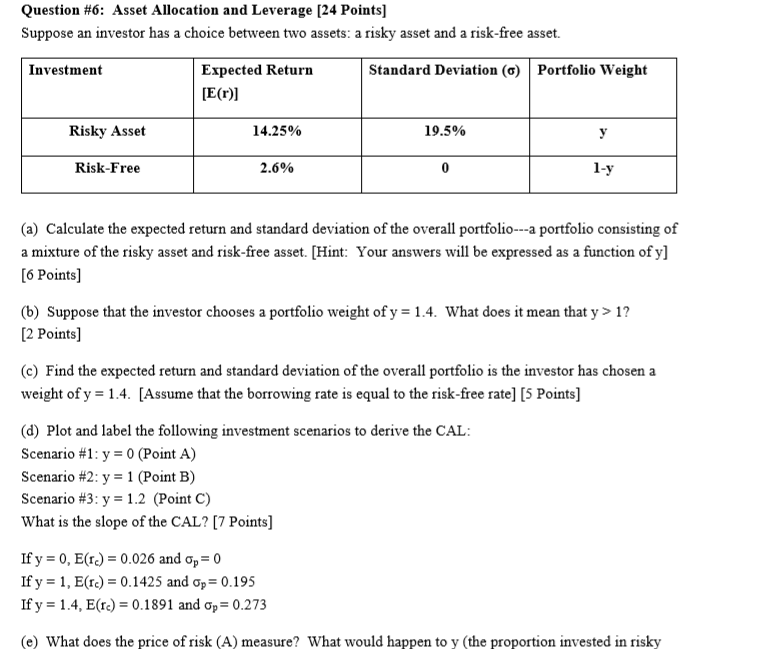

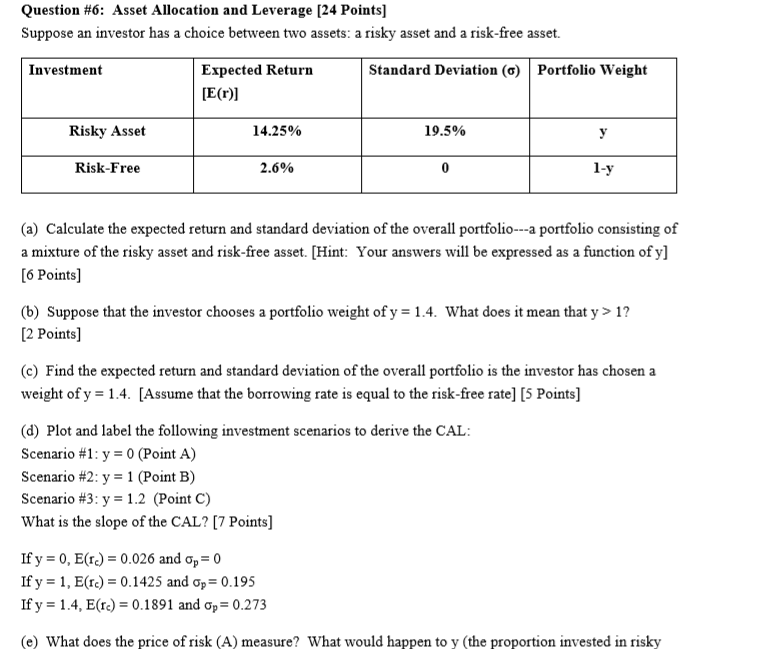

Question #6: Asset Allocation and Leverage [24 Points] Suppose an investor has a choice between two assets: a risky asset and a risk-free asset. Investment Expected Return [E(r)l Standard Deviation (Portfolio Weight Risky Asset 14.25% 19,5% Risk-Free 2.6% (a) Calculate the expected return and standard deviation of the overall portfolio---a portfolio consisting of a mixture of the risky asset and risk-free asset. [Hint: Your answers will be expressed as a function of y] 6 Points] (b) Suppose that the investor chooses a portfolio weight of y 1.4. What does it mean that y>1? 2 Points] (c) Find the expected return and standard deviation of the overall portfolio is the investor has chosen a weight of y 1.4. [Assume that the borrowing rate is equal to the risk-free rate] [5 Points] (d) Plot and label the following investment scenarios to derive the CAL Scenario #1 : y-0 (Point A) Scenario #2: y-1 (Point B) Scenario #3 : y 1.2 What is the slope of the CAL? [7 Points] oint C) If y-0, E(r)-0.026 and ?,-0 If y-1, E(rc)-0.1425 and ?,-0.195 If y-14, E(rc)-0.1891 and ?,-0.273 (e) What does the price of risk (A) measure? What would happen to y (the proportion invested in risky Question #6: Asset Allocation and Leverage [24 Points] Suppose an investor has a choice between two assets: a risky asset and a risk-free asset. Investment Expected Return [E(r)l Standard Deviation (Portfolio Weight Risky Asset 14.25% 19,5% Risk-Free 2.6% (a) Calculate the expected return and standard deviation of the overall portfolio---a portfolio consisting of a mixture of the risky asset and risk-free asset. [Hint: Your answers will be expressed as a function of y] 6 Points] (b) Suppose that the investor chooses a portfolio weight of y 1.4. What does it mean that y>1? 2 Points] (c) Find the expected return and standard deviation of the overall portfolio is the investor has chosen a weight of y 1.4. [Assume that the borrowing rate is equal to the risk-free rate] [5 Points] (d) Plot and label the following investment scenarios to derive the CAL Scenario #1 : y-0 (Point A) Scenario #2: y-1 (Point B) Scenario #3 : y 1.2 What is the slope of the CAL? [7 Points] oint C) If y-0, E(r)-0.026 and ?,-0 If y-1, E(rc)-0.1425 and ?,-0.195 If y-14, E(rc)-0.1891 and ?,-0.273 (e) What does the price of risk (A) measure? What would happen to y (the proportion invested in risky