Answered step by step

Verified Expert Solution

Question

1 Approved Answer

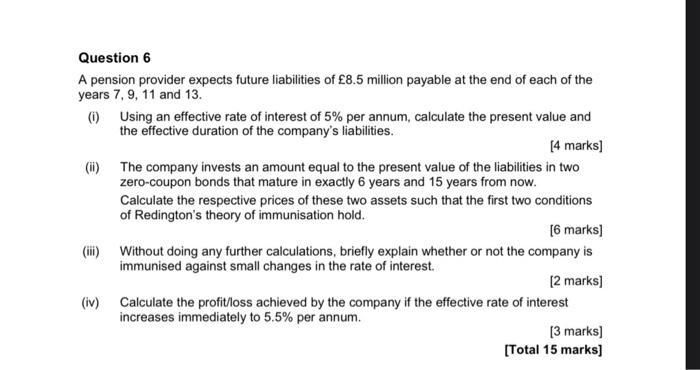

Question 6 A pension provider expects future liabilities of 8.5 million payable at the end of each of the years 7, 9, 11 and

Question 6 A pension provider expects future liabilities of 8.5 million payable at the end of each of the years 7, 9, 11 and 13. (i) Using an effective rate of interest of 5% per annum, calculate the present value and the effective duration of the company's liabilities. [4 marks] (ii) The company invests an amount equal to the present value of the liabilities in two zero-coupon bonds that mature in exactly 6 years and 15 years from now. Calculate the respective prices of these two assets such that the first two conditions of Redington's theory of immunisation hold. [6 marks] (iii) Without doing any further calculations, briefly explain whether or not the company is immunised against small changes in the rate of interest. [2 marks] (iv) Calculate the profit/loss achieved by the company if the effective rate of interest increases immediately to 5.5% per annum. [3 marks] [Total 15 marks]

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i To calculate the present value and effective duration of the companys liabilities we can use the following formula PV Li 1 rti where PV is the prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started