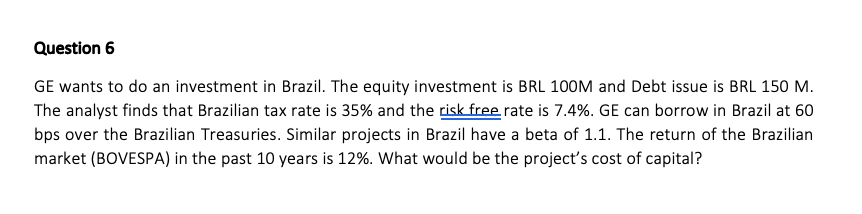

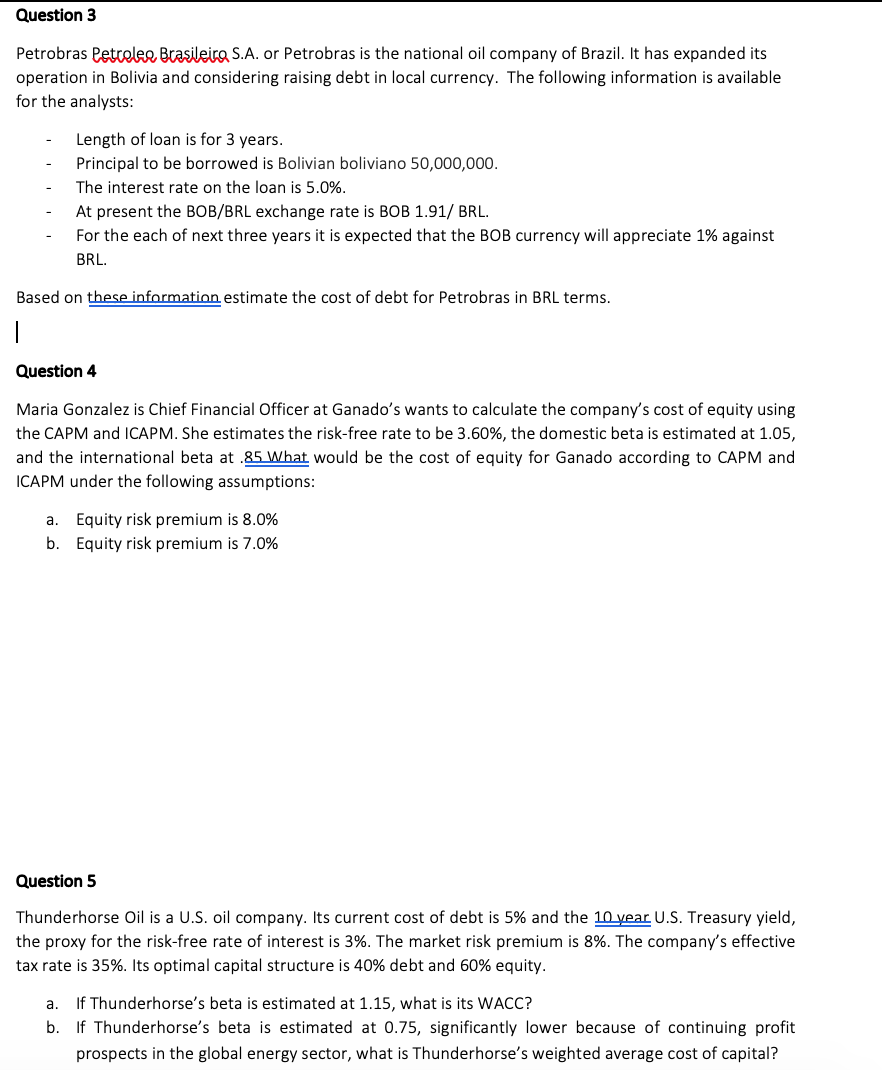

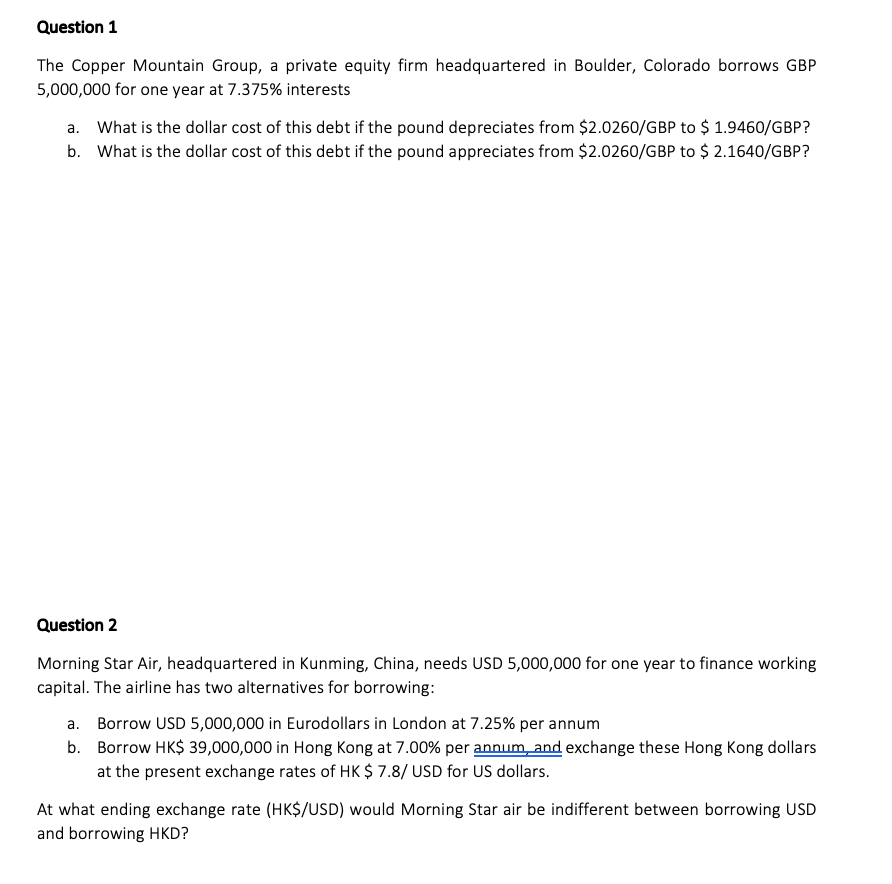

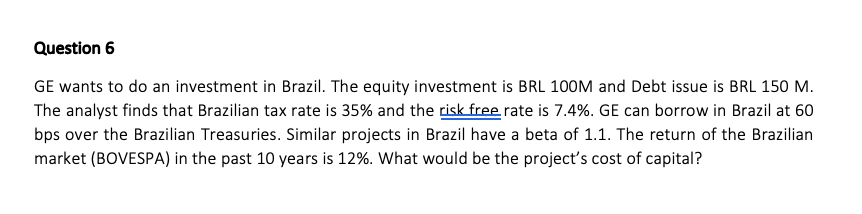

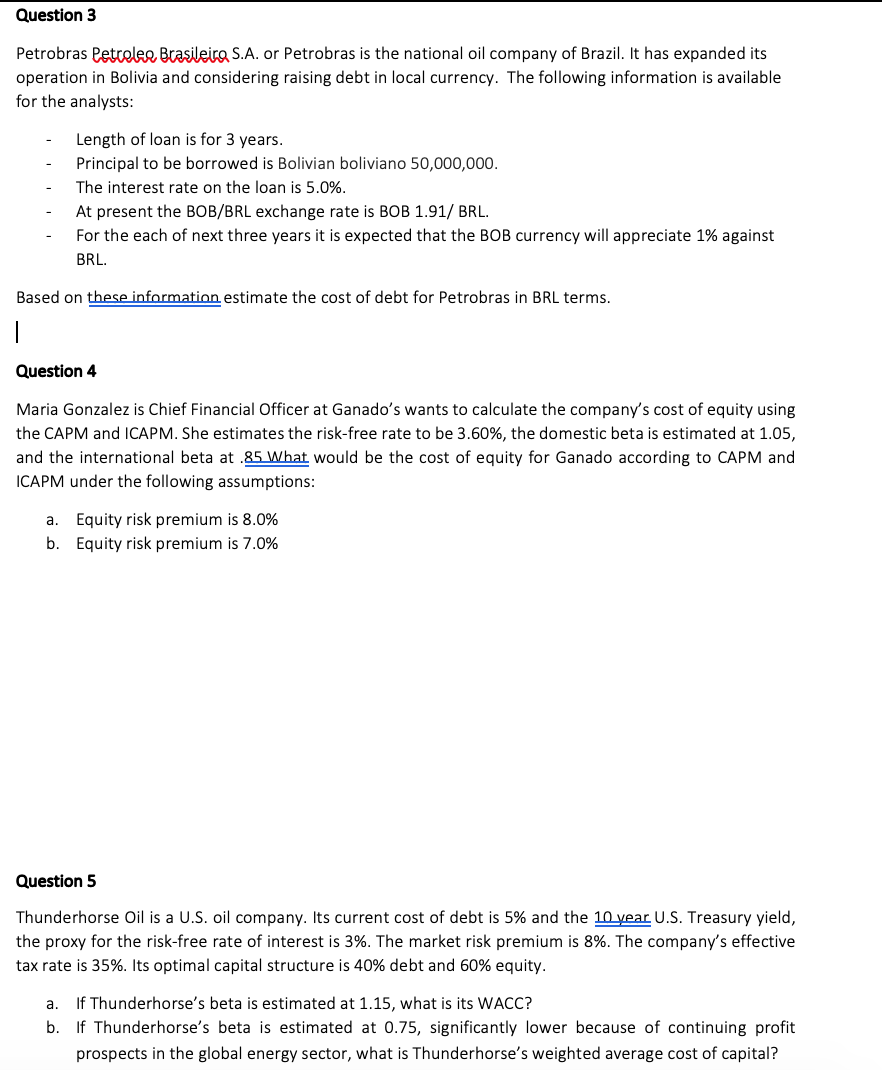

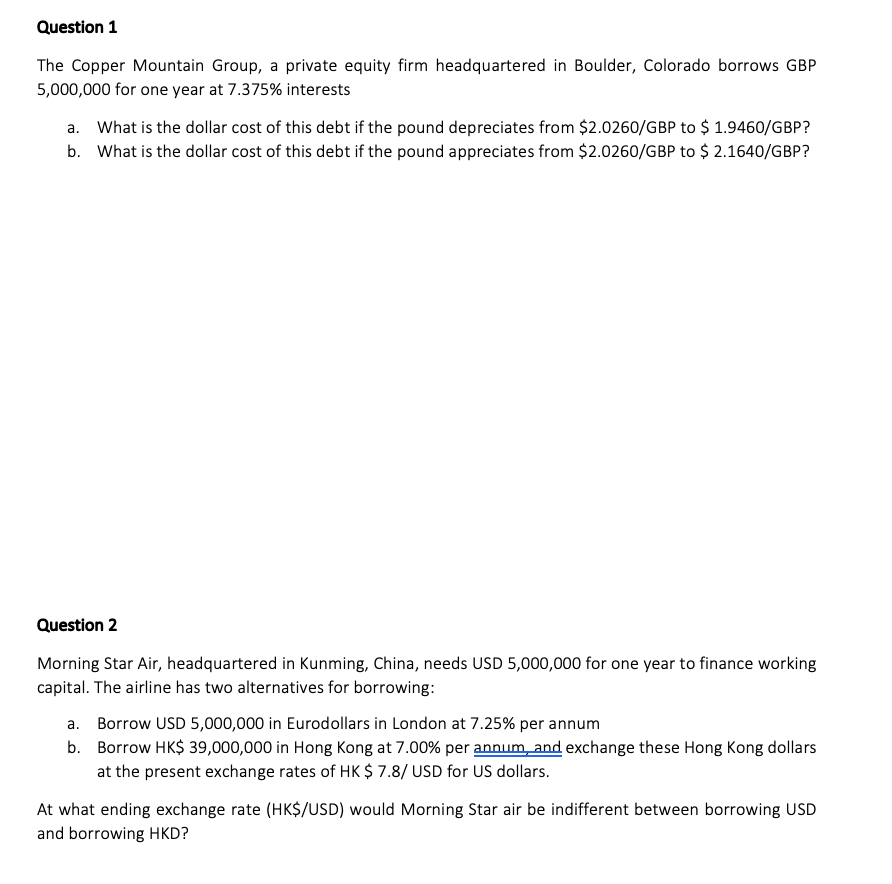

Question 6 GE wants to do an investment in Brazil. The equity investment is BRL 100M and Debt issue is BRL 150 M. The analyst finds that Brazilian tax rate is 35% and the risk free rate is 7.4%. GE can borrow in Brazil at 60 bps over the Brazilian Treasuries. Similar projects in Brazil have a beta of 1.1. The return of the Brazilian market (BOVESPA) in the past 10 years is 12%. What would be the project's cost of capital? Question 3 Petrobras Petceles Brasileira S.A. or Petrobras is the national oil company of Brazil. It has expanded its operation in Bolivia and considering raising debt in local currency. The following information is available for the analysts: - Length of loan is for 3 years. Principal to be borrowed is Bolivian boliviano 50,000,000. The interest rate on the loan is 5.0%. At present the BOB/BRL exchange rate is BOB 1.91/ BRL. For the each of next three years it is expected that the BOB currency will appreciate 1% against . BRL. Based on these information estimate the cost of debt for Petrobras in BRL terms. Question 4 Maria Gonzalez is Chief Financial Officer at Ganado's wants to calculate the company's cost of equity using the CAPM and ICAPM. She estimates the risk-free rate to be 3.60%, the domestic beta is estimated at 1.05, and the international beta at .85 What would be the cost of equity for Ganado according to CAPM and ICAPM under the following assumptions: a. Equity risk premium is 8.0% b. Equity risk premium is 7.0% Question 5 Thunderhorse Oil is a U.S. oil company. Its current cost of debt is 5% and the 10 year U.S. Treasury yield, the proxy for the risk-free rate of interest is 3%. The market risk premium is 8%. The company's effective tax rate is 35%. Its optimal capital structure is 40% debt and 60% equity. a. If Thunderhorse's beta is estimated at 1.15, what is its WACC? b. If Thunderhorse's beta is estimated at 0.75, significantly lower because of continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital? Question 1 The Copper Mountain Group, a private equity firm headquartered in Boulder, Colorado borrows GBP 5,000,000 for one year at 7.375% interests a. What is the dollar cost of this debt if the pound depreciates from $2.0260/GBP to $ 1.9460/GBP? b. What is the dollar cost of this debt if the pound appreciates from $2.0260/GBP to $ 2.1640/GBP? Question 2 Morning Star Air, headquartered in Kunming, China, needs USD 5,000,000 for one year to finance working capital. The airline has two alternatives for borrowing: a. Borrow USD 5,000,000 in Eurodollars in London at 7.25% per annum b. Borrow HK$ 39,000,000 in Hong Kong at 7.00% per annum and exchange these Hong Kong dollars at the present exchange rates of HK $ 7.8/ USD for US dollars. At what ending exchange rate (HK$/USD) would Morning Star air be indifferent between borrowing USD and borrowing HKD