Answered step by step

Verified Expert Solution

Question

1 Approved Answer

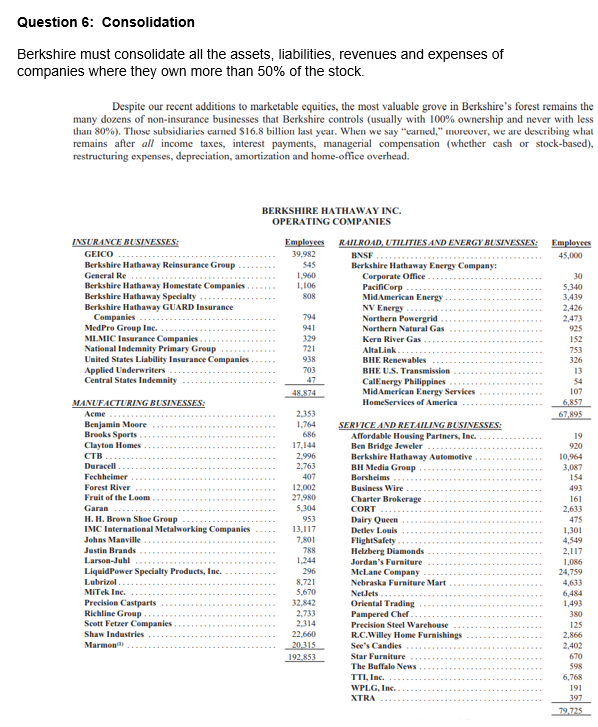

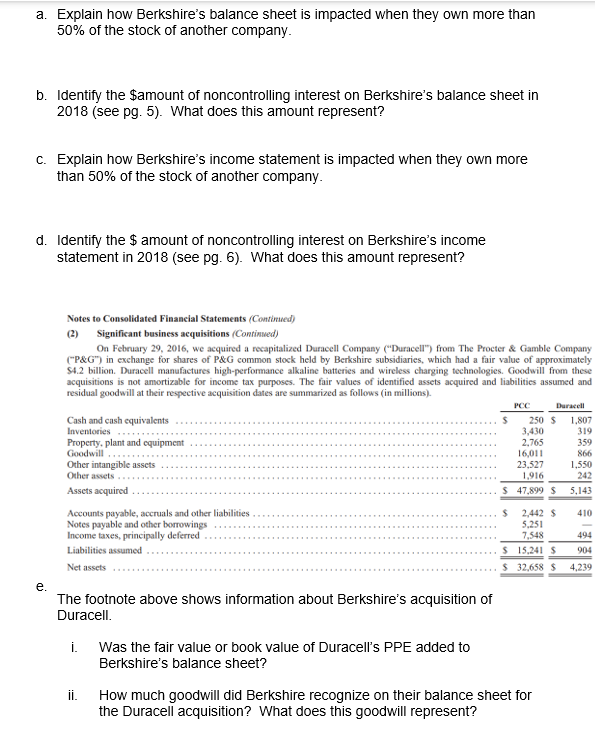

Question 6: Consolidation Berkshire must consolidate all the assets, liabilities, revenues and expenses of companies where they own more than 50% of the stock. Despite

Question 6: Consolidation Berkshire must consolidate all the assets, liabilities, revenues and expenses of companies where they own more than 50% of the stock. Despite our recent additions to marketable equities, the most valuable grove in Berkshire's forest remains the many dozens of non-insurance businesses that Berkshire controls (usually with 100% ownership and never with less than 80% ). Those subsidiaries earned $16.8 billion last year. When we say "eaned," moreover, we are describing what remains after all income taxes, interest payments, managerial compensation (whether cash or stock-based), restructuring expenses, depreciation, amortization and home-office overhead. BERKSHIRE HATHAWAY INC. a. Explain how Berkshire's balance sheet is impacted when they own more than 50% of the stock of another company. b. Identify the \$amount of noncontrolling interest on Berkshire's balance sheet in 2018 (see pg. 5). What does this amount represent? c. Explain how Berkshire's income statement is impacted when they own more than 50% of the stock of another company. d. Identify the \$ amount of noncontrolling interest on Berkshire's income statement in 2018 (see pg. 6). What does this amount represent? Notes to Consolidated Financial Statements (Contimined) (2) Significant business acquisitions (Continwed) On February 29, 2016, we acquired a recapitalized Darneell Company ("Duracell") from The Procter \& Gamble Company ("P&G) in exchange for shares of P\&G common stock held by Berkshire subsidiaries, which had a fair value of approximately \$4.2 billion. Duracell manufactures high-performance alkaline batteries and wireless charging technologies. Goodwill from these acquisitions is not amortizable for income tax purposes. The fair values of identified assets acquired and tiabilities assumed and residual goodwill at their respective acquisition dates are summarized as follows (in millions). e. The footnote above shows information about Berkshire's acquisition of Duracell. i. Was the fair value or book value of Duracell's PPE added to Berkshire's balance sheet? ii. How much goodwill did Berkshire recognize on their balance sheet for the Duracell acquisition? What does this goodwill represent? Question 6: Consolidation Berkshire must consolidate all the assets, liabilities, revenues and expenses of companies where they own more than 50% of the stock. Despite our recent additions to marketable equities, the most valuable grove in Berkshire's forest remains the many dozens of non-insurance businesses that Berkshire controls (usually with 100% ownership and never with less than 80% ). Those subsidiaries earned $16.8 billion last year. When we say "eaned," moreover, we are describing what remains after all income taxes, interest payments, managerial compensation (whether cash or stock-based), restructuring expenses, depreciation, amortization and home-office overhead. BERKSHIRE HATHAWAY INC. a. Explain how Berkshire's balance sheet is impacted when they own more than 50% of the stock of another company. b. Identify the \$amount of noncontrolling interest on Berkshire's balance sheet in 2018 (see pg. 5). What does this amount represent? c. Explain how Berkshire's income statement is impacted when they own more than 50% of the stock of another company. d. Identify the \$ amount of noncontrolling interest on Berkshire's income statement in 2018 (see pg. 6). What does this amount represent? Notes to Consolidated Financial Statements (Contimined) (2) Significant business acquisitions (Continwed) On February 29, 2016, we acquired a recapitalized Darneell Company ("Duracell") from The Procter \& Gamble Company ("P&G) in exchange for shares of P\&G common stock held by Berkshire subsidiaries, which had a fair value of approximately \$4.2 billion. Duracell manufactures high-performance alkaline batteries and wireless charging technologies. Goodwill from these acquisitions is not amortizable for income tax purposes. The fair values of identified assets acquired and tiabilities assumed and residual goodwill at their respective acquisition dates are summarized as follows (in millions). e. The footnote above shows information about Berkshire's acquisition of Duracell. i. Was the fair value or book value of Duracell's PPE added to Berkshire's balance sheet? ii. How much goodwill did Berkshire recognize on their balance sheet for the Duracell acquisition? What does this goodwill represent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started