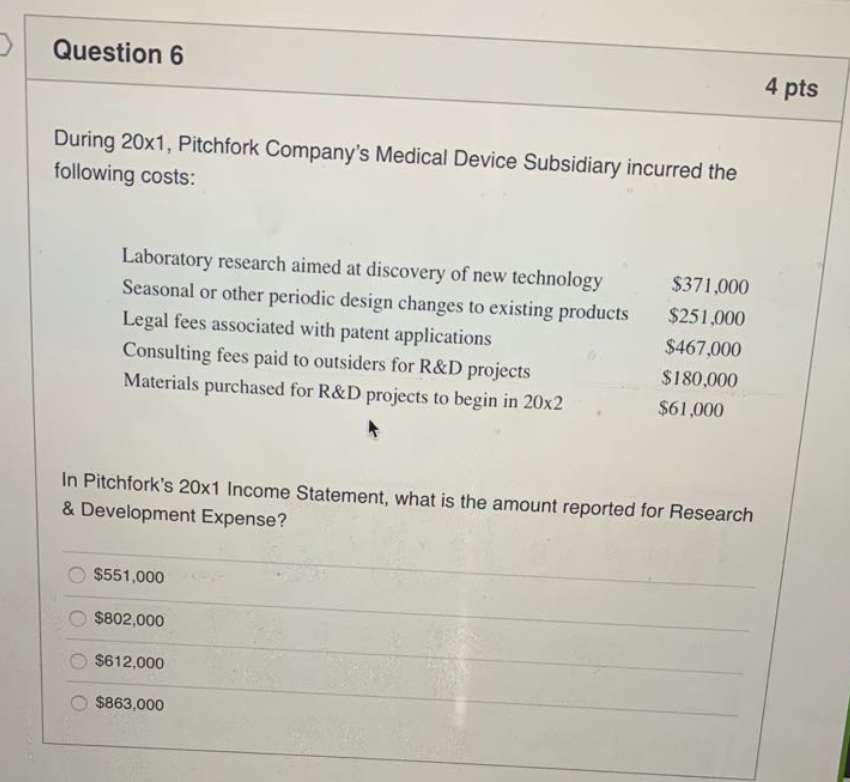

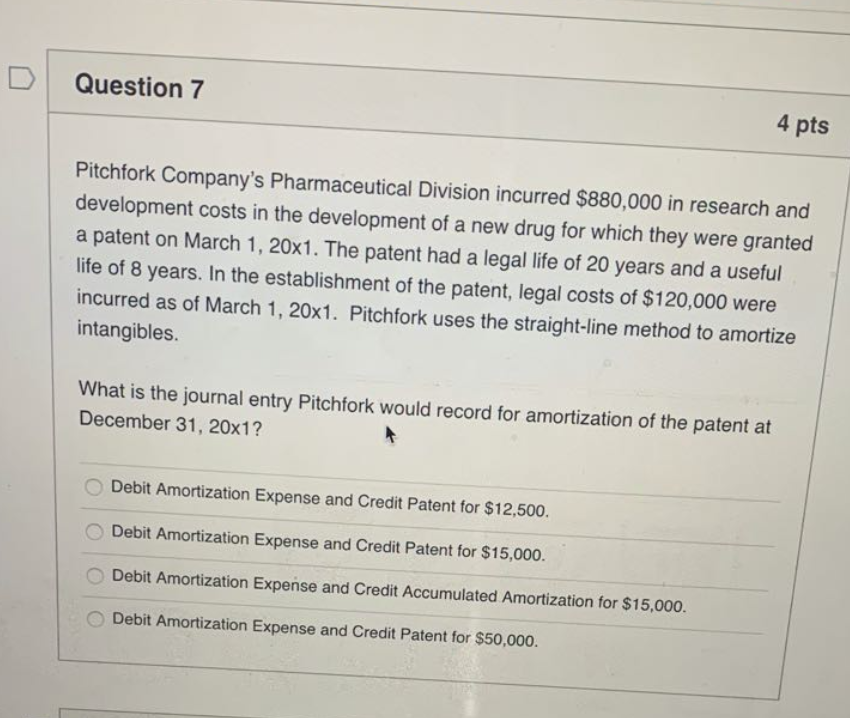

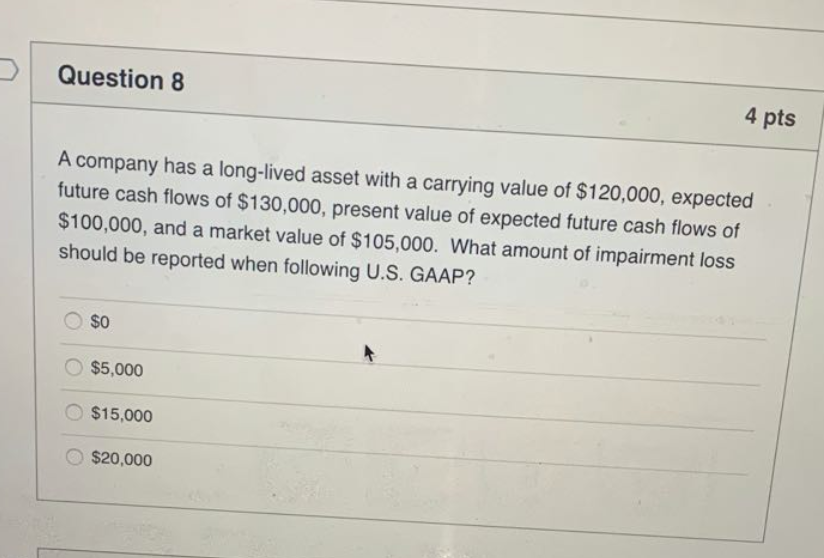

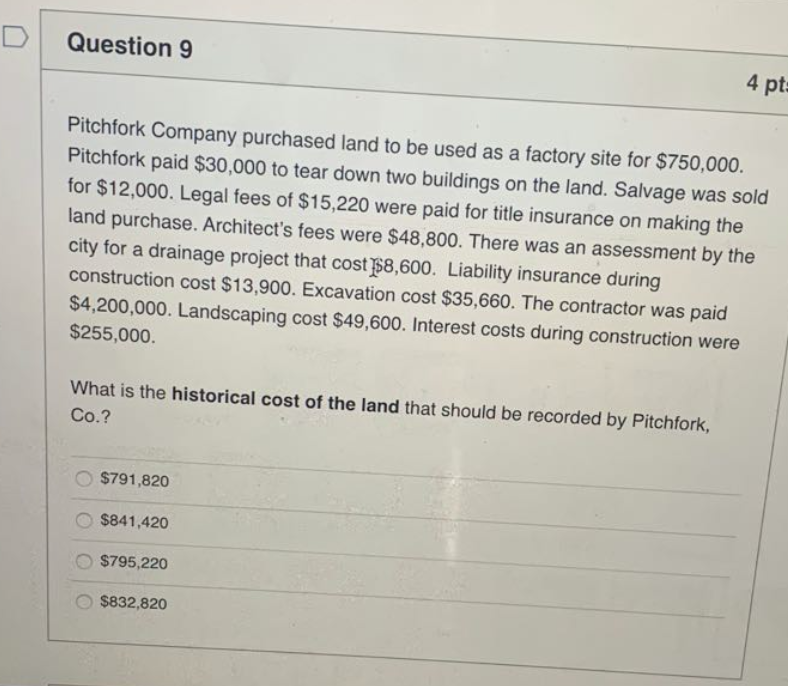

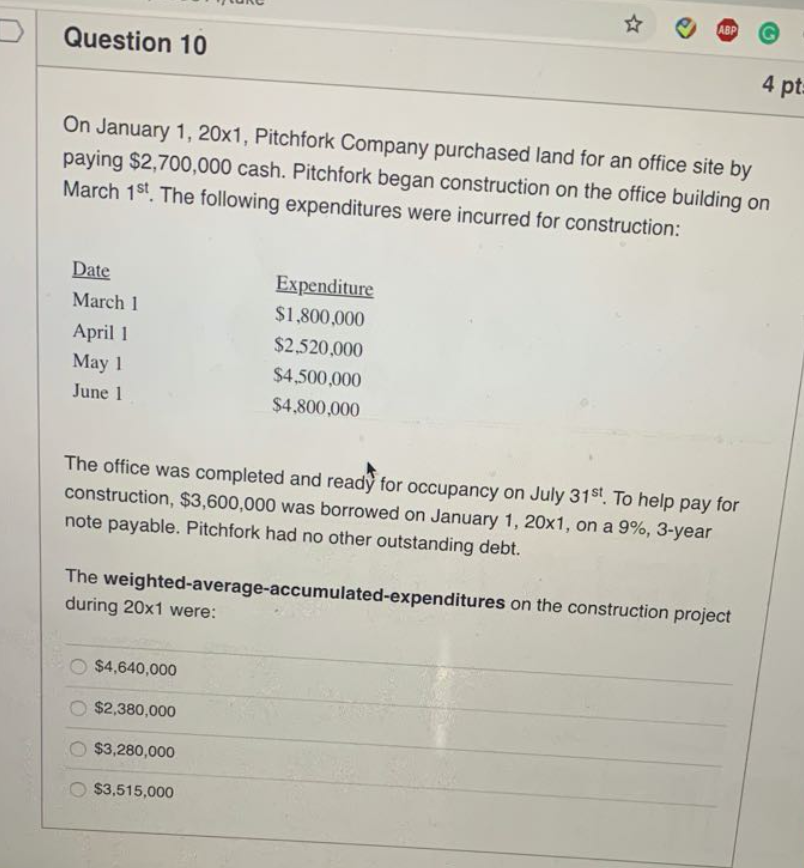

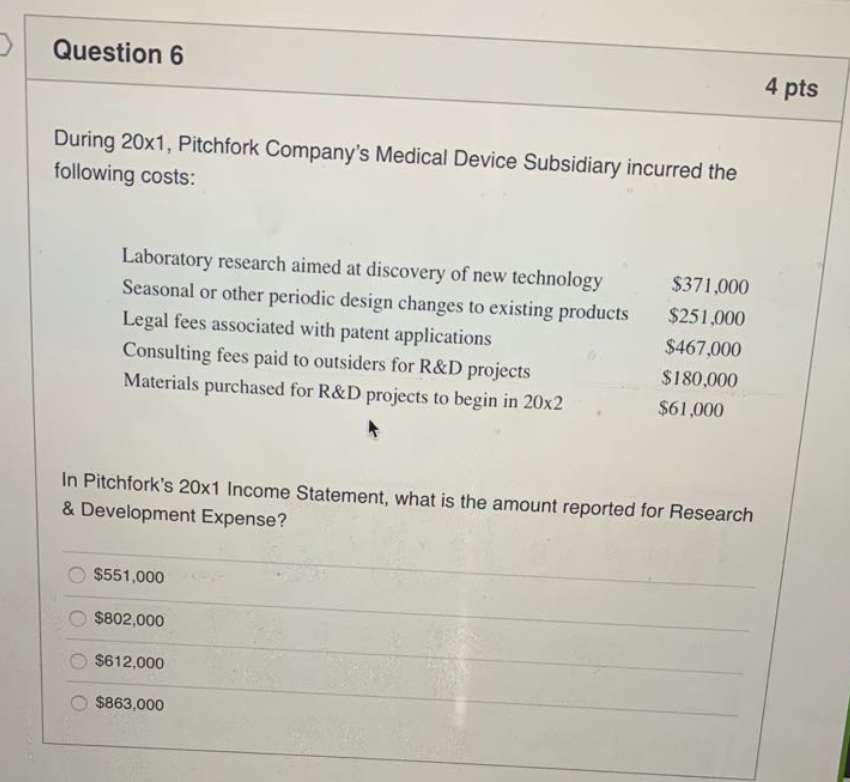

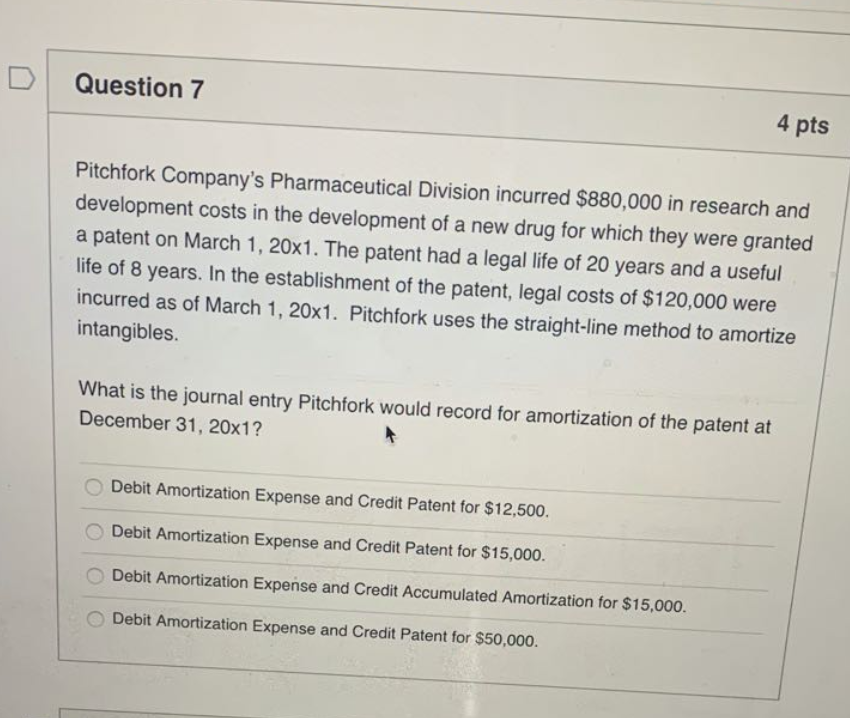

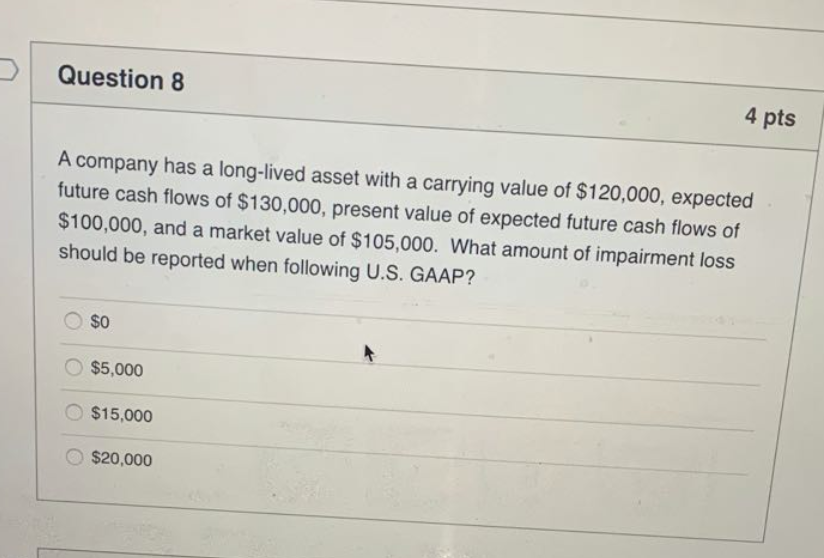

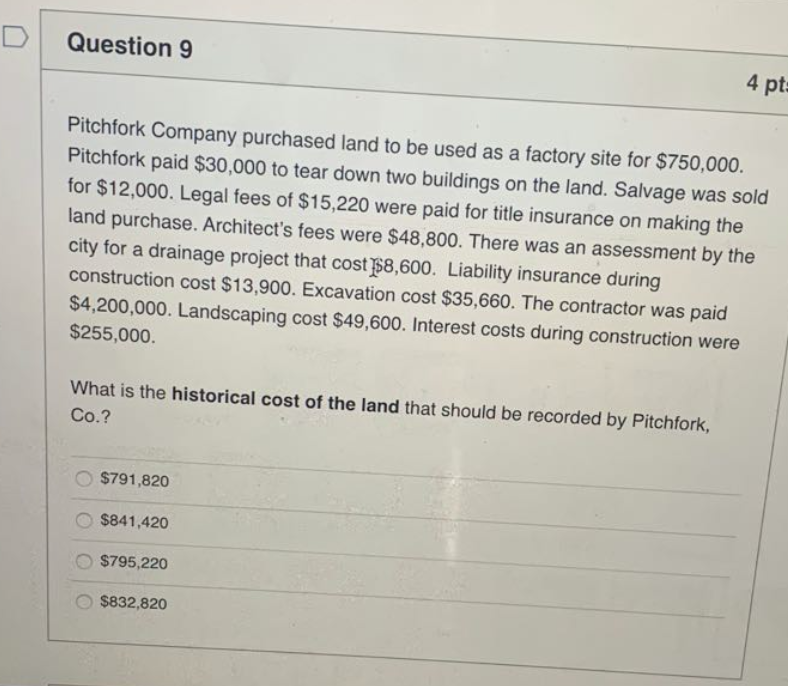

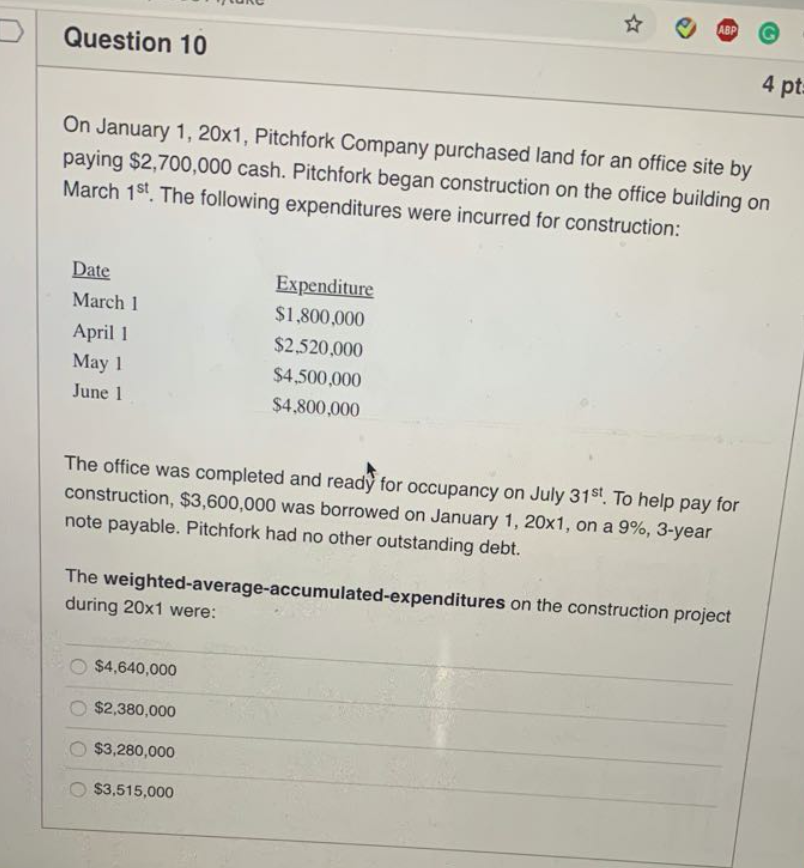

Question 6 4 pts During 20x1, Pitchfork Company's Medical Device Subsidiary incurred the following costs: Laboratory research aimed at discovery of new technology Seasonal or other periodic design changes to existing products Legal fees associated with patent applications Consulting fees paid to outsiders for R&D projects Materials purchased for R&D projects to begin in 20x2 $371.000 $251,000 $467,000 $180,000 $61,000 In Pitchfork's 20x1 Income Statement, what is the amount reported for Research & Development Expense? $551,000 $802,000 $612,000 $863,000 Question 7 4 pts Pitchfork Company's Pharmaceutical Division incurred $880,000 in research and development costs in the development of a new drug for which they were granted a patent on March 1, 20x1. The patent had a legal life of 20 years and a useful life of 8 years. In the establishment of the patent, legal costs of $120,000 were incurred as of March 1, 20x1. Pitchfork uses the straight-line method to amortize intangibles. What is the journal entry Pitchfork would record for amortization of the patent at December 31, 20x1? Debit Amortization Expense and Credit Patent for $12,500. Debit Amortization Expense and Credit Patent for $15,000. Debit Amortization Expense and Credit Accumulated Amortization for $15,000. Debit Amortization Expense and Credit Patent for $50,000. Question 8 4 pts A company has a long-lived asset with a carrying value of $120,000, expected future cash flows of $130,000, present value of expected future cash flows of $100,000, and a market value of $105,000. What amount of impairment loss should be reported when following U.S. GAAP? $0 $5,000 $15,000 $20,000 Question 9 4 pt Pitchfork Company purchased land to be used as a factory site for $750,000. Pitchfork paid $30,000 to tear down two buildings on the land. Salvage was sold for $12,000. Legal fees of $15,220 were paid for title insurance on making the land purchase. Architect's fees were $48,800. There was an assessment by the city for a drainage project that cost $8,600. Liability insurance during construction cost $13,900. Excavation cost $35,660. The contractor was paid $4,200,000. Landscaping cost $49,600. Interest costs during construction were $255,000 What is the historical cost of the land that should be recorded by Pitchfork, Co.? $791,820 $841,420 $795,220 $832,820 Question 10 4 pt On January 1, 20x1, Pitchfork Company purchased land for an office site by paying $2,700,000 cash. Pitchfork began construction on the office building on March 1st. The following expenditures were incurred for construction: Date March 1 April 1 May 1 June 1 Expenditure $1,800,000 $2,520,000 $4,500,000 $4.800,000 The office was completed and ready for occupancy on July 31st. To help pay for construction, $3,600,000 was borrowed on January 1, 20x1, on a 9%, 3-year note payable. Pitchfork had no other outstanding debt. The weighted average-accumulated-expenditures on the construction project during 20x1 were: $4,640,000 $2,380,000 $3,280,000 $3,515,000