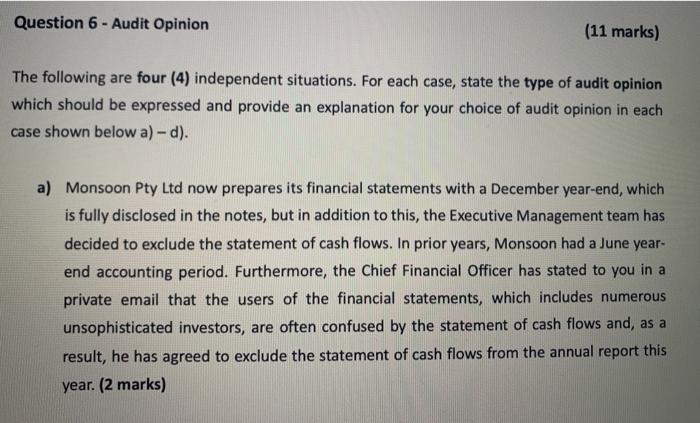

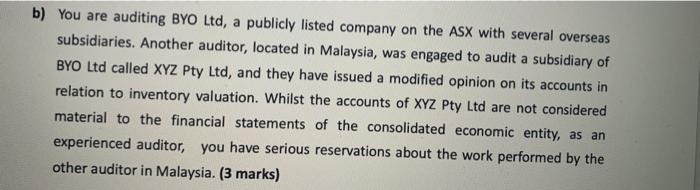

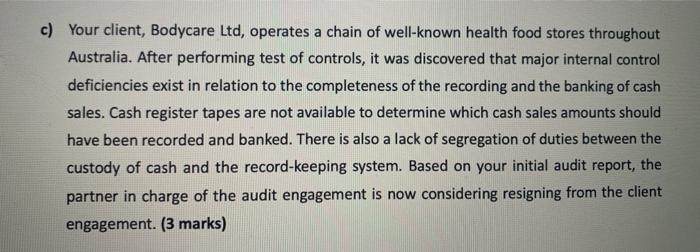

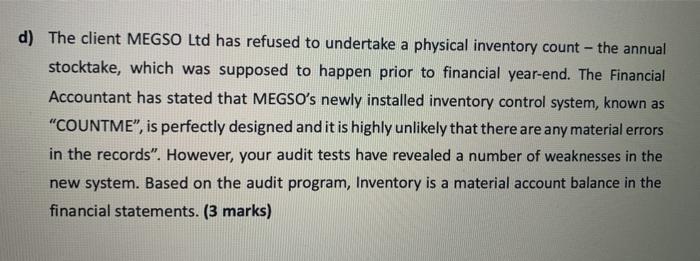

Question 6 - Audit Opinion (11 marks) The following are four (4) independent situations. For each case, state the type of audit opinion which should be expressed and provide an explanation for your choice of audit opinion in each case shown below a) - d). a) Monsoon Pty Ltd now prepares its financial statements with a December year-end, which is fully disclosed in the notes, but in addition to this, the Executive Management team has decided to exclude the statement of cash flows. In prior years, Monsoon had a June year- end accounting period. Furthermore, the Chief Financial Officer has stated to you in a private email that the users of the financial statements, which includes numerous unsophisticated investors, are often confused by the statement of cash flows and, as a result, he has agreed to exclude the statement of cash flows from the annual report this year. (2 marks) b) You are auditing BYO Ltd, a publicly listed company on the ASX with several overseas subsidiaries. Another auditor, located in Malaysia, was engaged to audit a subsidiary of BYO Ltd called XYZ Pty Ltd, and they have issued a modified opinion on its accounts in relation to inventory valuation. Whilst the accounts of XYZ Pty Ltd are not considered material to the financial statements of the consolidated economic entity, as an experienced auditor, you have serious reservations about the work performed by the other auditor in Malaysia. (3 marks) c) Your client, Bodycare Ltd, operates a chain of well-known health food stores throughout Australia. After performing test of controls, it was discovered that major internal control deficiencies exist in relation to the completeness of the recording and the banking of cash sales. Cash register tapes are not available to determine which cash sales amounts should have been recorded and banked. There is also a lack of segregation of duties between the custody of cash and the record-keeping system. Based on your initial audit report, the partner in charge of the audit engagement is now considering resigning from the client engagement. (3 marks) d) The client MEGSO Ltd has refused to undertake a physical inventory count - the annual stocktake, which was supposed to happen prior to financial year-end. The Financial Accountant has stated that MEGSO's newly installed inventory control system, known as "COUNTME", is perfectly designed and it is highly unlikely that there are any material errors in the records. However, your audit tests have revealed a number of weaknesses in the new system. Based on the audit program, Inventory is a material account balance in the financial statements