Question

Many international funds offer more reasonable equity valuations than those found in the United States. Because international markets often move in different directions than the

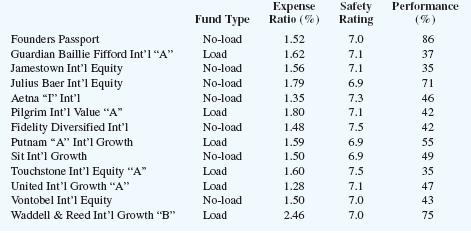

Many international funds offer more reasonable equity valuations than those found in the United States. Because international markets often move in different directions than the U.S. market, investments in foreign markets can also reduce an investor’s overall risk. The following table shows the fund type (load or no-load), expense ratio (%), safety rating (0 = riskiest, 10 = safest), and the one-year performance through December 10, 1999, for 20 international funds (Mutual Funds, February 2000).n

a. Use the methods in this chapter to develop an estimated regression equation that can be used to estimate the performance of a fund on the basis of the data provided.

b. Did the estimated regression equation developed in part (a) provide a good fit? Explain.

c. Acorn International is a no-load fund that has an annual expense ratio of 1.12% and a safety rating of 7.6. Use the estimated regression equation developed in part (a) to estimate the one-year performance for Acorn International.

Expense Ratio (%) Safety Rating Performance Fund Type (%) ABN AMRO Int'l Equity "Com" Accessor Int'l Equity Adv" Artisan International No-load 1.38 6.9 36 No-load 1.59 7.1 42 No-load 1.45 6.8 72 Columbia Int'l Stock No-load 1.56 7.1 54 Concert Inv. "A" Int'l Equity Diversified Invstr Int'l Eqty Driehaus Int'l Growth Load 2.16 6.3 116 No-load 1.40 7.3 54 No-load 1.88 6.5 92

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a There are two categories of Fund type One is Noload and o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started