Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 (8 points) In 2018, the accountant for Harris Pilton discovered an error. In 2017, the company failed to record $15,000 of a rent

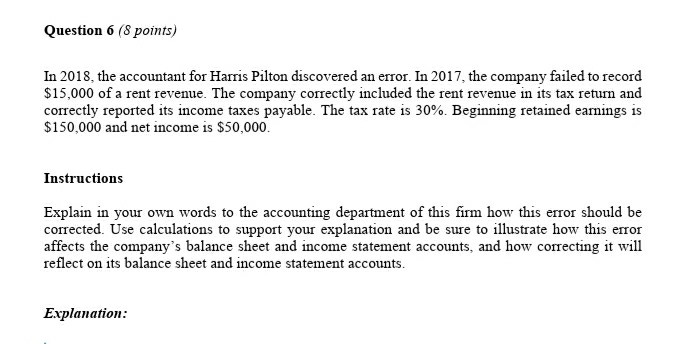

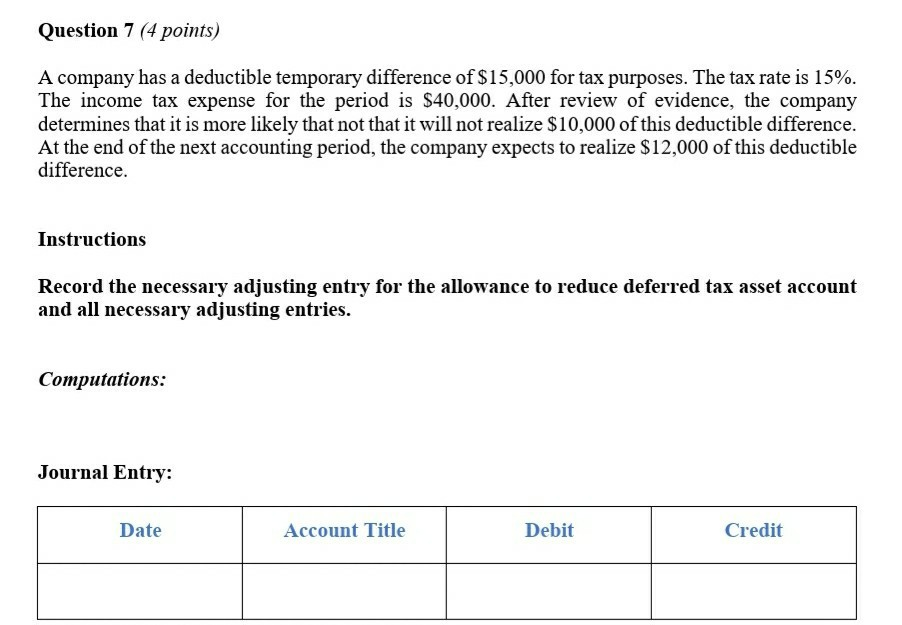

Question 6 (8 points) In 2018, the accountant for Harris Pilton discovered an error. In 2017, the company failed to record $15,000 of a rent revenue. The company correctly included the rent revenue in its tax return and correctly reported its income taxes payable. The tax rate is 30%. Beginning retained earnings is $150,000 and net income is $50,000. Instructions Explain in your own words to the accounting department of this firm how this error should be corrected. Use calculations to support your explanation and be sure to illustrate how this error affects the company's balance sheet and income statement accounts, and how correcting it will reflect on its balance sheet and income statement accounts. Explanation: Question 7 (4 points) A company has a deductible temporary difference of $15,000 for tax purposes. The tax rate is 15%. The income tax expense for the period is $40,000. After review of evidence, the company determines that it is more likely that not that it will not realize $10,000 of this deductible difference. At the end of the next accounting period, the company expects to realize $12,000 of this deductible difference. Instructions Record the necessary adjusting entry for the allowance to reduce deferred tax asset account and all necessary adjusting entries. Computations: Journal Entry: Date Account Title Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started