Answered step by step

Verified Expert Solution

Question

1 Approved Answer

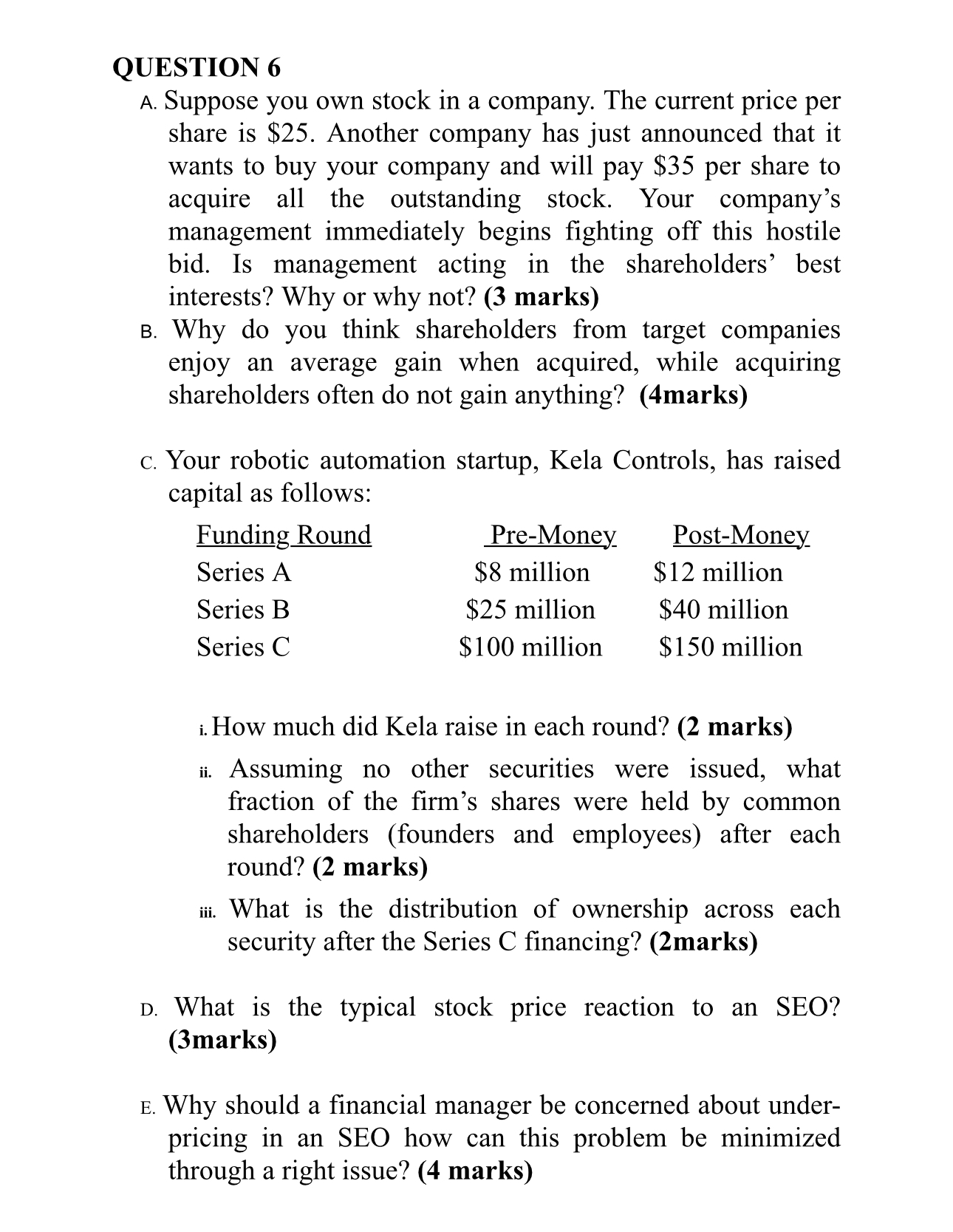

QUESTION 6 A . Suppose you own stock in a company. The current price per share is $ 2 5 . Another company has just

QUESTION

A Suppose you own stock in a company. The current price per share is $ Another company has just announced that it wants to buy your company and will pay $ per share to acquire all the outstanding stock. Your company's management immediately begins fighting off this hostile bid. Is management acting in the shareholders' best interests? Why or why not? marks

B Why do you think shareholders from target companies enjoy an average gain when acquired, while acquiring shareholders often do not gain anything? marks

c Your robotic automation startup, Kela Controls, has raised capital as follows:

tableFunding Round,PreMoney,PostMoneySeries A$ million,$ millionSeries B$ million,$ millionSeries C$ million,$ million

i How much did Kela raise in each round? marks

ii Assuming no other securities were issued, what fraction of the firm's shares were held by common shareholders founders and employees after each round? marks

iii. What is the distribution of ownership across each security after the Series C financing? marks

D What is the typical stock price reaction to an SEO? marks

E Why should a financial manager be concerned about underpricing in an SEO how can this problem be minimized through a right issue? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started