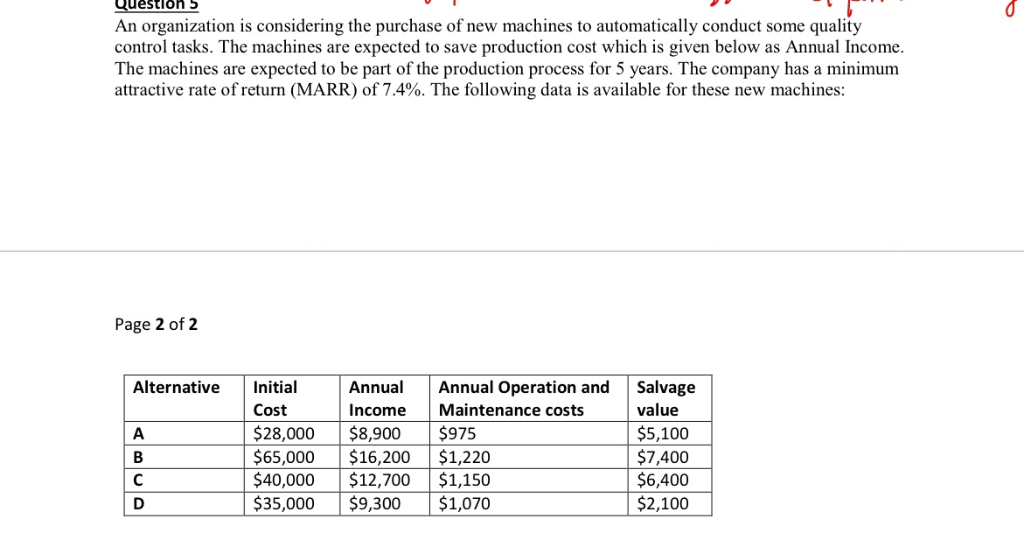

Question

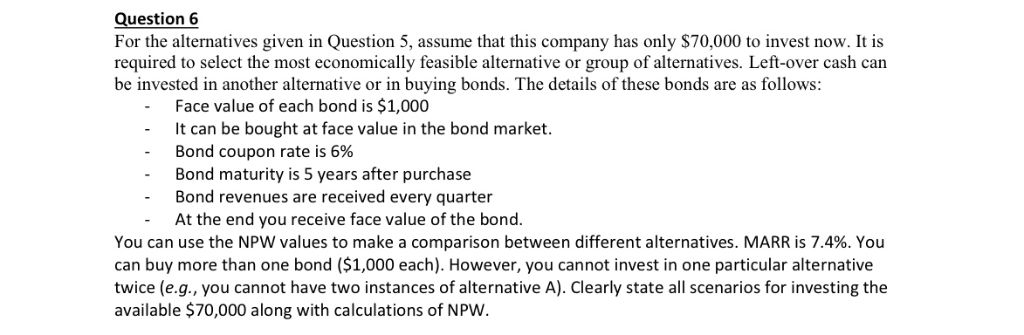

Question 6 For the alternatives given in Question 5, assume that this company has only $70,000 to invest now. It is required to select the

Question 6 For the alternatives given in Question 5, assume that this company has only $70,000 to invest now. It is required to select the most economically feasible alternative or group of alternatives. Left-over cash can be invested in another alternative or in buying bonds. The details of these bonds are as follows: - Face value of each bond is $1,000 - It can be bought at face value in the bond market. - Bond coupon rate is 6% - Bond maturity is 5 years after purchase - Bond revenues are received every quarter - At the end you receive face value of the bond. You can use the NPW values to make a comparison between different alternatives. MARR is 7.4%. You can buy more than one bond ($1,000 each). However, you cannot invest in one particular alternative twice (e.g., you cannot have two instances of alternative A). Clearly state all scenarios for investing the available $70,000 along with calculations of NPW

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started