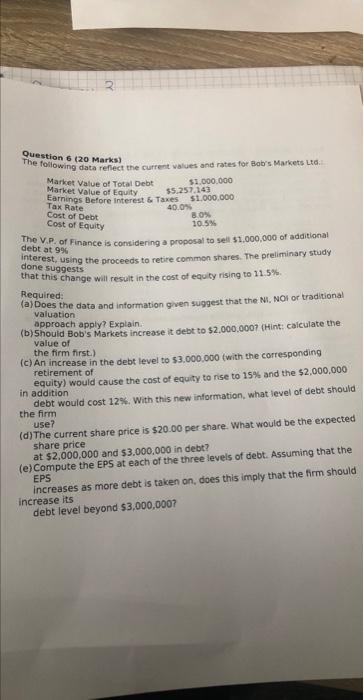

Question 6 (20 Marks) The following data reflect the current values and rates for Bob's Markets Ltd. Market Value of Total Debt Market Value of Equity Earnings Before Interest & Taxes Tax Rate Cost of Debt Cost of Equity $1.000.000 $1.000.000 $5.257.143 40.0% 8.0% 10.5% The V.P. of Finance is considering a proposal to sell $1,000,000 of additional debt at 9% interest, using the proceeds to retire common shares. The preliminary study done suggests that this change will result in the cost of equity rising to 11.5%. Required: (a) Does the data and information given suggest that the NI, NOI or traditional valuation approach apply? Explain. (b) Should Bob's Markets increase it debt to $2,000,000? (Hint: calculate the value of the firm first.) (c) An increase in the debt level to $3.000.000 (with the corresponding retirement of equity) would cause the cost of equity to rise to 15% and the $2,000,000 in addition debt would cost 12%. With this new information, what level of debt should the firm use? (d) The current share price is $20.00 per share. What would be the expected share price. at $2,000,000 and $3.000.000 in debt? (e) Compute the EPS at each of the three levels of debt. Assuming that the EPS increases as more debt is taken on, does this imply that the firm should increase its debt level beyond $3,000,000? Question 6 (20 Marks) The following data reflect the current values and rates for Bob's Markets Ltd. Market Value of Total Debt Market Value of Equity Earnings Before Interest & Taxes Tax Rate Cost of Debt Cost of Equity $1.000.000 $1.000.000 $5.257.143 40.0% 8.0% 10.5% The V.P. of Finance is considering a proposal to sell $1,000,000 of additional debt at 9% interest, using the proceeds to retire common shares. The preliminary study done suggests that this change will result in the cost of equity rising to 11.5%. Required: (a) Does the data and information given suggest that the NI, NOI or traditional valuation approach apply? Explain. (b) Should Bob's Markets increase it debt to $2,000,000? (Hint: calculate the value of the firm first.) (c) An increase in the debt level to $3.000.000 (with the corresponding retirement of equity) would cause the cost of equity to rise to 15% and the $2,000,000 in addition debt would cost 12%. With this new information, what level of debt should the firm use? (d) The current share price is $20.00 per share. What would be the expected share price. at $2,000,000 and $3.000.000 in debt? (e) Compute the EPS at each of the three levels of debt. Assuming that the EPS increases as more debt is taken on, does this imply that the firm should increase its debt level beyond $3,000,000