Answered step by step

Verified Expert Solution

Question

1 Approved Answer

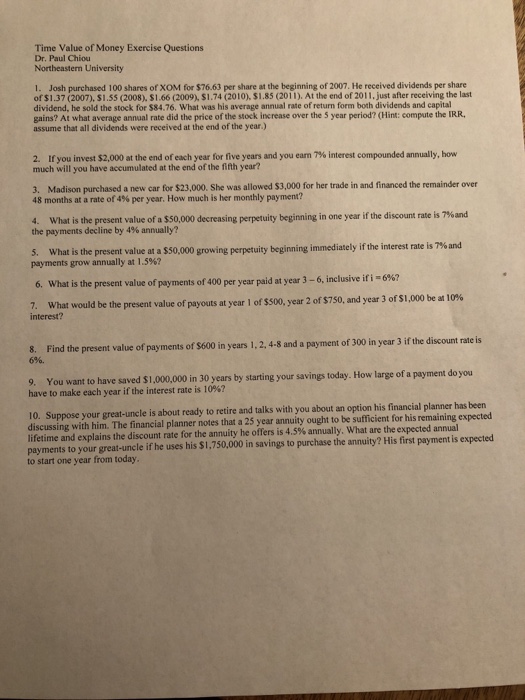

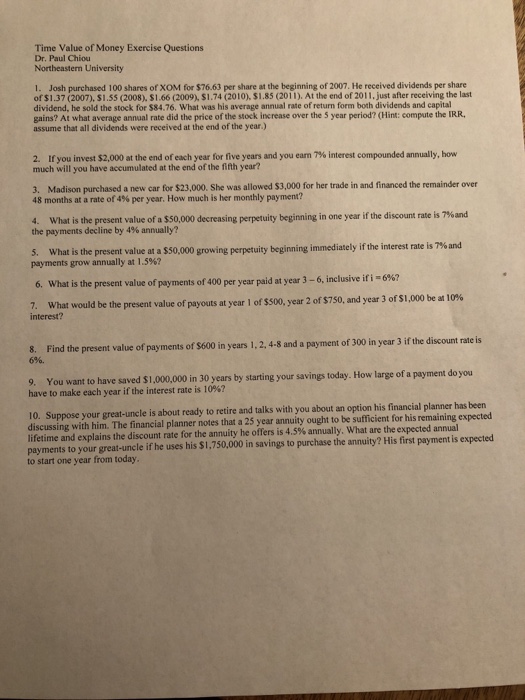

Question 6 and 7 Explain answer Show work Time Value of Money Exercise Questions Dr. Paul Chiou 1. Josh purchased 100 shares of XOM for

Question 6 and 7

Time Value of Money Exercise Questions Dr. Paul Chiou 1. Josh purchased 100 shares of XOM for $76.63 per share at the beginning of 2007. He received dividends per share of $1.37 (2007), $1.55 (2008), $1.66 (2009), $1.74 (2010), $1.85 (2011). At the end of 2011, just after receiving the last dividend, he sold the stock for $84.76. What was his average annual rate of return form both dividends and capital gains? At what average annual rate did the price of the stock increase over the 5 year period? (Hint: compute the IRR assume that all dividends were received at the end of the year.) 2. If you invest S2.000 at the end of each year for five years and you earn 7% interest compounded annually, how much will you have accumulated at the end of the fifth year? 3. Madison purchased a new car for $23,000. She was allowed $3,000 for her trade in and financed the remainder over 48 months at a rate of 4% per year. How much is her monthly payment? 4. What is the present value of asso,000 decreasing perpetuity beginning in one year if the discount rate is 7%and the payments decline by 4% annually? interest rate is 7% and 5 What is the present valueat a $50,000 growing perpetuity beginning immediately ifth payments grow annually at 1-5%? usive iri-6967 6. What is the present value of payments of 400 per year paid at year 3-6, incl payouts at year l of SS00 year 2 of S750 and year 3 orsi 000 be at 10% 7. What would be the present value of interest? of payments of $600 in years 1, 2, 4-8 and a payment of 300 in year 3 if the discount rate is 8. Find the 696. 9. You want to have saved $1,000,000 in 30 years by starting your savings today. How large of a payment do you have to make each year if the interest rate is 10%? 10. Suppose your great-uncle is about ready to retire and talks with you about an option his financial planner has been discussing with him. The financial planner notes that a 25 year annuity ought to be sufficient for his remaining expected lifetime and explains the discount rate for the annuity he offers is 4.5% annually, what are he espected annual payments to your great-uncle if he uses his $1,750,000 in savings to purchase the amnuity? His first payment is expected to start one year from today Explain answer

Show work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started