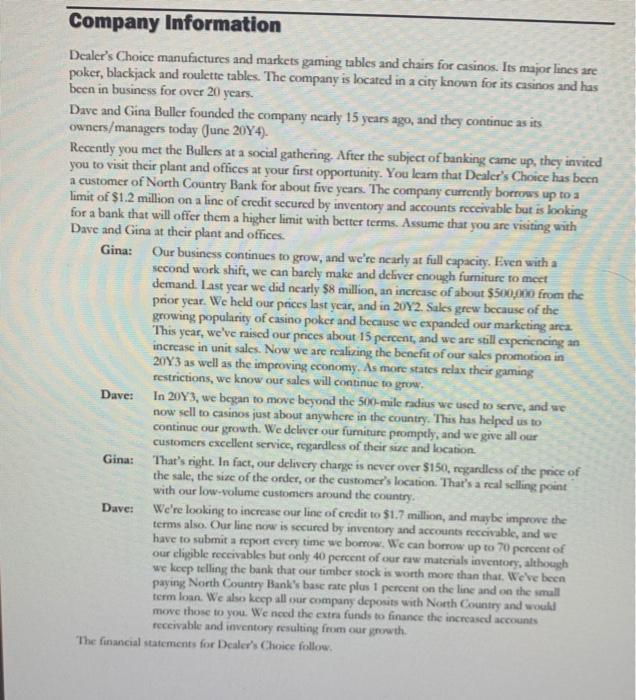

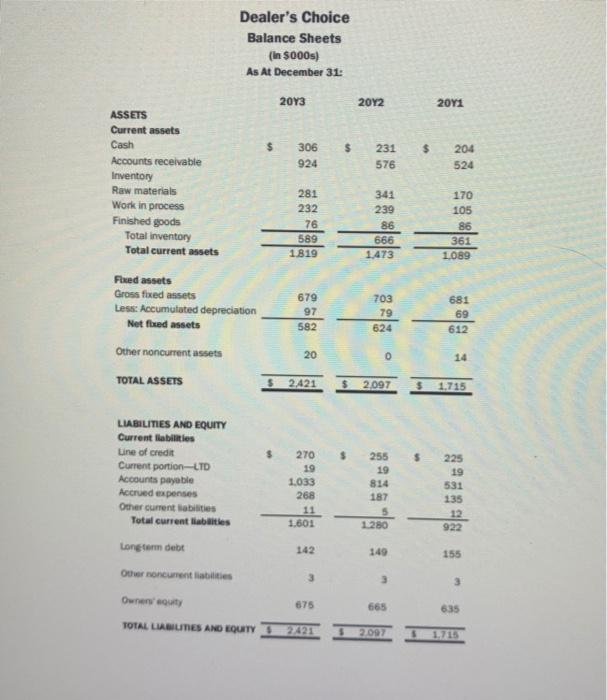

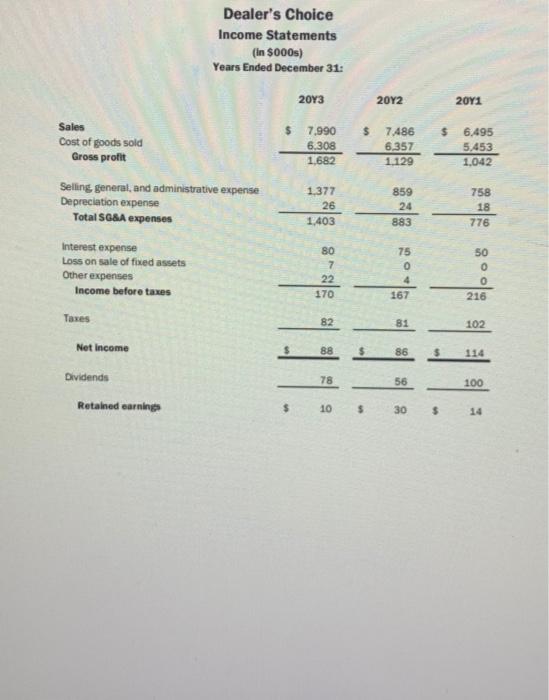

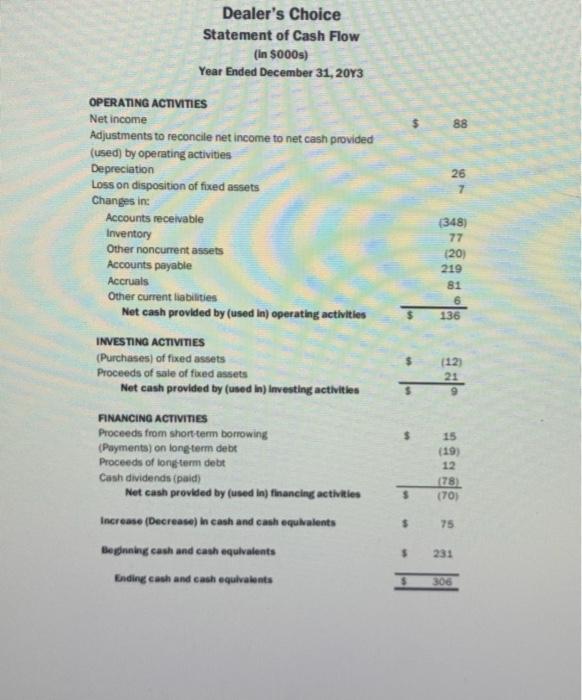

Question (6) Directions: Click the case link above and use the information provided in Dealer's Choice, Part B, to answer this question: Dealer's Choice's management expects 2014 pretax and net profit margins to equal or exceed 2041 levels. How realistic is Rhat expectation? Dealer's Choice's narrow gross profit margin makes sustaining its operating, protax, and net profit margins very challenging Given the substantial improvement in its gross profit margin, the company should be able to meet its expectations. Dealer's Choice's operating expenses are growing much faster than sales. The company will need to control those costs better in order to meet its expectations. with interest and depreciation expenses growing, it will be difficult for the company to maintain its most recent pretax and net profit margins. Company Information Dealer's Choice manufactures and markets gaming tables and chairs for casinos. Its major lines are poker, blackjack and roulette tables. The company is located in a city known for its casinos and has been in business for over 20 years. Dave and Gina Baller founded the company nearly 15 years ago, and they continue as its owners/managers today (June 20Y4). Recently you met the Bullers at a social gathering. After the subject of banking came up, they invited you to visit their plant and offices at your first opportunity. You leam that Dealer's Choice has been a customer of North Country Bank for about five years. The company currently borows up to a limit of $1.2 million on a line of credit secured by inventory and accounts receivable but is looking for a bank that will offer them a higher limit with better terms. Assume that you are visiting with Dave and Gina at their plant and offices. Gina: Our business continues to grow, and we're nearly at full capacity. Even with a second work shift, we can barely make and deliver enough furniture to meet demand. Last year we did nearly $8 million, an increase of about $500,000 from the prior year. We held our prices last year, and in 2012. Sales grew because of the growing popularity of casino poker and because we expanded our marketing area This year, we've raised our prices about 15 percent, and we are still experiencing an increase in unit sales. Now we are realizing the benefit of our sales promotion in 20Y3 as well as the improving economy. As more states relax their gaming restrictions, we know our sales will continue to grow Dave: In 2043, we began to move beyond the 500-mile radius we used to serve, and we now sell to casinos just about anywhere in the country. This has helped us to continue our growth. We deliver our furniture promptly, and we give all our customers excellent service, regardless of their size and location. Gina: That's right. In fact, our delivery charge is never over $150, regardless of the price of the sale, the size of the order, or the customer's location. That's a real selling point with our low-volume customers around the country Dave: We're looking to increase our line of credit to $1.7 million, and maybe impove the terms also. Our line now is secured by inventory and accounts receivable, and we have to submit a report every time we borrow. We can borrow up to 70 percent of our cligible receivables but only 40 percent of our raw materials inventory, although we keep telling the bank that our timber stock is worth more than that. We've been paying North Country Bank' base rate plus 1 percent on the line and on the small term loan. We also keep all our company deposits with North Country and would mowe those to you. We need the extra funds to finance the increased accounts receivable and inventory resulting from our growth. The financial statements for Dealer's Choice follow Dealer's Choice Balance Sheets (In S000s) As At December 31: 2013 2012 2011 $ 306 $ $ 231 576 204 524 924 ASSETS Current assets Cash Accounts receivable Inventory Raw materials Work in process Finished goods Total inventory Total current assets 281 232 76 589 1819 341 239 86 666 1.473 170 105 86 361 1,089 M Fixed assets Gross feed assets Less: Accumulated depreciation Net flued assets 679 97 582 703 79 624 681 69 612 20 0 14 Other noncurrent assets TOTAL ASSETS 2.421 $ 2.097 $ 1.715 $ $ LIABILITIES AND EQUITY Current liabilities Line of credit Current portion-LTD Accounts payable Accrued expenses Other current abilities Total current liabilities 270 19 1.033 268 11 1.601 255 19 814 187 5 1280 225 19 531 135 12 922 142 149 155 Longsor debt Other concurrenties 3 3 3 Owner ty 675 665 635 TOTAL LIABUTES AND EQUITY2421 2.097 1.715 Dealer's Choice Income Statements (in $000s) Years Ended December 31: 2013 2012 2011 $ $ $ Sales Cost of goods sold Gross profit 7.990 6.308 1.682 7.486 6.357 1.129 6.495 5.453 1,042 859 Selling general, and administrative expense Depreciation expense Total SG&A expenses 1.377 26 1.403 24 883 758 18 776 Interest expense Loss on sale of fixed assets Other expenses Income before taxes 80 7 22 170 75 0 4 167 50 0 0 216 Taxes 82 81 102 Net income 88 86 $ 114 111: Dividends 78 56 100 Retained earnings $ 10 $ 30 $ 14 Dealer's Choice Statement of Cash Flow (in $000s) Year Ended December 31, 2043 88 26 7 OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation Loss on disposition of fixed assets Changes in Accounts receivable Inventory Other noncurrent assets Accounts payable Accruals Other current liabilities Net cash provided by (used In) operating activities INVESTING ACTIVITIES (Purchases) of fixed assets Proceeds of sale of fued assets Net cash provided by (used in) Investing activities (348) 77 (20) 219 81 6 136 $ (12) 21 9 FINANCING ACTIVITIES Proceeds from short-term borrowing (Payments) on long-term debe Proceeds of long-term debt Cash dividends (paid) Net cash provided by (used in financing activities 15 (19 12 (78) (70) $ Increase (Decrease in cash and cash equivalents $ 75 Beginning cash and cash equivalents $ 231 Ending cash and cash equivalents 5 306 Question (6) Directions: Click the case link above and use the information provided in Dealer's Choice, Part B, to answer this question: Dealer's Choice's management expects 2014 pretax and net profit margins to equal or exceed 2041 levels. How realistic is Rhat expectation? Dealer's Choice's narrow gross profit margin makes sustaining its operating, protax, and net profit margins very challenging Given the substantial improvement in its gross profit margin, the company should be able to meet its expectations. Dealer's Choice's operating expenses are growing much faster than sales. The company will need to control those costs better in order to meet its expectations. with interest and depreciation expenses growing, it will be difficult for the company to maintain its most recent pretax and net profit margins. Company Information Dealer's Choice manufactures and markets gaming tables and chairs for casinos. Its major lines are poker, blackjack and roulette tables. The company is located in a city known for its casinos and has been in business for over 20 years. Dave and Gina Baller founded the company nearly 15 years ago, and they continue as its owners/managers today (June 20Y4). Recently you met the Bullers at a social gathering. After the subject of banking came up, they invited you to visit their plant and offices at your first opportunity. You leam that Dealer's Choice has been a customer of North Country Bank for about five years. The company currently borows up to a limit of $1.2 million on a line of credit secured by inventory and accounts receivable but is looking for a bank that will offer them a higher limit with better terms. Assume that you are visiting with Dave and Gina at their plant and offices. Gina: Our business continues to grow, and we're nearly at full capacity. Even with a second work shift, we can barely make and deliver enough furniture to meet demand. Last year we did nearly $8 million, an increase of about $500,000 from the prior year. We held our prices last year, and in 2012. Sales grew because of the growing popularity of casino poker and because we expanded our marketing area This year, we've raised our prices about 15 percent, and we are still experiencing an increase in unit sales. Now we are realizing the benefit of our sales promotion in 20Y3 as well as the improving economy. As more states relax their gaming restrictions, we know our sales will continue to grow Dave: In 2043, we began to move beyond the 500-mile radius we used to serve, and we now sell to casinos just about anywhere in the country. This has helped us to continue our growth. We deliver our furniture promptly, and we give all our customers excellent service, regardless of their size and location. Gina: That's right. In fact, our delivery charge is never over $150, regardless of the price of the sale, the size of the order, or the customer's location. That's a real selling point with our low-volume customers around the country Dave: We're looking to increase our line of credit to $1.7 million, and maybe impove the terms also. Our line now is secured by inventory and accounts receivable, and we have to submit a report every time we borrow. We can borrow up to 70 percent of our cligible receivables but only 40 percent of our raw materials inventory, although we keep telling the bank that our timber stock is worth more than that. We've been paying North Country Bank' base rate plus 1 percent on the line and on the small term loan. We also keep all our company deposits with North Country and would mowe those to you. We need the extra funds to finance the increased accounts receivable and inventory resulting from our growth. The financial statements for Dealer's Choice follow Dealer's Choice Balance Sheets (In S000s) As At December 31: 2013 2012 2011 $ 306 $ $ 231 576 204 524 924 ASSETS Current assets Cash Accounts receivable Inventory Raw materials Work in process Finished goods Total inventory Total current assets 281 232 76 589 1819 341 239 86 666 1.473 170 105 86 361 1,089 M Fixed assets Gross feed assets Less: Accumulated depreciation Net flued assets 679 97 582 703 79 624 681 69 612 20 0 14 Other noncurrent assets TOTAL ASSETS 2.421 $ 2.097 $ 1.715 $ $ LIABILITIES AND EQUITY Current liabilities Line of credit Current portion-LTD Accounts payable Accrued expenses Other current abilities Total current liabilities 270 19 1.033 268 11 1.601 255 19 814 187 5 1280 225 19 531 135 12 922 142 149 155 Longsor debt Other concurrenties 3 3 3 Owner ty 675 665 635 TOTAL LIABUTES AND EQUITY2421 2.097 1.715 Dealer's Choice Income Statements (in $000s) Years Ended December 31: 2013 2012 2011 $ $ $ Sales Cost of goods sold Gross profit 7.990 6.308 1.682 7.486 6.357 1.129 6.495 5.453 1,042 859 Selling general, and administrative expense Depreciation expense Total SG&A expenses 1.377 26 1.403 24 883 758 18 776 Interest expense Loss on sale of fixed assets Other expenses Income before taxes 80 7 22 170 75 0 4 167 50 0 0 216 Taxes 82 81 102 Net income 88 86 $ 114 111: Dividends 78 56 100 Retained earnings $ 10 $ 30 $ 14 Dealer's Choice Statement of Cash Flow (in $000s) Year Ended December 31, 2043 88 26 7 OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation Loss on disposition of fixed assets Changes in Accounts receivable Inventory Other noncurrent assets Accounts payable Accruals Other current liabilities Net cash provided by (used In) operating activities INVESTING ACTIVITIES (Purchases) of fixed assets Proceeds of sale of fued assets Net cash provided by (used in) Investing activities (348) 77 (20) 219 81 6 136 $ (12) 21 9 FINANCING ACTIVITIES Proceeds from short-term borrowing (Payments) on long-term debe Proceeds of long-term debt Cash dividends (paid) Net cash provided by (used in financing activities 15 (19 12 (78) (70) $ Increase (Decrease in cash and cash equivalents $ 75 Beginning cash and cash equivalents $ 231 Ending cash and cash equivalents 5 306