Answered step by step

Verified Expert Solution

Question

1 Approved Answer

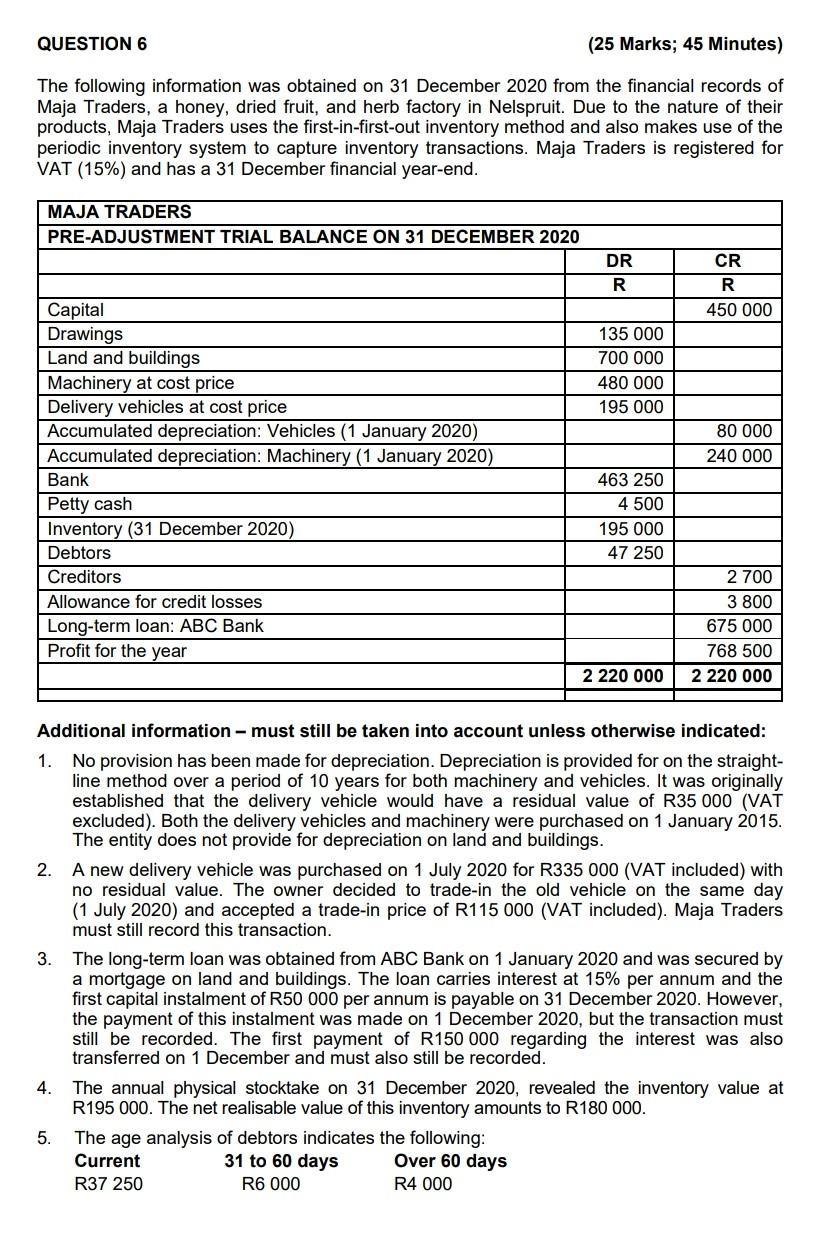

(25 Marks; 45 Minutes) The following information was obtained on 31 December 2020 from the financial records of Maja Traders, a honey, dried fruit,

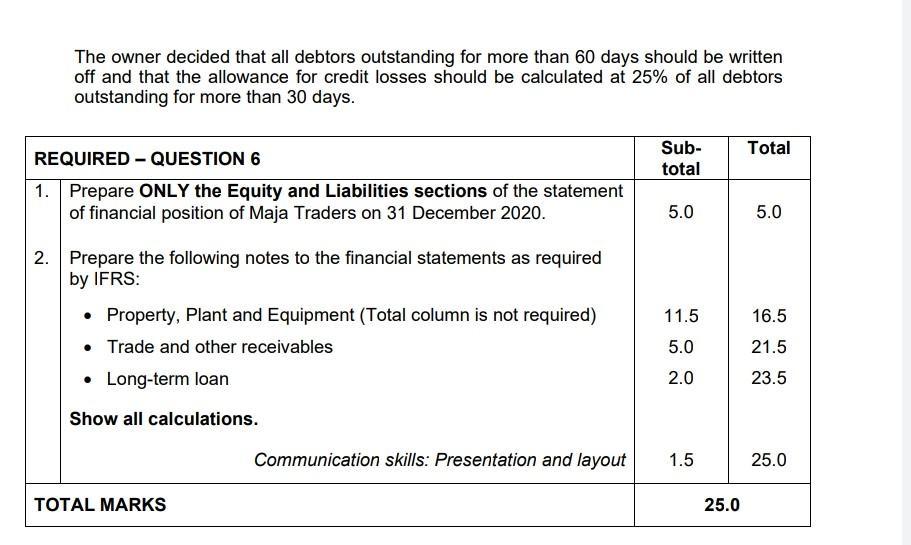

(25 Marks; 45 Minutes) The following information was obtained on 31 December 2020 from the financial records of Maja Traders, a honey, dried fruit, and herb factory in Nelspruit. Due to the nature of their products, Maja Traders uses the first-in-first-out inventory method and also makes use of the periodic inventory system to capture inventory transactions. Maja Traders is registered for VAT (15%) and has a 31 December financial year-end. QUESTION 6 MAJA TRADERS PRE-ADJUSTMENT TRIAL BALANCE ON 31 DECEMBER 2020 Capital Drawings Land and buildings Machinery at cost price Delivery vehicles at cost price Accumulated depreciation: Vehicles (1 January 2020) Accumulated depreciation: Machinery (1 January 2020) Bank Petty cash Inventory (31 December 2020) Debtors Creditors Allowance for credit losses Long-term loan: ABC Bank Profit for the year 3. 4. DR R 5. 135 000 700 000 480 000 195 000 463 250 4 500 195 000 47 250 2 220 000 Additional information - must still be taken into account unless otherwise indicated: 1. No provision has been made for depreciation. Depreciation is provided for on the straight- line method over a period of 10 years for both machinery and vehicles. It was originally established that the delivery vehicle would have a residual value of R35 000 (VAT excluded). Both the delivery vehicles and machinery were purchased on 1 January 2015. The entity does not provide for depreciation on land and buildings. The age analysis of debtors indicates the following: Current 31 to 60 days Over 60 days R4 000 R37 250 R6 000 CR R 450 000 2. A new delivery vehicle was purchased on 1 July 2020 for R335 000 (VAT included) with no residual value. The owner decided to trade-in the old vehicle on the same day (1 July 2020) and accepted a trade-in price of R115 000 (VAT included). Maja Traders must still record this transaction. 80 000 240 000 2 700 3 800 675 000 768 500 2 220 000 The long-term loan was obtained from ABC Bank on 1 January 2020 and was secured by a mortgage on land and buildings. The loan carries interest at 15% per annum and the first capital instalment of R50 000 per annum is payable on 31 December 2020. However, the payment of this instalment was made on 1 December 2020, but the transaction must still be recorded. The first payment of R150 000 regarding the interest was also transferred on 1 December and must also still be recorded. The annual physical stocktake on 31 December 2020, revealed the inventory value at R195 000. The net realisable value of this inventory amounts to R180 000. The owner decided that all debtors outstanding for more than 60 days should be written off and that the allowance for credit losses should be calculated at 25% of all debtors outstanding for more than 30 days. REQUIRED - QUESTION 6 1. Prepare ONLY the Equity and Liabilities sections of the statement of financial position of Maja Traders on 31 December 2020. 2. Prepare the following notes to the financial statements as required by IFRS: Property, Plant and Equipment (Total column is not required) Trade and other receivables Long-term loan Show all calculations. TOTAL MARKS Communication skills: Presentation and layout Sub- total 5.0 11.5 5.0 2.0 1.5 25.0 Total 5.0 16.5 21.5 23.5 25.0

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

STATEMENT OF FINANCIAL POSITION AS ON 31st DECEMBER 2020 EQUIT...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started