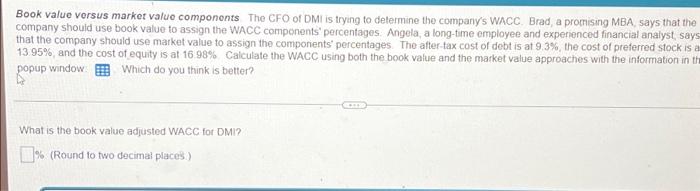

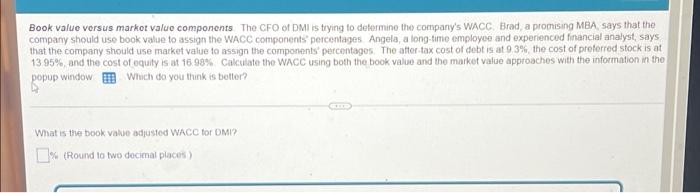

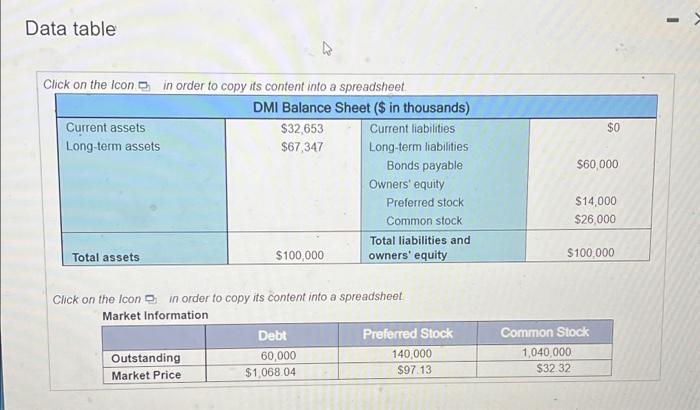

= Homework: Chapter 11 Homework Question 6, P11-12 (similar to) Part 1 of 3 HW Score: 11.11%, 1 of 9 points Points: 0 of 1 Save Book value versus market value components The CFO of DM is trying to determine the company WACC Brad, prom. MBA, says that the company should use book value to assign the WACC components' percentages. Angela, a long time employee and experience francia ly, says that the company should use market value to assign the components percentages The other tax cost of debt is at 939 the cost of preferred stocks at 13.9% and the cost of equity is at 10.08% Calculate the WACC using to the book value and the market value acproaches with the information in the popup window Which do you think is better? Data table What is the book vajadusted WACC for OM? D (Round to two decimal places 30 Click on the con Dindor to copy its content to a readsheet DMI Balance Sheet (s in thousands) Current assets 532,653 Currenties Long term asse 507347 Long mababa Bonds payable Owners equally Preferred stock Commonsta Total abilities and Total assets 5100 000 owners' equity 560.000 $14.000 $26.000 $100,000 Click on the moon wonder to copy its content spread Market Information Det Preferred Stock Outstanding 00.000 100 000 Market Price 51 0 SOT 13 Common Stock 1040000 3237 Help me solve this View an example Book value versus market value components The CFO of DM is trying to determine the company's WACC Brad, a promising MBA says that the company should use book value to assign the WACC components' percentages Angela, a long-time employee and experienced financial analyst, says that the company should use market value to assign the components' percentages. The after-tax cost of debt is at 9.3%, the cost of preferred stock is a 13.95%and the cost of equity is at 1698% Calculate the WACC using both the book value and the market value approaches with the information in the popup window. Which do you think is better? What is the book value adjusted WACC for DMI? 1% (Round to two decimal places) Book value versus markot value components The CFO of DMI is trying to determine the company's WACC. Brad, a promising MBA, says that tho company should use book value to assign the WACC components percentages Angela, a long time employee and experienced financial analyst, says that the company should use market value to assign the components percentages. The after tax cost of debt is at 9 3, the cost of preferred stock is at 13 95%, and the cost of equity is at 16.98% Calculate the WACC using both the book value and the market value approaches with the information in the popup window Which do you think is better? What is the book value adjusted WACC for DMI? I (Round to two decimal places) Data table $0 Click on the icon in order to copy its content into a spreadsheet DMI Balance Sheet ($ in thousands) Current assets $32,653 Current liabilities Long-term assets $67,347 Long-term liabilities Bonds payable Owners' equity Preferred stock Common stock Total liabilities and Total assets $100,000 owners' equity $60,000 $14,000 $26,000 $100,000 Click on the icon in order to copy its content into a spreadsheet Market Information Debt Preferred Stock Outstanding 60,000 140.000 Market Price $1.068.04 $97.13 Common Stock 1,040,000 $32.32