Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6 Cleveland Inc., a Malaysian company, is expecting to receive AUD200,000 from an Australian company based in Melbourne as a settlement of an

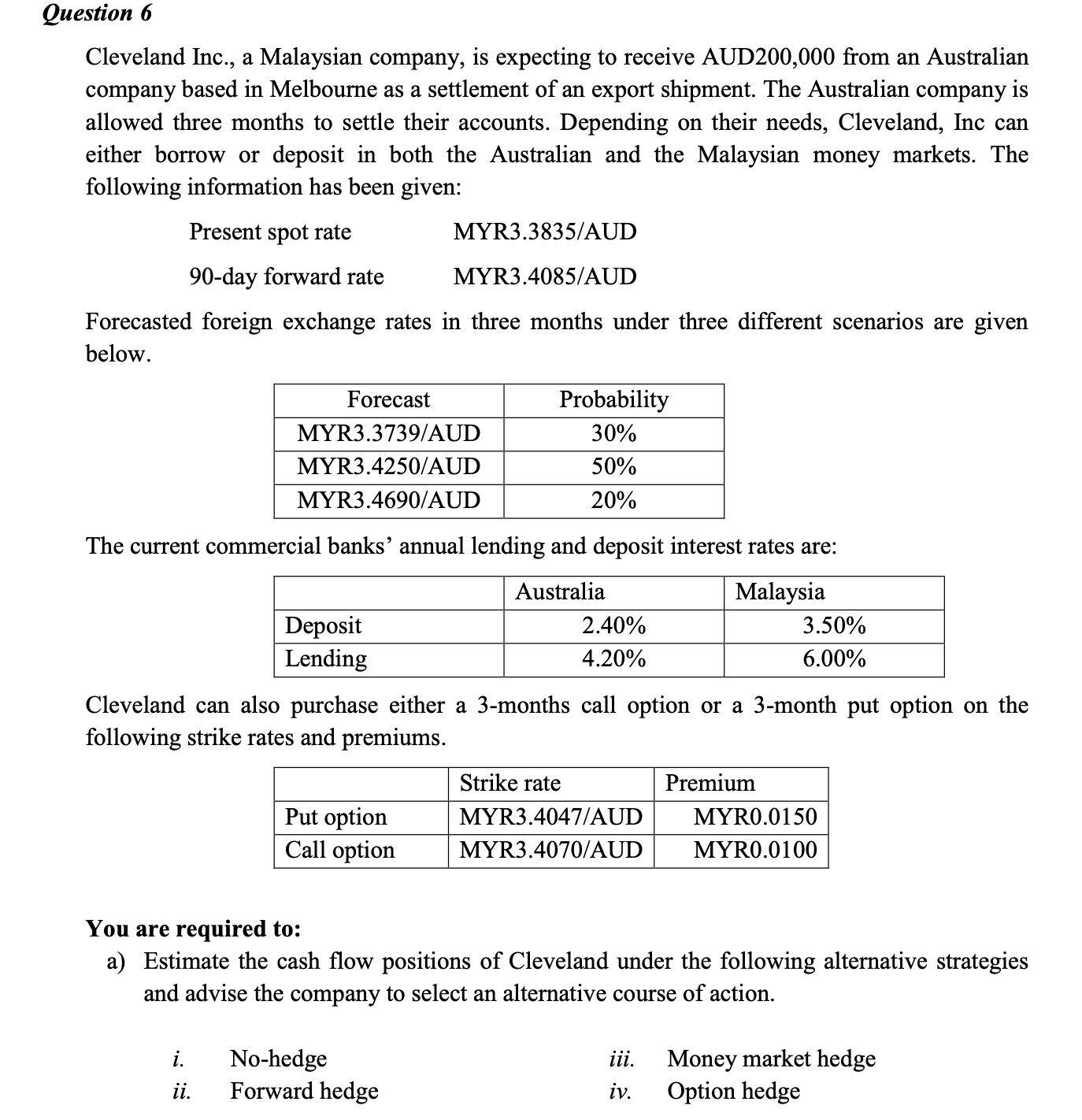

Question 6 Cleveland Inc., a Malaysian company, is expecting to receive AUD200,000 from an Australian company based in Melbourne as a settlement of an export shipment. The Australian company is allowed three months to settle their accounts. Depending on their needs, Cleveland, Inc can either borrow or deposit in both the Australian and the Malaysian money markets. The following information has been given: Present spot rate 90-day forward rate MYR3.3835/AUD MYR3.4085/AUD Forecasted foreign exchange rates in three months under three different scenarios are given below. Forecast MYR3.3739/AUD MYR3.4250/AUD Probability 30% 50% 20% MYR3.4690/AUD The current commercial banks' annual lending and deposit interest rates are: Deposit Lending Australia 2.40% 4.20% Malaysia 3.50% 6.00% Cleveland can also purchase either a 3-months call option or a 3-month put option on the following strike rates and premiums. Strike rate Premium Put option MYR3.4047/AUD MYR0.0150 Call option MYR3.4070/AUD MYR0.0100 You are required to: a) Estimate the cash flow positions of Cleveland under the following alternative strategies and advise the company to select an alternative course of action. i. ii. No-hedge Forward hedge iii. Money market hedge iv. Option hedge

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the cash flow positions of Cleveland Inc under different hedging strategies we will calculate the expected cash flow in Malaysian Ringgit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started