Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6. Jeff Douglas believes strongly that they should help fully fund the equivalent of a state university education (4 years) for Paul and Marcy.

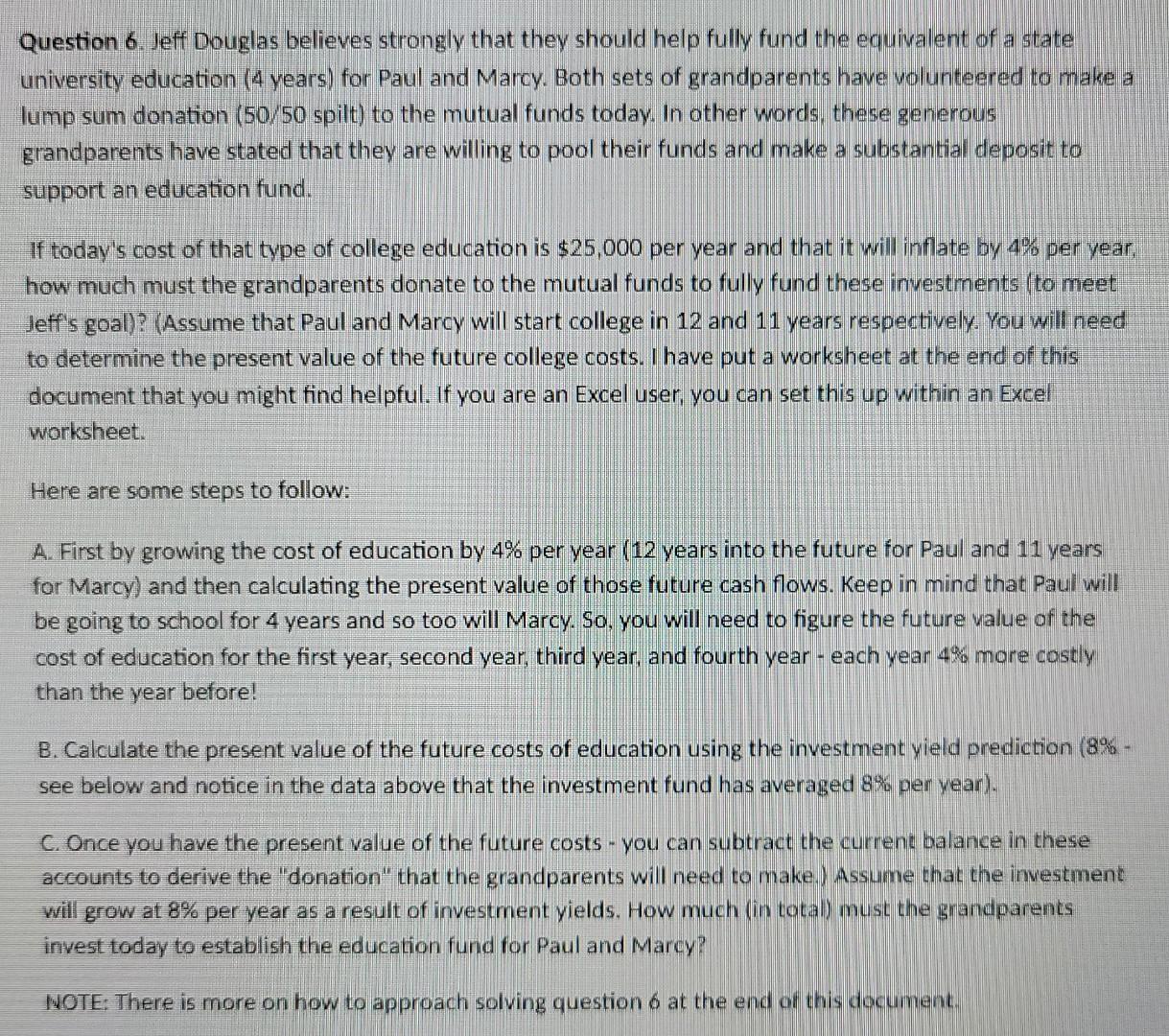

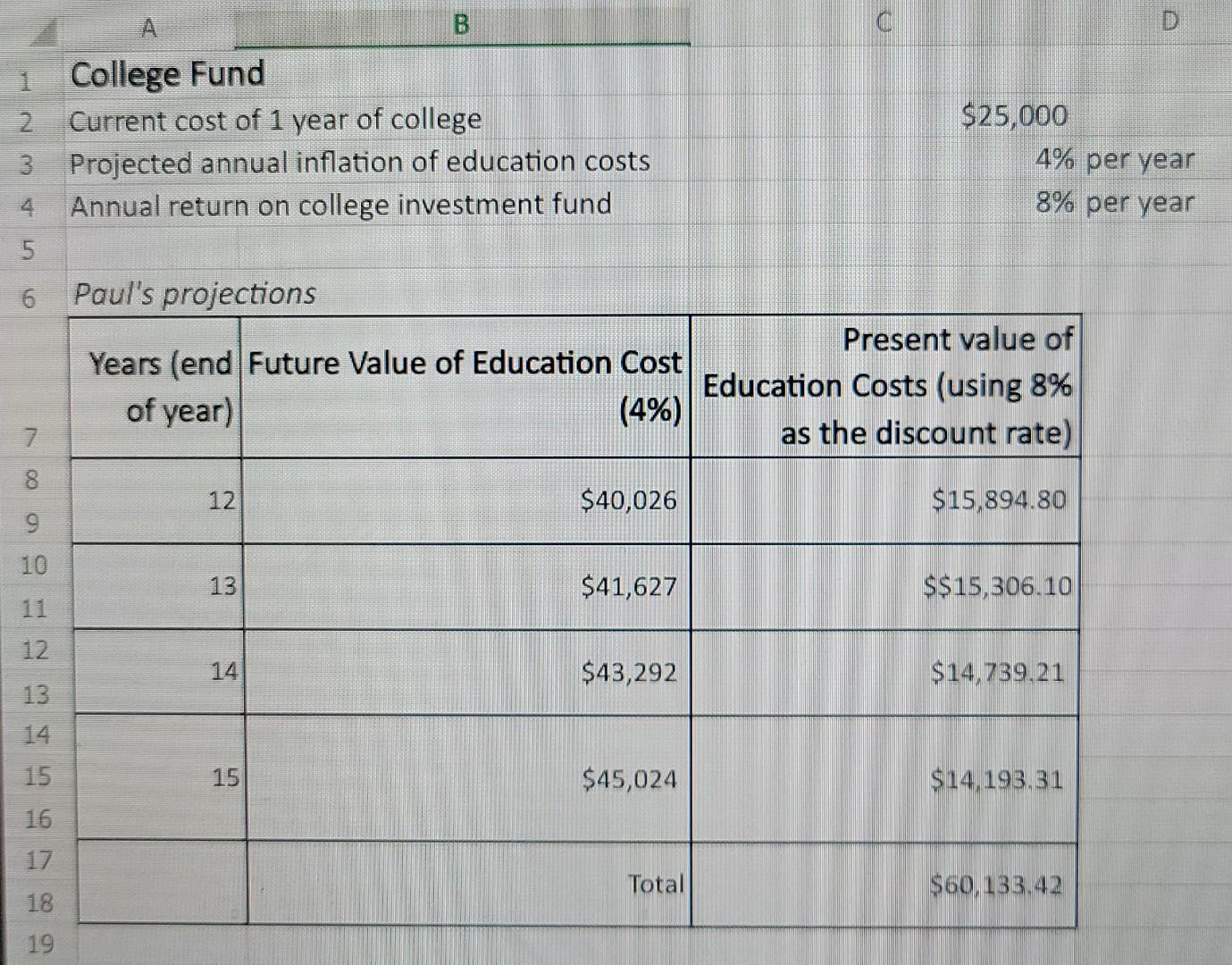

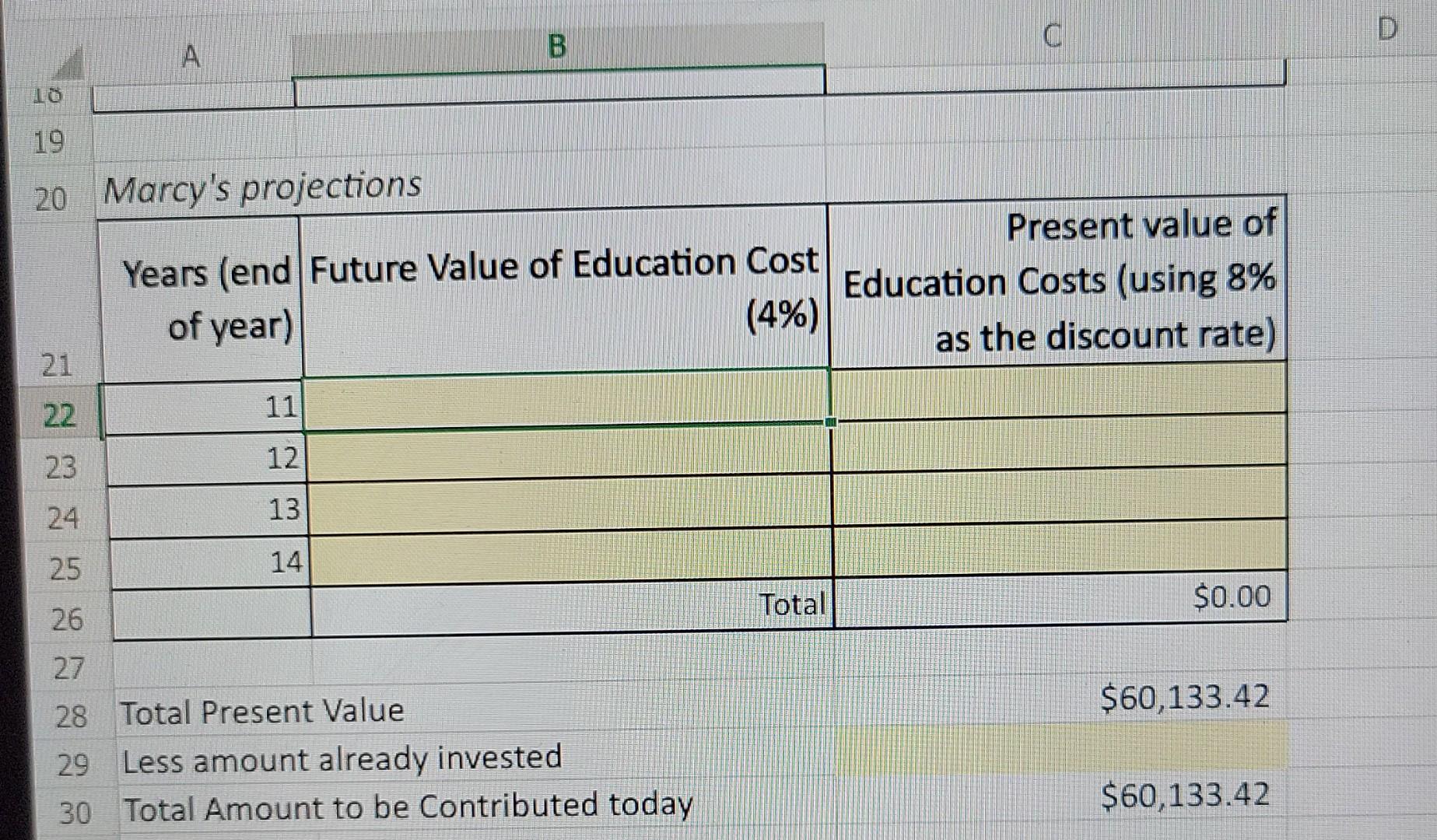

Question 6. Jeff Douglas believes strongly that they should help fully fund the equivalent of a state university education (4 years) for Paul and Marcy. Both sets of grandparents have volunteered to make a lump sum donation (50/50 spilt) to the mutual funds today. In other words, these generous grandparents have stated that they are willing to pool their funds and make a substantial deposit to support an education fund. if today's cost of that type of college education is $25,000 per year and that it will inflate by 4% per year, how much must the grandparents donate to the mutual funds to fully fund these investments (to meet Jeff's goal)? (Assume that Paul and Marcy will start college in 12 and 11 years respectively. You will need to determine the present value of the future college costs. I have put a worksheet at the end of this document that you might find helpful. If you are an Excel user, you can set this up within an Excel worksheet. Here are some steps to follow: A. First by growing the cost of education by 4% per year (12 years into the future for Paul and 11 years for Marcy) and then calculating the present value of those future cash flows. Keep in mind that Paul will be going to school for 4 years and so too will Marcy. So, you will need to figure the future value of the cost of education for the first year, second year, third year, and fourth year - each year 4% more costly than the year before! B. Calculate the present value of the future costs of education using the investment vield prediction (8%- see below and notice in the data above that the investment fund has averaged 8% per year). C. Once you have the present value of the future costs - you can subtract the current balance in these accounts to derive the "donation" that the grandparents will need to make. Assume that the investment will grow at 8% per year as a result of investment yields. How much (in total) must the grandparents invest today to establish the education fund for Paul and Marcy? NOTE: There is more on how to approach solving question 6 at the end of this document. B 1 College Fund 2 Current cost of 1 year of college 3 Projected annual inflation of education costs 4 Annual return on college investment fund 5 6 Paul's projections $25,000 4% per year 8% per year Years (end Future Value of Education Cost of year) (4%) Present value of Education Costs (using 8% as the discount rate) 7. 8 00 12. $40,026 $15,894.80 9 . 10 13 $41,627 $$15,306.10 12 14 $43,292 $14,739.21 13 6 GN 15 15 $45,024 $14,193.31 17 Total $60,133.42 18 19 B a A. 10 19 20 Marcy's projections Years (end Future Value of Education Cost of year) (4%) Present value of Education Costs (using 8% as the discount rate) 21 22 11 23 12 24 13 25 14 Total $0.00 26 $60,133.42 27 28 Total Present Value 29 Less amount already invested 30 Total Amount to be Contributed today $60,133.42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started