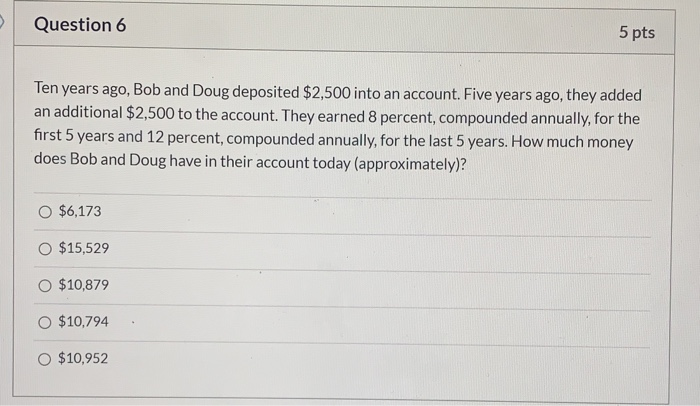

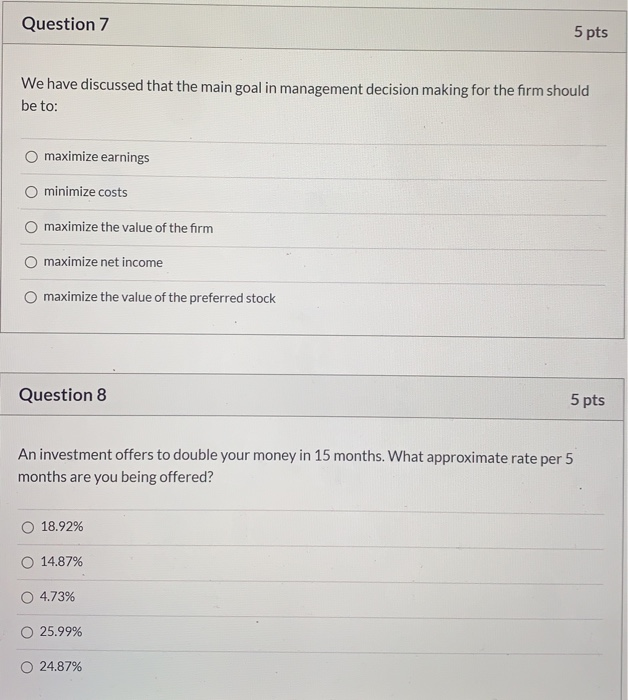

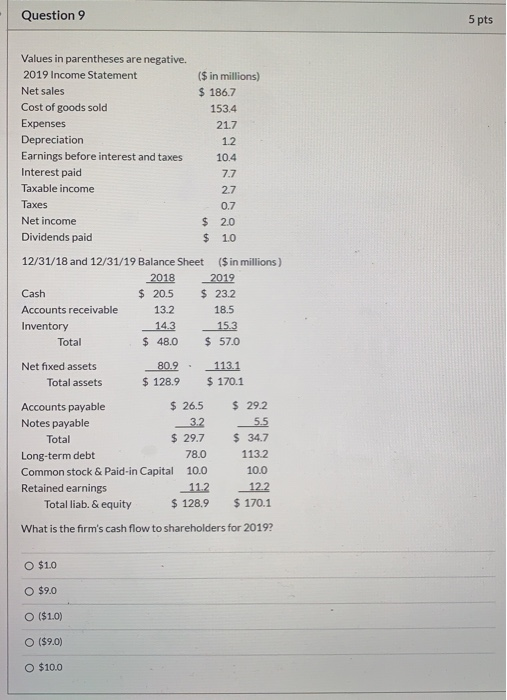

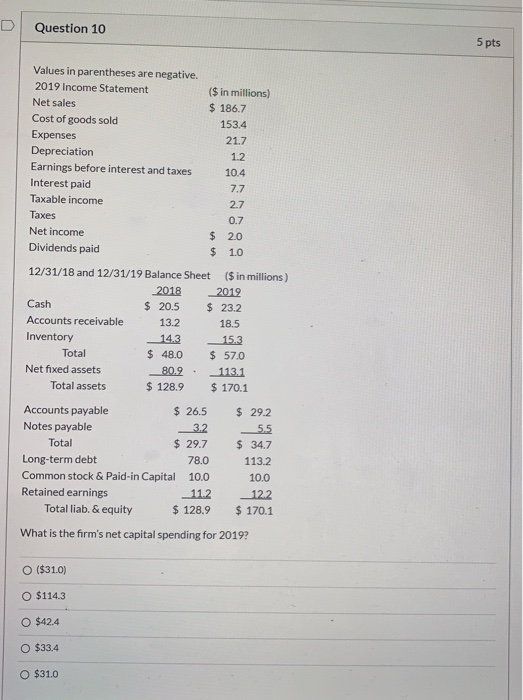

Question 6 5 pts Ten years ago, Bob and Doug deposited $2,500 into an account. Five years ago, they added an additional $2,500 to the account. They earned 8 percent, compounded annually, for the first 5 years and 12 percent, compounded annually, for the last 5 years. How much money does Bob and Doug have in their account today (approximately)? O $6,173 O $15,529 $10,879 $10,794 $10,952 Question 7 5 pts We have discussed that the main goal in management decision making for the firm should be to: maximize earnings minimize costs O maximize the value of the firm maximize net income maximize the value of the preferred stock Question 8 5 pts An investment offers to double your money in 15 months. What approximate rate per 5 months are you being offered? 18.92% 14.87% 4.73% 0 25.99% O 24.87% Question 9 5 pts Values in parentheses are negative. 2019 Income Statement ($ in millions) Net sales $ 186.7 Cost of goods sold 153.4 Expenses 21.7 Depreciation 1.2 Earnings before interest and taxes 10.4 Interest paid 7.7 Taxable income 2.7 Taxes 0.7 Net income $ 2.0 Dividends paid $ 1.0 12/31/18 and 12/31/19 Balance Sheet ($ in millions) 2018 2019 Cash $ 20.5 $ 23.2 Accounts receivable 13.2 18.5 Inventory 14.3 15.3 Total $ 48.0 $ 57.0 Net fixed assets 80.2. 113.1 Total assets $ 128.9 $ 170.1 Accounts payable $ 26.5 $ 29.2 Notes payable 3.2 5.5 Total $ 29.7 $ 34.7 Long-term debt 78.0 113.2 Common stock & Paid-in Capital 10.0 10.0 Retained earnings 112 122 Total liab. & equity $ 128.9 $ 170.1 What is the firm's cash flow to shareholders for 2019? O $1.0 O $9.0 O ($1.0) O ($9.0) O $10.0 Question 10 5 pts Values in parentheses are negative. 2019 Income Statement Net sales Cost of goods sold Expenses Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Dividends paid ($ in millions) $ 186.7 153.4 21.7 1.2 10.4 7.7 2.7 0.7 $ 2.0 $ 1.0 12/31/18 and 12/31/19 Balance Sheet ($ in millions) 2018 2012 Cash $ 20.5 $ 23.2 Accounts receivable 13.2 18.5 Inventory 14.3 153 Total $ 48.0 $ 57.0 Net fixed assets 80.2 113.1 Total assets $ 128.9 $ 170.1 Accounts payable $ 26.5 $ 29.2 Notes payable 3.2 5.5 Total $ 29.7 $ 34.7 Long-term debt 78.0 113.2 Common stock & Paid-in Capital 10.0 10.0 Retained earnings 112 __122 Total liab.& equity $ 128,9 $ 170.1 What is the firm's net capital spending for 2019? O ($31.0) $114.3 O $42.4 O $33.4 O $31.0