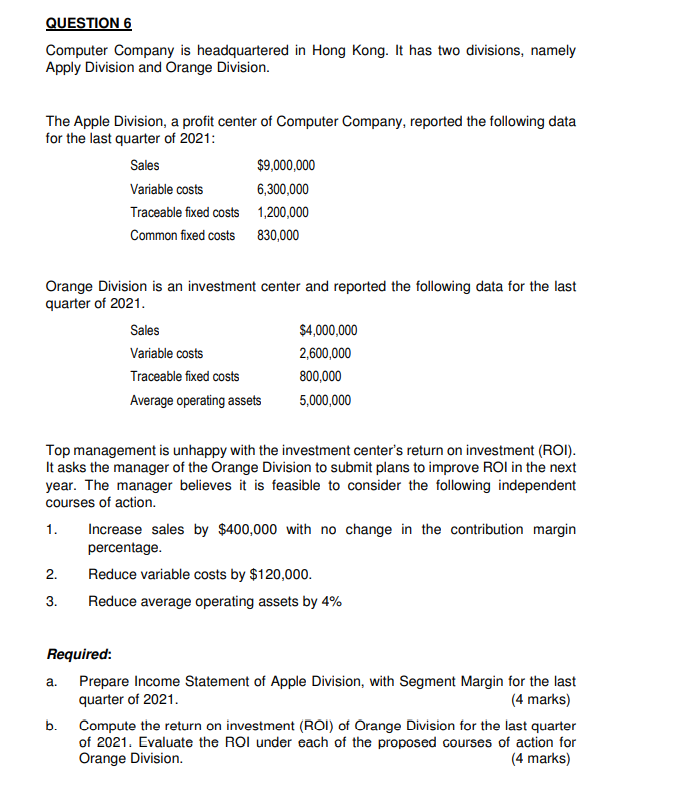

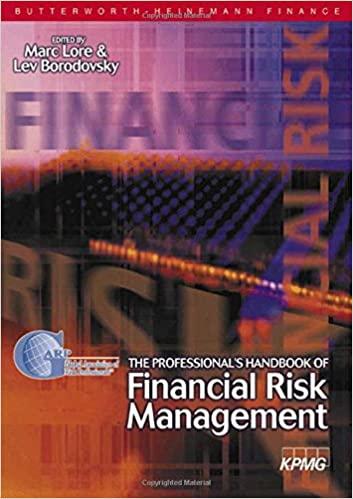

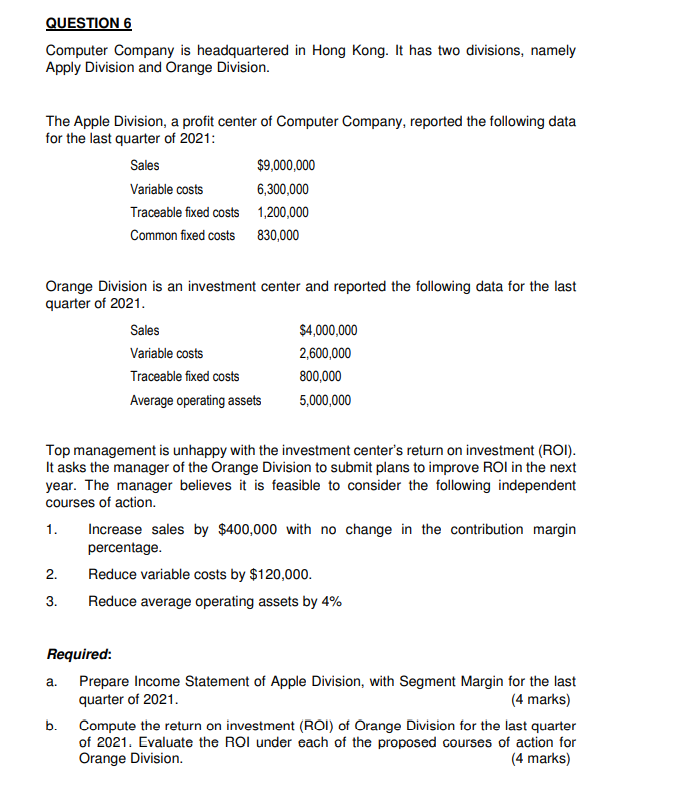

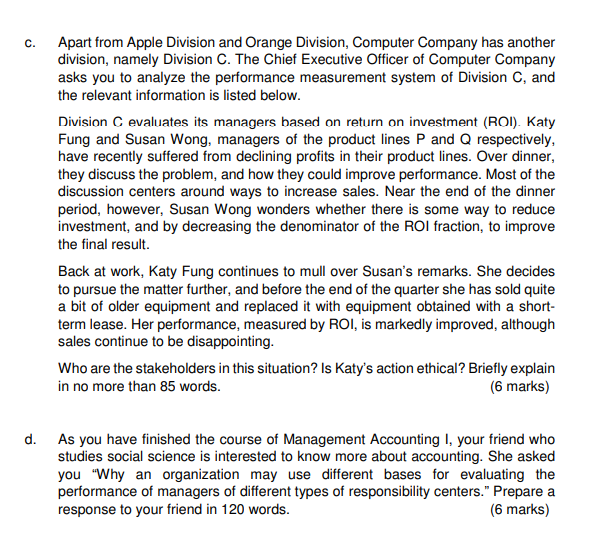

QUESTION 6 Computer Company is headquartered in Hong Kong. It has two divisions, namely Apply Division and Orange Division. The Apple Division, a profit center of Computer Company, reported the following data for the last quarter of 2021: Sales $9,000,000 Variable costs 6,300,000 Traceable fixed costs 1,200,000 Common fixed costs 830,000 Orange Division is an investment center and reported the following data for the last quarter of 2021. Sales $4,000,000 Variable costs 2,600,000 Traceable fixed costs 800,000 Average operating assets 5,000,000 Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the Orange Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $400,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $120,000. 3. Reduce average operating assets by 4% a. Required: Prepare Income Statement of Apple Division, with Segment Margin for the last quarter of 2021. (4 marks) b. Compute the return on investment (ROI) of Orange Division for the last quarter of 2021. Evaluate the ROI under each of the proposed courses of action for Orange Division (4 marks) C. Apart from Apple Division and Orange Division, Computer Company has another division, namely Division C. The Chief Executive Officer of Computer Company asks you to analyze the performance measurement system of Division C, and the relevant information is listed below. Division C evaluates its managers based on return on investment (ROI). Katy Fung and Susan Wong, managers of the product lines P and Q respectively, have recently suffered from declining profits in their product lines. Over dinner, they discuss the problem, and how they could improve performance. Most of the discussion centers around ways to increase sales. Near the end of the dinner period, however, Susan Wong wonders whether there is some way to reduce investment, and by decreasing the denominator of the ROI fraction, to improve the final result Back at work, Katy Fung continues to mull over Susan's remarks. She decides to pursue the matter further, and before the end of the quarter she has sold quite a bit of older equipment and replaced it with equipment obtained with a short- term lease. Her performance, measured by ROI, is markedly improved, although sales continue to be disappointing. Who are the stakeholders in this situation? Is Katy's action ethical? Briefly explain in no more than 85 words. (6 marks) d. As you have finished the course of Management Accounting I, your friend who studies social science is interested to know more about accounting. She asked you "Why an organization may use different bases for evaluating the performance of managers of different types of responsibility centers." Prepare a response to your friend in 120 words. (6 marks) QUESTION 6 Computer Company is headquartered in Hong Kong. It has two divisions, namely Apply Division and Orange Division. The Apple Division, a profit center of Computer Company, reported the following data for the last quarter of 2021: Sales $9,000,000 Variable costs 6,300,000 Traceable fixed costs 1,200,000 Common fixed costs 830,000 Orange Division is an investment center and reported the following data for the last quarter of 2021. Sales $4,000,000 Variable costs 2,600,000 Traceable fixed costs 800,000 Average operating assets 5,000,000 Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the Orange Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. 1. Increase sales by $400,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $120,000. 3. Reduce average operating assets by 4% a. Required: Prepare Income Statement of Apple Division, with Segment Margin for the last quarter of 2021. (4 marks) b. Compute the return on investment (ROI) of Orange Division for the last quarter of 2021. Evaluate the ROI under each of the proposed courses of action for Orange Division (4 marks) C. Apart from Apple Division and Orange Division, Computer Company has another division, namely Division C. The Chief Executive Officer of Computer Company asks you to analyze the performance measurement system of Division C, and the relevant information is listed below. Division C evaluates its managers based on return on investment (ROI). Katy Fung and Susan Wong, managers of the product lines P and Q respectively, have recently suffered from declining profits in their product lines. Over dinner, they discuss the problem, and how they could improve performance. Most of the discussion centers around ways to increase sales. Near the end of the dinner period, however, Susan Wong wonders whether there is some way to reduce investment, and by decreasing the denominator of the ROI fraction, to improve the final result Back at work, Katy Fung continues to mull over Susan's remarks. She decides to pursue the matter further, and before the end of the quarter she has sold quite a bit of older equipment and replaced it with equipment obtained with a short- term lease. Her performance, measured by ROI, is markedly improved, although sales continue to be disappointing. Who are the stakeholders in this situation? Is Katy's action ethical? Briefly explain in no more than 85 words. (6 marks) d. As you have finished the course of Management Accounting I, your friend who studies social science is interested to know more about accounting. She asked you "Why an organization may use different bases for evaluating the performance of managers of different types of responsibility centers." Prepare a response to your friend in 120 words. (6 marks)