Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 6 As the number of assets in a portfolio increases, the variance of the portfolio returns will tend towards O A. The average component

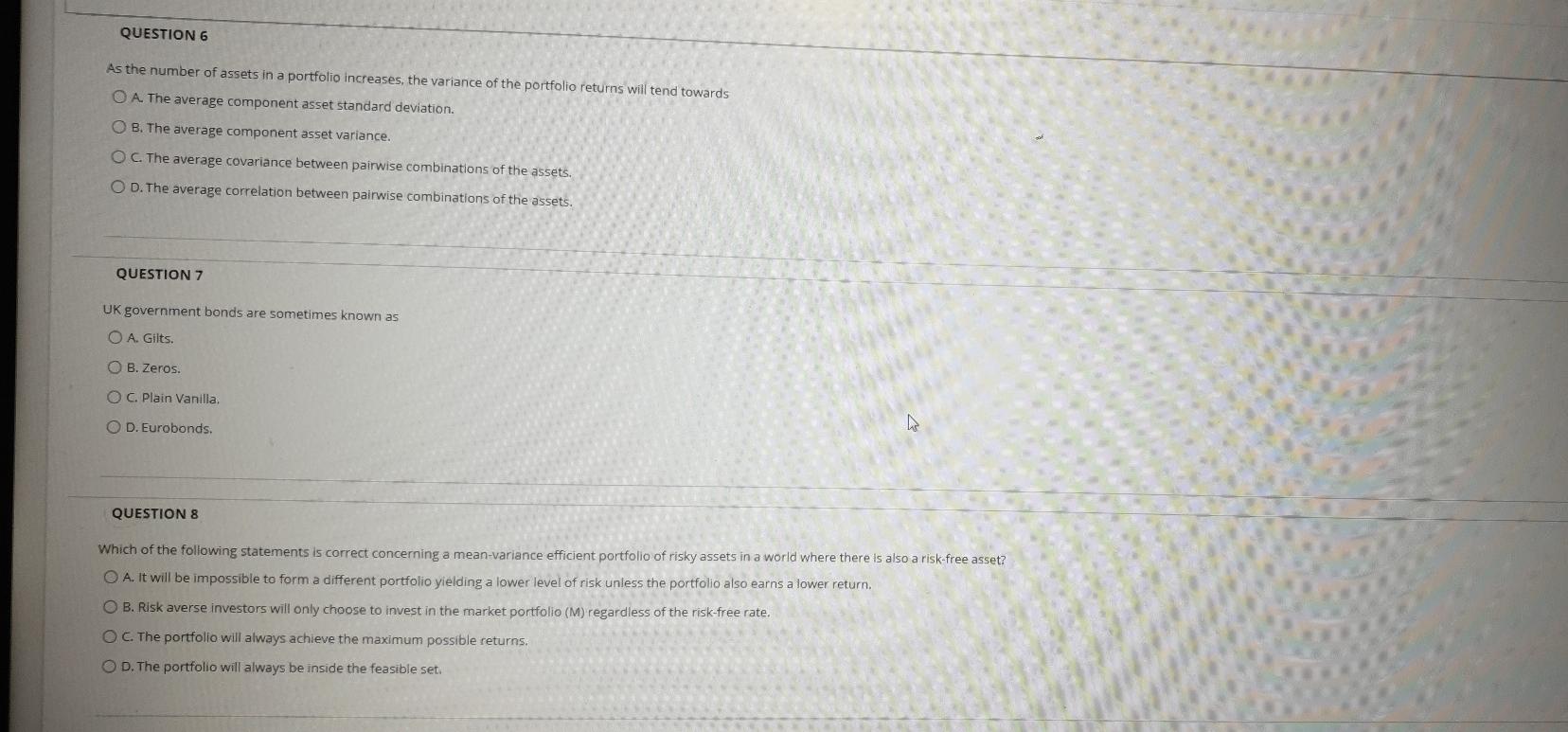

QUESTION 6 As the number of assets in a portfolio increases, the variance of the portfolio returns will tend towards O A. The average component asset standard deviation B. The average component asset variance. OC. The average covariance between pairwise combinations of the assets. O D. The average correlation between pairwise combinations of the assets. QUESTION 7 UK government bonds are sometimes known as O A. Gilts. O B. Zeros. O C. Plain Vanilla, O D. Eurobonds. QUESTION 8 Which of the following statements is correct concerning a mean-variance efficient portfolio of risky assets in a world where there is also a risk-free asset? O A. It will be impossible to form a different portfolio yielding a lower level of risk unless the portfolio also earns a lower return. O B. Risk averse investors will only choose to invest in the market portfolio (M) regardless of the risk-free rate. O C. The portfolio will always achieve the maximum possible returns. O D. The portfolio will always be inside the feasible set. QUESTION 6 As the number of assets in a portfolio increases, the variance of the portfolio returns will tend towards O A. The average component asset standard deviation B. The average component asset variance. OC. The average covariance between pairwise combinations of the assets. O D. The average correlation between pairwise combinations of the assets. QUESTION 7 UK government bonds are sometimes known as O A. Gilts. O B. Zeros. O C. Plain Vanilla, O D. Eurobonds. QUESTION 8 Which of the following statements is correct concerning a mean-variance efficient portfolio of risky assets in a world where there is also a risk-free asset? O A. It will be impossible to form a different portfolio yielding a lower level of risk unless the portfolio also earns a lower return. O B. Risk averse investors will only choose to invest in the market portfolio (M) regardless of the risk-free rate. O C. The portfolio will always achieve the maximum possible returns. O D. The portfolio will always be inside the feasible set

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started