Answered step by step

Verified Expert Solution

Question

1 Approved Answer

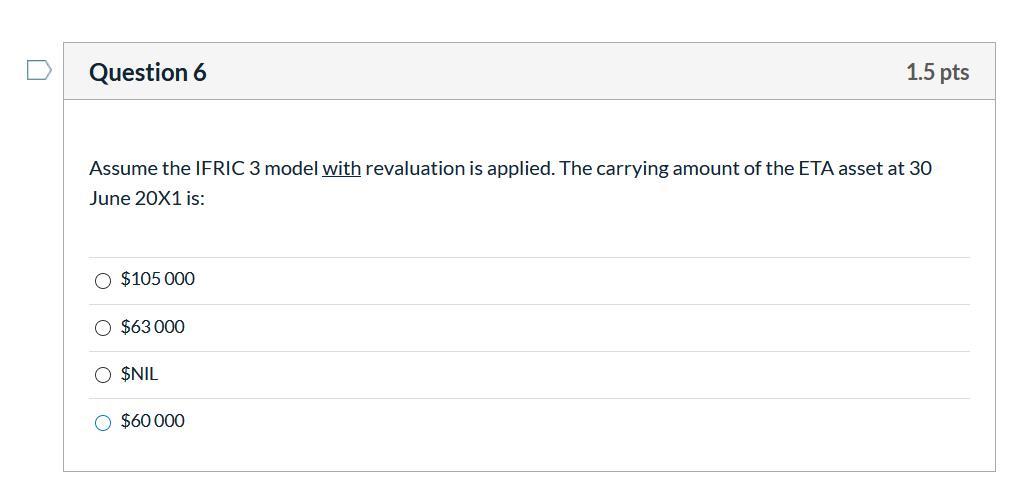

Question 6 1.5 pts Assume the IFRIC 3 model with revaluation is applied. The carrying amount of the ETA asset at 30 June 20X1

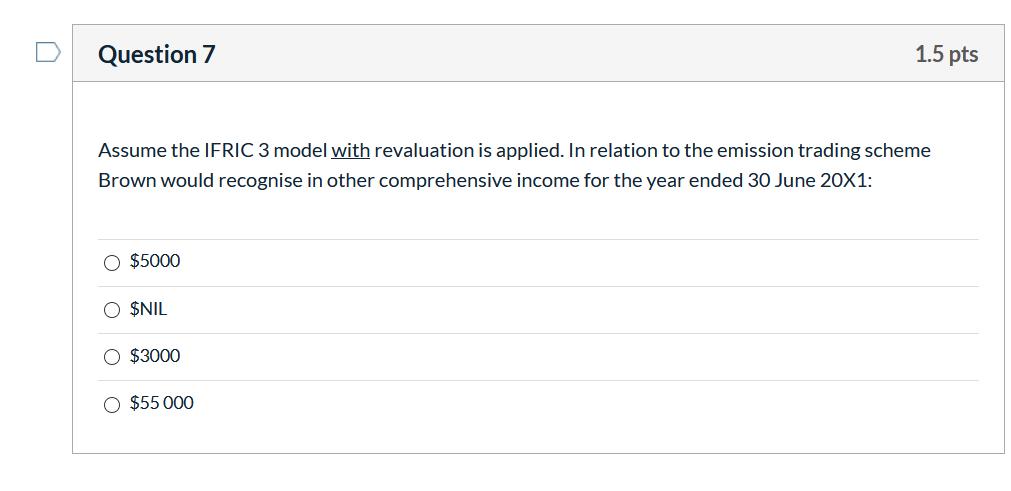

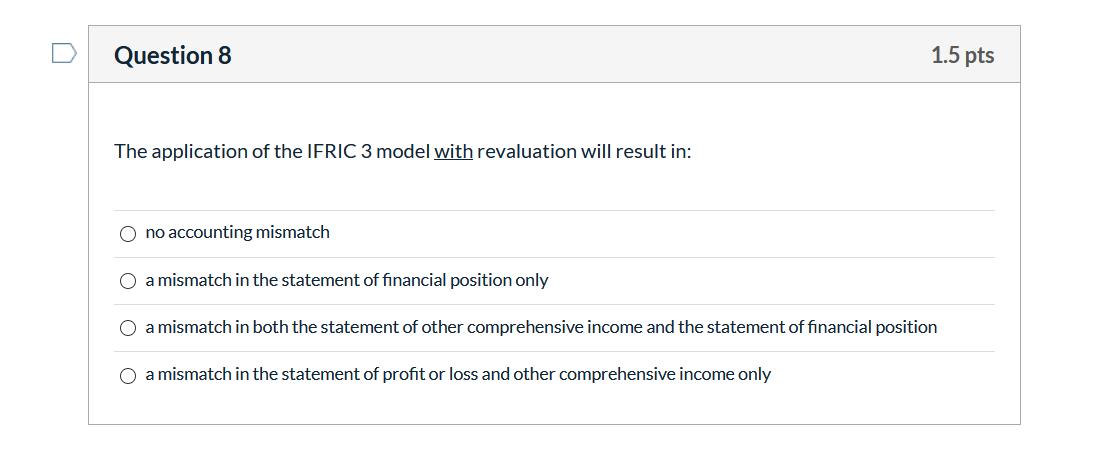

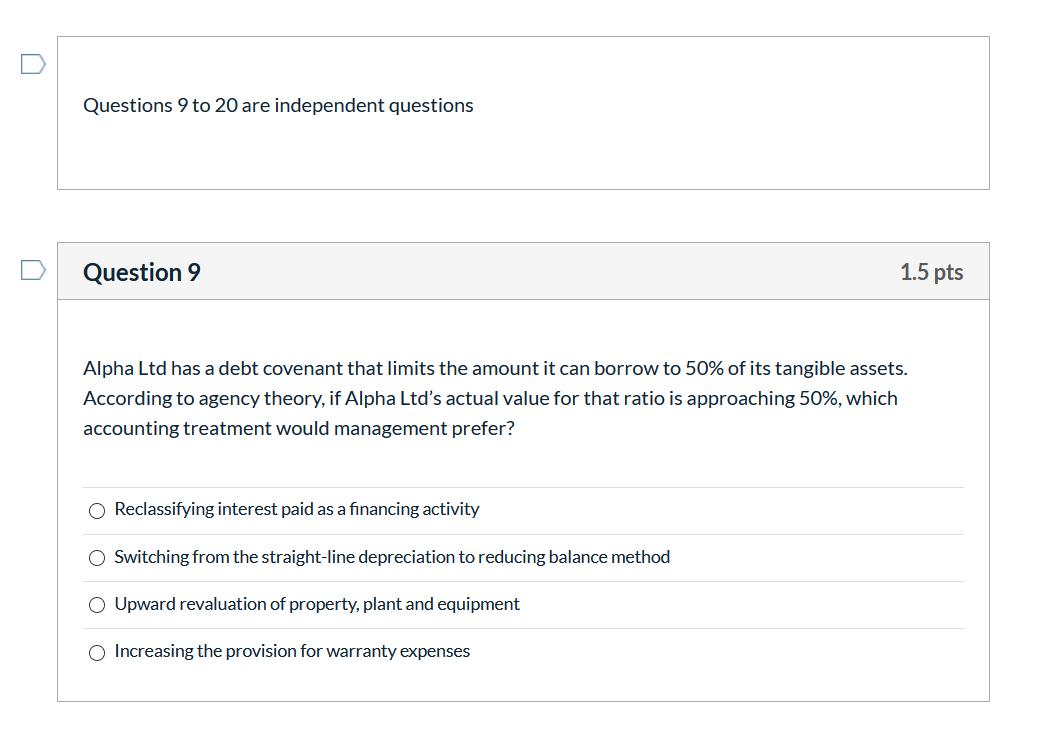

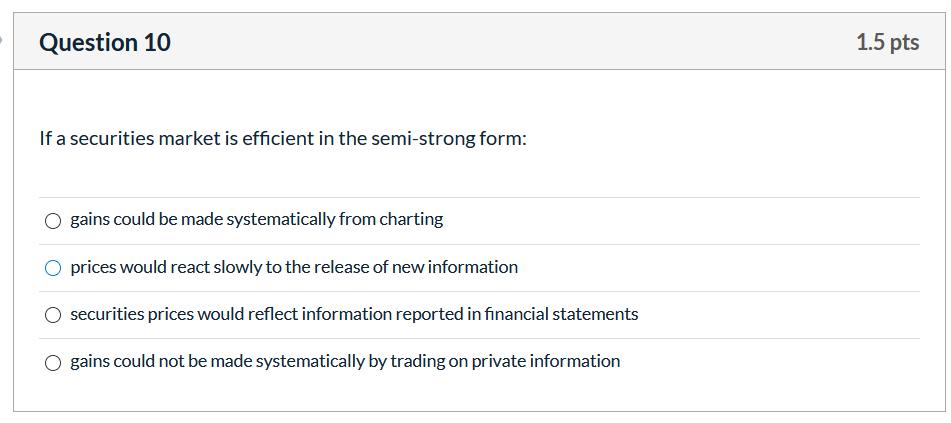

Question 6 1.5 pts Assume the IFRIC 3 model with revaluation is applied. The carrying amount of the ETA asset at 30 June 20X1 is: $105 000 O $63 000 $NIL $60 000 Question 7 1.5 pts Assume the IFRIC 3 model with revaluation is applied. In relation to the emission trading scheme Brown would recognise in other comprehensive income for the year ended 30 June 20X1: O $5000 O $NIL $3000 $55 000 Question 8 1.5 pts The application of the IFRIC 3 model with revaluation will result in: no accounting mismatch a mismatch in the statement of financial position only O a mismatch in both the statement of other comprehensive income and the statement of financial position O a mismatch in the statement of profit or loss and other comprehensive income only Questions 9 to 20 are independent questions Question 9 1.5 pts Alpha Ltd has a debt covenant that limits the amount it can borrow to 50% of its tangible assets. According to agency theory, if Alpha Ltd's actual value for that ratio is approaching 50%, which accounting treatment would management prefer? Reclassifying interest paid as a financing activity Switching from the straight-line depreciation to reducing balance method Upward revaluation of property, plant and equipment O Increasing the provision for warranty expenses Question 10 1.5 pts If a securities market is efficient in the semi-strong form: O gains could be made systematically from charting O prices would react slowly to the release of new information O securities prices would reflect information reported in financial statements O gains could not be made systematically by trading on private information

Step by Step Solution

★★★★★

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Question 6 Answer NIL Explanation Under Revaluation model allowances are recognized at their fair value Revaluation model measures changes in the value of an asset over the life of such asset For usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started