Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greg Accounting Pty Ltd (a family company) receives contract receipts (approximately $90,000 per year) for accounting services provided by Greg (director of the company).

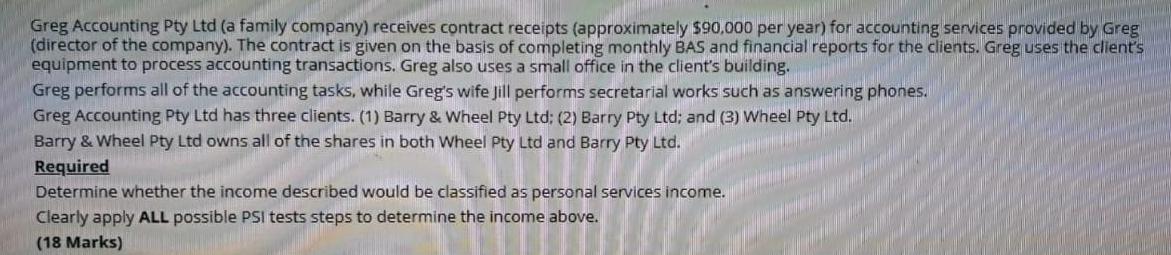

Greg Accounting Pty Ltd (a family company) receives contract receipts (approximately $90,000 per year) for accounting services provided by Greg (director of the company). The contract is given on the basis of completing monthly BAS and financial reports for the clients. Greg uses the client's equipment to process accounting transactions. Greg also uses a small office in the client's building. Greg performs all of the accounting tasks, while Greg's wife Jill performs secretarial works such as answering phones. Greg Accounting Pty Ltd has three clients. (1) Barry & Wheel Pty Ltd: (2) Barry Pty Ltd; and (3) Wheel Pty Ltd. Barry & Wheel Pty Ltd owns all of the shares in both Wheel Pty Ltd and Barry Pty Ltd. Required Determine whether the income described would be classified as personal services income. Clearly apply ALL possible PSI tests steps to determine the income above. (18 Marks)

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution An individual may receive reward as a consideration for a contract for his personal skills efforts or labour which is assessed in his hands though income is earned by an entity like company p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started