Question

Question 6 [21] Suppose the government introduces a production (output) tax on luxury motor vehicles in South Africa. The average selling price of these motor

Question 6 [21]

Suppose the government introduces a production (output) tax on luxury motor vehicles in South Africa. The average selling price of these motor vehicles is R380 000. The amount of tax introduced is R30 000.

6.1. Will the price elasticity of demand for luxury motor vehicles in this scenario be equal to one, greater than one or zero? (1)

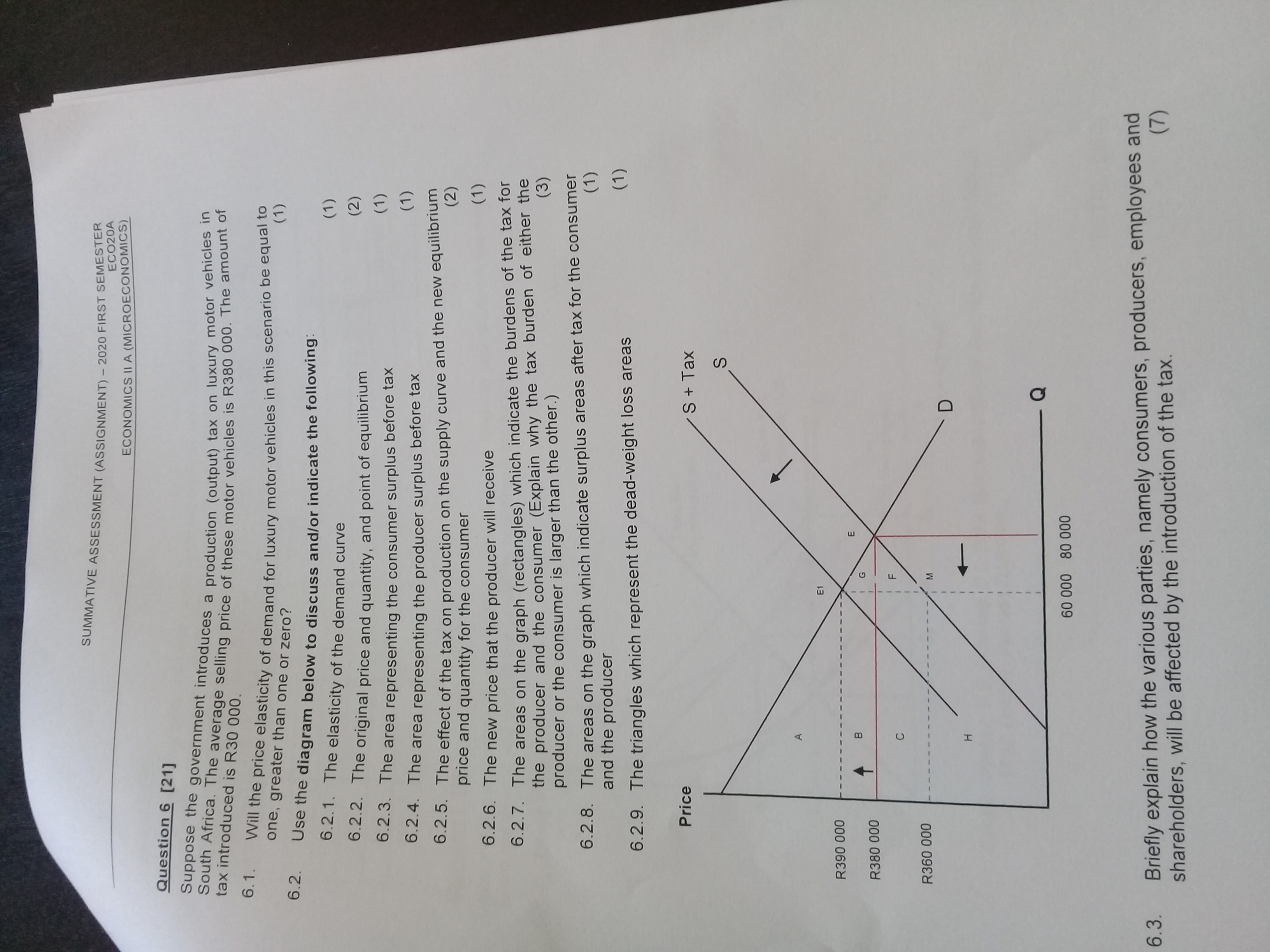

6.2. Use the diagram below to discuss and/or indicate the following:

6.2.1. The elasticity of the demand curve (1)

6.2.2. The original price and quantity, and point of equilibrium (2)

6.2.3. The area representing the consumer surplus before tax (1)

6.2.4. The area representing the producer surplus before tax (1)

6.2.5. The effect of the tax on production on the supply curve and the new equilibrium price and quantity for the consumer (2)

6.2.6. The new price that the producer will receive (1)

6.2.7. The areas on the graph (rectangles) which indicate the burdens of the tax for the producer and the consumer (Explain why the tax burden of either the producer or the consumer is larger than the other.) (3)

6.2.8. The areas on the graph which indicate surplus areas after tax for the consumer and the producer (1)

6.2.9. The triangles which represent the dead-weight loss areas (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started