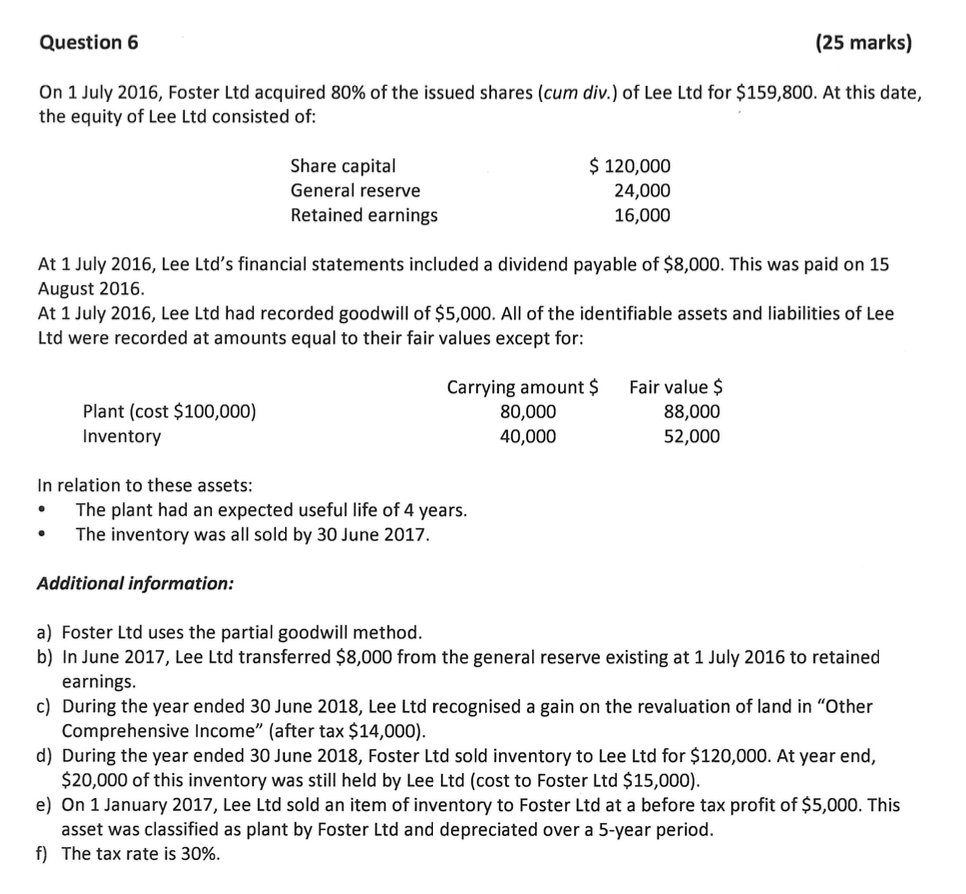

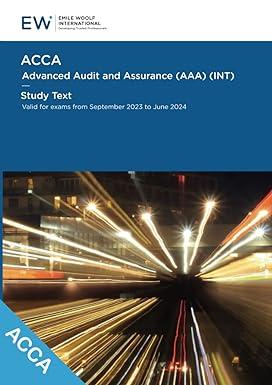

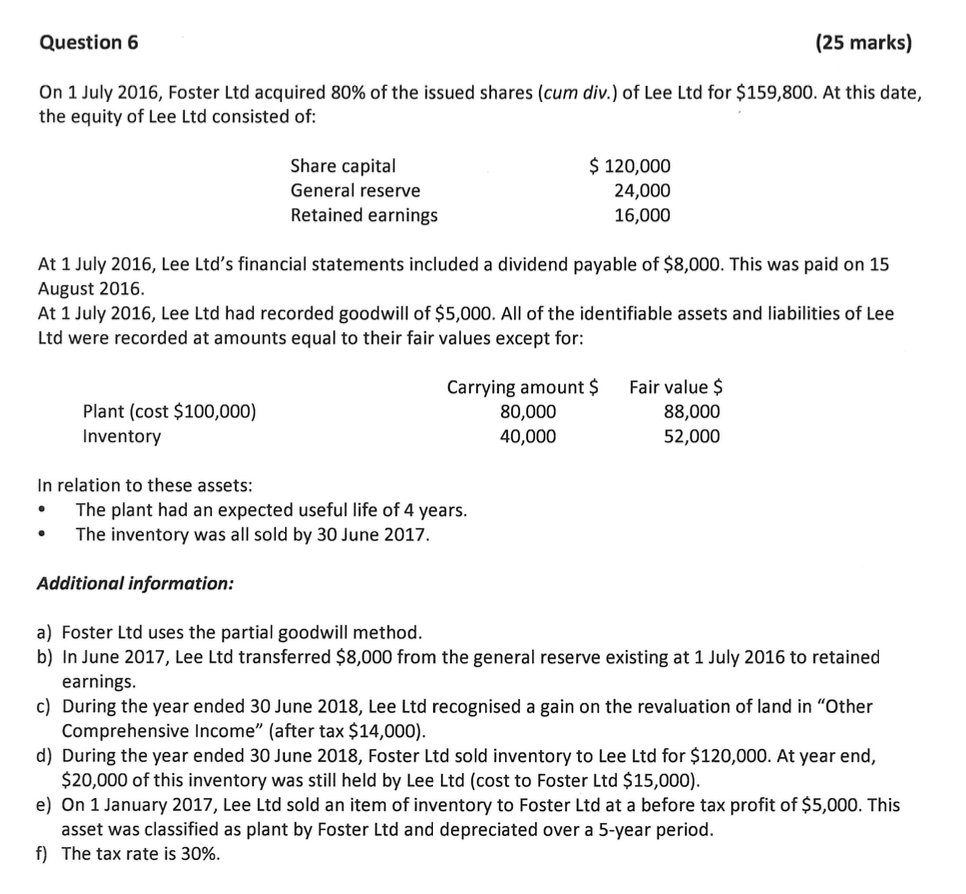

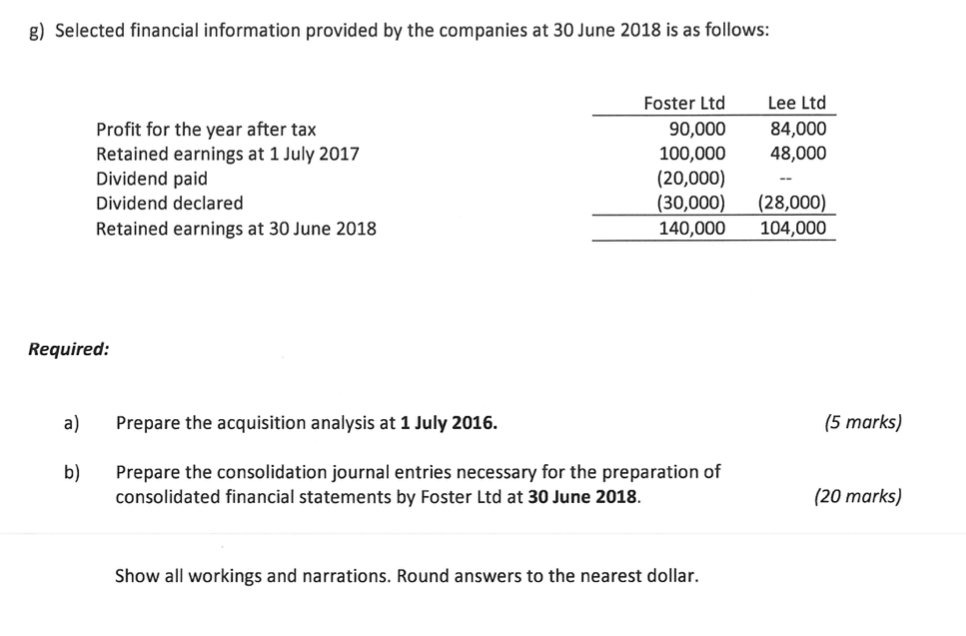

Question 6 (25 marks) On 1 July 2016, Foster Ltd acquired 80% of the issued shares (cum div.) of Lee Ltd for $159,800. At this date, the equity of Lee Ltd consisted of: Share capital General reserve Retained earnings $ 120,000 24,000 16,000 At 1 July 2016, Lee Ltd's financial statements included a dividend payable of $8,000. This was paid on 15 August 2016. At 1 July 2016, Lee Ltd had recorded goodwill of $5,000. All of the identifiable assets and liabilities of Lee Ltd were recorded at amounts equal to their fair values except for: Plant (cost $100,000) Inventory Carrying amount $ 80,000 40,000 Fair value $ 88,000 52,000 In relation to these assets: The plant had an expected useful life of 4 years. The inventory was all sold by 30 June 2017. . Additional information: a) Foster Ltd uses the partial goodwill method. b) In June 2017, Lee Ltd transferred $8,000 from the general reserve existing at 1 July 2016 to retained earnings. c) During the year ended 30 June 2018, Lee Ltd recognised a gain on the revaluation of land in "Other Comprehensive Income" (after tax $14,000). d) During the year ended 30 June 2018, Foster Ltd sold inventory to Lee Ltd for $120,000. At year end, $20,000 of this inventory was still held by Lee Ltd (cost to Foster Ltd $15,000). e) On 1 January 2017, Lee Ltd sold an item of inventory to Foster Ltd at a before tax profit of $5,000. This asset was classified as plant by Foster Ltd and depreciated over a 5-year period. f) The tax rate is 30%. g) Selected financial information provided by the companies at 30 June 2018 is as follows: Foster Ltd Lee Ltd 84,000 48,000 Profit for the year after tax Retained earnings at 1 July 2017 Dividend paid Dividend declared Retained earnings at 30 June 2018 90,000 100,000 (20,000) (30,000) 140,000 (28,000) 104,000 Required: a) Prepare the acquisition analysis at 1 July 2016. (5 marks) b) Prepare the consolidation journal entries necessary for the preparation of consolidated financial statements by Foster Ltd at 30 June 2018. (20 marks) Show all workings and narrations. Round answers to the nearest dollar. Question 6 (25 marks) On 1 July 2016, Foster Ltd acquired 80% of the issued shares (cum div.) of Lee Ltd for $159,800. At this date, the equity of Lee Ltd consisted of: Share capital General reserve Retained earnings $ 120,000 24,000 16,000 At 1 July 2016, Lee Ltd's financial statements included a dividend payable of $8,000. This was paid on 15 August 2016. At 1 July 2016, Lee Ltd had recorded goodwill of $5,000. All of the identifiable assets and liabilities of Lee Ltd were recorded at amounts equal to their fair values except for: Plant (cost $100,000) Inventory Carrying amount $ 80,000 40,000 Fair value $ 88,000 52,000 In relation to these assets: The plant had an expected useful life of 4 years. The inventory was all sold by 30 June 2017. . Additional information: a) Foster Ltd uses the partial goodwill method. b) In June 2017, Lee Ltd transferred $8,000 from the general reserve existing at 1 July 2016 to retained earnings. c) During the year ended 30 June 2018, Lee Ltd recognised a gain on the revaluation of land in "Other Comprehensive Income" (after tax $14,000). d) During the year ended 30 June 2018, Foster Ltd sold inventory to Lee Ltd for $120,000. At year end, $20,000 of this inventory was still held by Lee Ltd (cost to Foster Ltd $15,000). e) On 1 January 2017, Lee Ltd sold an item of inventory to Foster Ltd at a before tax profit of $5,000. This asset was classified as plant by Foster Ltd and depreciated over a 5-year period. f) The tax rate is 30%. g) Selected financial information provided by the companies at 30 June 2018 is as follows: Foster Ltd Lee Ltd 84,000 48,000 Profit for the year after tax Retained earnings at 1 July 2017 Dividend paid Dividend declared Retained earnings at 30 June 2018 90,000 100,000 (20,000) (30,000) 140,000 (28,000) 104,000 Required: a) Prepare the acquisition analysis at 1 July 2016. (5 marks) b) Prepare the consolidation journal entries necessary for the preparation of consolidated financial statements by Foster Ltd at 30 June 2018. (20 marks) Show all workings and narrations. Round answers to the nearest dollar